- DeFi Dev Corp. (Nasdaq: DFDV)

- Posts

- June 2025 Recap: Gearing Up For Accumulation

June 2025 Recap: Gearing Up For Accumulation

June might have marked a temporary pause in our pace of SOL accumulation, but it became one of the most pivotal months in laying the strategic foundation for what’s to come. From unlocking a $5B capital facility and expanding dfdvSOL utility to pioneering tokenized public equity and deepening validator partnerships, DeFi Dev Corp. made critical moves that position us for accelerated growth in Q3 and beyond.

June 2025 went down as an undesired pause in our SOL accumulation strategy; paradoxically, it was also one of the most strategically important months in our company’s history. In other words, we deliberately shifted our focus toward laying the groundwork and securing the partnerships necessary to support sustained long-term growth. This included unlocking new capital pathways, expanding the utility of our onchain assets, and positioning DeFi Development Corp. (NASDAQ: DFDV) to reaccelerate SOL accumulation into July and beyond.

We believe that the significance of the challenges DeFi Dev Corp. overcame in June will become increasingly apparent as time passes, especially as we begin to execute what is now in place. To understand why we believe this to be the case, it’s worth being considerate of all that went down in June.

In this recap, we cover our progress across onchain infrastructure, the tokenization of DFDV stock, updates to our treasury strategy, recent validator expansion, thought leadership & media appearances, community engagement, notable Solana ecosystem metrics, and key press coverage.

Expanded dfdvSOL Utility, Driving SPS Growth

We started the month by unveiling a suite of new integrations and ecosystem partnerships designed to grow the utility of the dfdvSOL liquid staking token (LST), thereby fueling greater demand that translates into Solana Per Share (SPS) growth for shareholders (as outlined in our recent blog post). This strategy can explain the 83,861 SOL staked via dfdvSOL as of the month-end, representing a +92.3% month-over-month increase. These integrations include the following:

Partnered with Exponent

Holders of the dfdvSOL liquid staking token (LST) can access capital-efficient leverage and smart liquidity strategies to boost their yield. The partnership with Exponent expands the utility of dfdvSOL and will help drive SOL Per Share (SPS) growth.

Partnership with RateX

Our collaboration with RateX, a yield trading and farming protocol on Solana, unlocks institutional-grade DeFi yield opportunities for dfdvSOL. By plugging into RateX’s infrastructure, we enable more sophisticated capital rotation strategies, transforming dfdvSOL from a passive yield token into an actively integrated asset within a broader yield market.

Drift Protocol Integration

Drift, Solana’s most liquid perpetual futures DEX, integrated dfdvSOL as a collateral asset, bringing institutional-grade exposure and utility to the dfdvSOL LST. The integration enables traders to utilize dfdvSOL in perpetual trading strategies, thereby creating demand-side pressure and reinforcing dfdvSOL’s value as a capital-efficient building block across the ecosystem.

Orca Pool Support

Orca, one of Solana’s leading DEXs for retail and institutional swaps, launched support for a dfdvSOL/SOL liquidity pool - thereby enhancing pricing depth, capital efficiency, and composability for dfdvSOL. This improves ease of access and strengthens dfdvSOL’s use as both a DeFi primitive and yield-bearing treasury asset.

Kamino Lending Integration

In a major milestone, dfdvSOL became the first LST from a public company integrated into Kamino, Solana’s premier onchain lending protocol. The integration adds dfdvSOL to Kamino’s borrow/lending market, allowing users to supply or borrow against dfdvSOL as collateral, as well as being included in Kamino’s Multiply Vaults, which provide users with access to automated leveraged-yield strategies.

Fragmetric Partnership

Through our integration with Fragmetric, a restaking infrastructure platform, dfdvSOL holders can now access restaking opportunities. This unlocks new layers of staking yield and reinforces our belief that DeFi-native treasury assets can outperform traditional corporate capital structures in both return and versatility.

DFDV Becomes First Crypto Treasury Strategy to Be Tokenized

In a landmark development, we partnered with Kraken and Backed to tokenize DFDV shares on the Solana blockchain, making DFDV the first crypto treasury strategy to be tokenized onchain under “DFDVx.”

