- DeFi Dev Corp. (Nasdaq: DFDV)

- Posts

- Digital Asset Treasuries (DATs): The Next Frontier of Crypto Exposure

Digital Asset Treasuries (DATs): The Next Frontier of Crypto Exposure

A data-driven guide to Digital Asset Treasuries (DATs) on Bitcoin, Ethereum, and Solana: how they create value, their business model, underlying risks, why premiums matter, and why Solana DATs could lead the next leg higher.

Every few years, a new crypto narrative captures the market’s attention and draws in waves of capital and talent. From 2013 to 2017, it was Initial Coin Offerings (ICOs). In 2020 and 2021, Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs) dominated the cycle. The 2023-2024 era was characterized by memecoin speculation and the rapid growth of Layer-2 blockchains.

Today’s newest frontier? Digital Asset Treasuries (DATs).

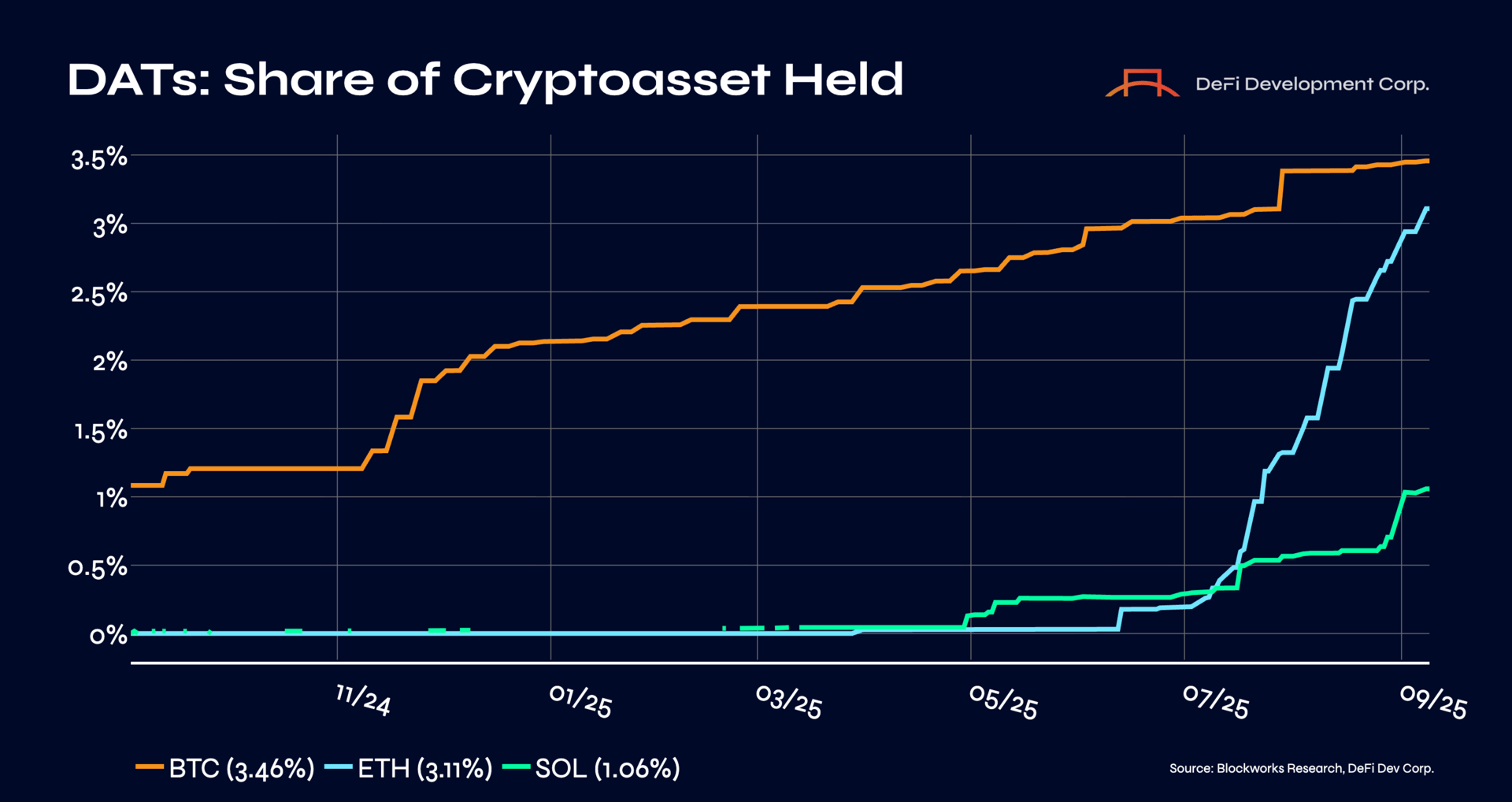

DATs are publicly traded companies that use capital markets to acquire cryptoassets. Popularized by Michael Saylor’s MicroStrategy (Nasdaq: MSTR), DATs offer investors enhanced exposure to digital assets. DATs deliver increasing crypto exposure over time, enabling investors to own more crypto per dollar invested than spot purchases alone. As of publication, DATs collectively hold over $98 billion in crypto, up +104% from $48 billion at the start of the year.

Now that this model has expanded beyond bitcoin (BTC), key questions are emerging. How do DATs work? What risks do they carry? Where are they headed?

This post unpacks those questions - and explains why Solana (SOL) and firms like DeFi Development Corp. (Nasdaq: DFDV) represent the next wave of this structural evolution in crypto.

Defining DATs

Digital Asset Treasury (DAT) companies come in many forms. Still, they all share a common foundation: they are publicly traded firms that raise capital through equity, debt, or both, to acquire cryptoassets. If executed properly, the use of debt and/or equity is done in a way that is accretive to shareholders. Accretion occurs when each new raise increases Crypto Per Share. At DeFi Development Corp., we specifically measure this as SOL Per Share (SPS).

In a perfect world, DATs buy and hold these assets indefinitely. This provides investors with exposure to BTC, ETH, SOL, and other cryptoassets through a traditional brokerage account, without the responsibilities or risks associated with self-custody. It also opens the door to gaining greater exposure over time than buying spot.

While DATs are fairly new, their underlying model builds on traditional corporate finance. Most public companies issue stock or debt to fund operations, invest in research, or hold cash in low-risk instruments. DATs mirror traditional public companies structurally, but place their emphasis on crypto accumulation over operating a traditional business. As a result, shareholder value is tied not to cash flow, but to the growth and appreciation of the tokens on the balance sheet.

A traditional DAT operates as such:

Raise capital via stock issuance, convertible notes, and/or an equity line of credit.

Acquire crypto using proceeds to purchase large quantities of the chosen digital asset.

Hold and custody those assets securely.

Amplify exposure by raising more capital, tapping leverage, or, in some cases, deploying assets in staking or yield strategies.

The performance of a DAT is often measured by the growth of its Net Asset Value (NAV), or the total value of crypto holdings divided by shares outstanding. Market participants also pay close attention to the mNAV (multiple of net asset value), which reflects the premium or discount relative to the actual value of assets. For example, if a DAT holds $100M of crypto but trades at a $150M market cap, it is valued at a 50% premium to NAV or an mNAV of 1.5x.

DATs that can execute properly and return value to their shareholders can create a flywheel that ensures their longevity and success. This flywheel, which is predicated on the underlying digital asset(s) appreciating over time, can be explained as such:

Rising crypto prices push the value of a DAT’s holdings higher.

mNAV expands, investors are willing to pay a premium for the DAT’s ability to increase its exposure to appreciating assets.

The DAT can then issue new equity or debt at attractive valuations.

New capital is used to purchase crypto, thus increasing the total holdings.

Greater holdings and higher valuations reinforce the cycle, making the DAT an increasingly powerful accumulation engine.

Additional accelerators can amplify this flywheel further:

Leverage through convertible notes or credit facilities can allow for faster accumulation.

Yield strategies such as staking or lending can add incremental returns, though increasing execution risk.

Brand and narratives (particularly for first-movers on emerging assets like SOL) can draw in retail demand and widen NAV premiums even further.

Onchain innovation, such as a liquid staking token (LST) tied to staking operations, tokenized equity, DeFi integrations, strategic partnerships, etc.

Not every DAT is able to get the flywheel spinning or keep it going. Common failure points include issuing into discounts, mistimed asset purchases, idle balance sheets, confusing disclosures, and incorrect filings. DeFi Development Corp. has sustained its flywheel through a disciplined focus on growing SOL Per Share (SPS), operating validators to earn native SOL, expanding through a global franchising model, forming strategic partnerships, driving onchain innovation, and publishing consistent thought leadership to educate market participants. Consider that DFDV’s SPS has grown 71% over the past 90 days to a reading of 0.0721 SOL.

What separates DATs from crypto ETFs or trusts is their flexibility and ability to actively compound exposure. ETFs and trusts passively hold assets and charge annual management fees, which steadily reduce the investor’s exposure to the underlying cryptoasset. DATs, by contrast, can transform one dollar of investor capital into more Crypto Per Share over time by raising capital at a premium, staking assets, running validators, and redeploying proceeds in a way that benefits shareholders.

Market Landscape

DATs are not one-size-fits-all. They differ across several dimensions, including their primary treasury asset (such as BTC, ETH, or SOL), their capital structure, and their positioning against competitors. By analyzing the largest players with market capitalizations over $100 million, investors can identify which DATs are gaining traction, which are outperforming or underperforming relative to peers, and how effectively they are accumulating assets.

Bitcoin (BTC) Digital Asset Treasuries

Launched in January 2009 as the first decentralized digital bearer asset with a fixed supply of 21 million BTC, BTC is primarily used as a store of value and pristine collateral, with a predictable issuance schedule that halves approximately every four years. For DATs, BTC offers deep liquidity, broad institutional understanding, and a simple scarcity thesis that is easily communicated to public-market investors.

Ethereum (ETH) Digital Asset Treasuries

Ethereum launched in July 2015 as the leading programmable blockchain. ETH is the fee token for executing smart contracts and, since the Merge in 2022, secures the network through proof of stake. ETH has long been the default platform for DeFi and NFTs, and it introduced fee-burning in 2021. While Ethereum remains the go-to smart-contract platform in mindshare, it has lost momentum in recent years as activity, developers, and retail apps increasingly test lower-fee, higher-throughput alternatives. Nonetheless, that has not stopped DATs from accumulating ETH, as they believe that Ethereum is best positioned to capitalize on institutional adoption of crypto in the form of stablecoins and tokenization.

Solana (SOL) Digital Asset Treasuries

Solana (SOL) launched its mainnet-beta in March 2020 as a high-throughput, low-fee layer one built for consumer-scale applications, trading, payments, and more. Its native token, SOL, is used for transaction fees and staking. With a yield of approximately 7.5% at the time of publication, SOL offers one of the highest Proof-of-Stake (PoS) rewards among major general-purpose blockchains. This creates unique opportunities for SOL-focused DATs that are not available on other networks.

These opportunities include staking SOL to earn native rewards, operating validators to capture income from processing transactions, and using Liquid Staking Tokens (LSTs) to retain liquidity while compounding yield. In recent quarters, Solana has gained significant momentum across consumer applications, memecoins, payments, stablecoins, tokenized assets, DeFi, and trading. This growth has been driven by consistently low fees, fast throughput, and a user experience that outperforms peers.

Given that SOL currently trades at a fraction of ETH’s market cap, many SOL DATs have taken the position that no blockchain is better equipped to support both institutional and consumer-facing applications.

BNB Chain (BNB) Digital Asset Treasuries

BNB launched in 2017 and later migrated from an ERC-20 token to the BNB ecosystem, which today includes BNB Smart Chain. BNB is used to pay gas and participate across a large, retail-heavy network of dapps and services. For DATs, BNB offers exposure to a broad consumer user base and a high volume of onchain transactions. Though facing many of the same technical challenges as Ethereum, such as limited throughput and relatively high transaction fees, some view BNB as a means of capitalizing on the adoption of smart contracts in Asia, where BNB lives and breathes.

Business Model & Risks

Capturing The Premium

DATs are often compared to investment funds because they raise capital to buy assets with the expectation of future appreciation, and they report holdings with a high degree of transparency. While the structures may appear similar, the key difference lies in intent. A well-run DAT is not designed to mirror the asset it holds. Instead, it aims to maintain a premium to net asset value (NAV) to accumulate more crypto in a way that benefits shareholders continuously.

This leads to a fundamental question: why does a premium to NAV matter, and how is it achieved?

In short, a premium lowers the DAT’s effective cost of capital. When equity is sold at a premium to NAV, or debt is issued on favorable terms backed by that premium, the proceeds can be used to acquire more crypto per share than spot buyers could achieve. That accretive outcome is what powers the DAT flywheel. The challenge for every DAT is maintaining that premium consistently over time. Said premium can be explained by:

Active compounding: Gows Crypto Per Share through staking, validator operations, and selective acquisitions, not just buy-and-hold.

Capital markets access: Raises at a premium and converts proceeds into more Crypto Per Share than spot buyers can.

Yield advantage vs. ETFs: Can stake and run validators to earn native yield; ETFs mostly track price and cannot fully stake or operate validators.

Long-term accumulation stance: Permanent balance sheet with no forced rebalancing, aligning with conviction holders.

Operational leverage from validators: Fee and reward scale directly compound NAV.

Investor optionality: Equity, convertibles, and options broaden the buyer base and support pricing.

Access for restricted mandates: Listed equity format fits investors barred from direct crypto or certain ETFs.

Tax-advantaged pathways: Eligibility for IRAs and 401(k)s enables exposure inside sheltered accounts.

When used selectively, leverage can help DATs operate more effectively and sustain a premium. Instruments like convertibles, term loans, or credit facilities can accelerate accumulation when the expected return on assets and premium capture outweigh the cost of funds. However, debt must be issued and structured in a way that avoids forced selling during future drawdowns. Poorly structured leverage can mark the beginning of the end for a DAT. In simple terms, clear use of proceeds, clean disclosures, and conservative sizing help preserve investor trust and support long-term premium behavior.

In addition, the recent wave of DAT launches has made it clear that brand and community will play a central role in long-term success. First movers, credible operators, and strong communicators have the advantage. They can attract broader investor bases, deepen secondary liquidity, and improve their ability to issue at or above NAV. Strategic partnerships, validator operations, research, and transparency demonstrate that a DAT is not just capitalizing on a short-term opportunity but is committed to the long-term vision of the asset it holds. The result is a lower cost of capital, stronger mNAV behavior, and a higher likelihood that each capital raise translates into more Crypto Per Share.

Measuring Success

The success of any DAT cannot be merely distilled down to its premium, NAV, or market cap at a single point in time. To truly understand whether or not a DAT in question is performing well, it’s best to look at a multitude of data points. This includes, but is not limited to, the following:

Crypto per share: Trend and pace of growth over months, quarters, and years; rising Crypto Per Share confirms that issuance and deployments are accretive, while flat or falling per-share figures signal dilution even if headline holdings grow.

mNAV behavior: Persistence of a premium through rallies and drawdowns; a premium that holds up in weak markets indicates durable demand and a reliable window to raise, while a premium that disappears with volatility implies a fragile cost of capital.

Debt/equity issuance quality: The mix of instruments used, NAV at which debt/equity is issued, cadence of issuance, and use of proceeds are all vital in assessing a DAT’s ability to use capital markets. At-the-market (ATM) offerings, where a company sells small amounts of stock into the market over time, and well-priced public offerings minimize overhang, while complex convertible debt or heavy warrant coverage raise the true cost of capital and can weigh on future premiums.

Liquidity and tradability: Because a DAT finances its growth with its stock, healthy trading is vital. That is to say, you want to consider the stock’s average daily dollar volume, borrow availability, options depth, and index inclusion. High liquidity keeps spreads tight, lets investors hedge or take the other side, brings steady passive demand, and allows the company to sell new shares without knocking the price down. These features allow the stock to preserve its premium during market volatility and make capital raises more reliably accretive.

Disclosure cadence and quality: Clear, consistent reporting reduces uncertainty, widens the pool of buyers that can underwrite the story, and helps keep any premium to NAV intact.

Balance sheet resilience: Resilient balance sheets avoid forced selling or emergency financings during market stress, which protects Crypto Per Share and helps maintain mNAV when the company most needs access to capital.

Dilution: Consider that if shares outstanding rise 20% but the amount of Crypto Per Share rises only 5%, holders are getting diluted even if NAV grows. As previously mentioned, this is the cleanest test of whether the flywheel is actually working for existing shareholders.

Key Risks

DATs offer unprecedented upside, but they are not without real risks. These risks include, but are not limited to, the following:

Market and reflexivity risk: Drawdowns in the value of the underlying cryptoasset and/or the DAT’s stock price can shrink NAV and mNAV, meaning issuance windows close and liquidity thins right when capital is needed.

Listing and capital markets constraints: Minimum bid rules and shareholder approval thresholds can limit financing options, and poorly chosen instruments can create an overhang that limits a DAT's ability to accumulate more crypto.

Operational risk: Between custodying funds, trusting counterparties to assist with day-to-day operations, running validator operations, and innovating onchain, there are several operational risks that DATs are exposed to.

Financing-structure risk: The way a DAT raises money affects future dilution and the stock’s premium. Complex convertibles, floorless terms that convert at a floating price, and heavy warrant coverage often lead investors to hedge by shorting the stock, which pressures the price and raises the true cost of capital.

Governance and narrative risk: Inconsistent updates, scope drift away from the stated asset focus, or an unclear treasury policy can shrink the buyer base, compress mNAV, and stall the flywheel.

Where DATs Are Headed

The future of DATs is still unfolding. While no one can say exactly where the sector is headed in the near term, one thing is clear: DATs are here to stay. Their strong value proposition, structural flexibility, and surge in recent demand suggest that adoption will continue. It would not be surprising if, by year-end, the top 25 cryptoassets by market cap are each represented by at least one digital asset treasury.

We expect DATs to maintain momentum, especially amid rising institutional adoption, a potential Fed rate cut cycle, increasing global liquidity, and favorable regulatory developments. However, this momentum will not last indefinitely. As more DATs enter the market, investor dollars will fragment, underwriting standards will tighten, and mNAVs will compress as premiums are competed away. This will likely trigger a consolidation phase. Some weaker operators may be forced to sell, while stronger players could emerge as buyers, acquiring undervalued DATs with weaker balance sheets.

Throughout this process, BTC, ETH, and SOL are likely to maintain the majority of attention and capital flows. BTC will continue to represent the macro reserve, although its share of total DAT NAV will decline due to its early-mover advantage. ETH will defend its position as the leading programmable settlement layer. Meanwhile, SOL is expected to solidify its role as the preferred blockchain for both institutional and consumer-facing applications.

We believe Solana will continue to gain market share as it pushes the limits of performance, decentralization, and onchain innovation. Its ability to attract both institutional and retail users at an outsized pace is already reshaping investor preferences. Trading at just one-fifth of Ethereum’s market cap and outperforming ETH across critical metrics, including protocol revenue, transaction volume, active addresses, and fee stability, SOL is well-positioned to continue drawing capital away from Ethereum.

As a result, SOL DATs are expected to capture a growing share of circulating SOL. Today, they hold just over 1% of the total supply. We anticipate that figure will reach 5% by the end of the year and exceed 10% in 2026.

Policy remains a swing factor, but we do not see it as a structural roadblock. U.S. regulations will likely remain workable for listed issuers, while international treatment of DATs may vary by jurisdiction and remain episodic.

Like all crypto verticals, the DAT sector will see its share of failures in the next bear market. Many will struggle to raise accretively or grow Crypto Per Share. However, those that navigate the downturn effectively will emerge with stronger treasuries, deeper liquidity, and more persistent premiums. These are the DATs that will be best positioned to lead in the next bull market.

Conclusion

Digital Asset Treasuries represent one of the most compelling evolutions in crypto exposure, offering a compounding, capital markets-powered alternative to traditional spot buying. When executed properly, DATs don’t just lower friction; they unlock a structural advantage for shareholders.

As the sector matures, only the most resilient, transparent, and accretive DATs will endure. Execution, capital structure, community, and brand will matter more than ever, especially as mNAVs compress and investor capital grows more selective. The winners will master the flywheel: raising at a premium, accumulating intelligently, compounding exposure, and communicating clearly.

While BTC and ETH have led thus far, evidence continues to mount that SOL is best positioned to gain momentum and rerate higher. Superior throughput, user experience, and fee efficiency are pushing Solana to the forefront of institutional and consumer adoption. As a result, SOL DATs such as DeFi Development Corp. are positioned to capture a growing share of circulating supply, benefiting from price appreciation, staking yield, validator revenue, and onchain innovation.

In the quarters ahead, the DAT landscape will be filled with passive and active players, opportunists, and operators. But one thing is clear: DATs are not just a passing narrative. They represent a structural shift. And in that shift lies one of the most asymmetric opportunities in the entire crypto industry.

Disclaimer: This is for informational purposes only and reflects publicly announced developments, milestones, and media coverage related to DeFi Development Corp. (“the Company”). The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities, nor should it be relied upon as investment advice or a recommendation regarding any securities. Certain statements in this post may constitute “forward-looking statements” within the meaning of applicable securities laws. These statements are based on current expectations and assumptions and involve risks and uncertainties that could cause actual results or events to differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of publication. DeFi Development Corp. undertakes no obligation to update any forward-looking statements, except as required by law. All information is accurate as of the date posted and is subject to change without notice.