The tokenization of DFDV transforms how public equities can be held, transferred, and interacted with - introducing programmability, instant settlement, and onchain investor access. It marks a major step toward a future where public equities and crypto-native infrastructure converge, enabling entirely new financial workflows centered on compliance, custody, and secondary liquidity.

The milestone was covered by CoinDesk, CoinTelegraph, and Bloomberg, highlighting Kraken’s role in providing the underlying infrastructure for token custody and distribution.

1/ $DFDV stock is officially coming onchain! 🚨

Today, we're announcing that we’ve partnered with @krakenfx to bring $DFDVx on @solana - the first tokenized U.S.-listed crypto treasury strategy.

Here's what it unlocks. 🧵

— DeFi Dev Corp. (@defidevcorp)

12:07 PM • Jun 23, 2025

Unlocking $5 Billion of Solana Buying Power

On June 12, we announced a $5 billion equity line of credit (ELOC), representing one of the largest capital access programs ever secured by a digital asset treasury company. This facility enables us to raise capital on a rolling basis, at our discretion, allowing us to scale our SOL accumulation strategy with precision and flexibility over time.

Why this matters: traditional treasury models rely on infrequent, lump-sum raises. With an ELOC, we can match capital deployment to market conditions, manage dilution thoughtfully, and maintain long-term alignment with shareholders. It also allows us to execute on validator infrastructure, yield optimization, tokenized assets, and other growth verticals without needing to time the market or rely on one-off fundraising cycles.

To help investors and community members better understand our capital structure and growth strategy, we hosted a deep-dive Twitter Spaces and published a detailed blog post: “What We’ve Built & Where We’re Going”. These explain how tools like S-1 filings, PIPEs, at-the-market (ATM) programs, and the ELOC will be strategically layered to maximize capital efficiency and minimize dilution risk.

The announcement received coverage from Decrypt and CoinDesk, further validating the scale and significance of this capital facility.

dogwifhat Validator Partnership

On June 24, we announced a strategic validator partnership with the dogwifhat (WIF) community, marking a unique collaboration between a publicly traded company and one of Solana’s most culturally iconic memecoins.

Under this partnership, the dogwifhat validator will be community-owned and governed, while DeFi Development Corp. will provide professional infrastructure, uptime reliability, and operational support. Together, we’ll pursue delegated stake through grassroots campaigns and validator performance while jointly applying for inclusion in the Solana Foundation Delegation Program.

The partnership merges institutional-grade validator infrastructure with cultural community power, proving that serious public companies can embrace open, community-owned protocols without compromising on technical standards. It also expands our validator business, thereby opening the door to SPS growth for shareholders.

This milestone was covered by Sherwood, which highlighted the significance of a Nasdaq-listed company backing Solana’s most viral and socially resonant asset.

Global Expansion: DFDV Goes Live in Europe

On June 3, we made our official European debut, with DFDV shares now available for trading on the Frankfurt Stock Exchange (FWB) and through Trade Republic, one of Europe’s leading neo-brokerage platforms.

This listing marks an important milestone in our mission to make Solana exposure accessible through global public equity markets. By extending our reach into the European Union, we’re opening the door to a significantly broader investor base - one that increasingly values liquid, regulated access to digital asset strategies without needing to custody crypto directly.

European institutional and retail investors now have a frictionless, compliant path to participate in Solana’s growth through a publicly traded vehicle. This move also strengthens DFDV’s position as a globally recognized Solana treasury strategy, unlocking cross-border flows, expanding liquidity, and reinforcing our long-term ambition to bridge traditional finance and onchain ecosystems at a global scale.

Thought Leadership & Media Highlights

Our team appeared across major crypto and institutional media platforms, discussing everything from DFDV’s origins, recent successes, the road ahead, and crypto treasury strategies. Coverage included the following:

Thinking Crypto Podcast: CEO Joseph Onorati joined one of the most established crypto interview platforms to discuss why Solana is our treasury reserve asset of choice, how Cantor Fitzgerald’s research validates our model, and the long-term vision for public companies in crypto, especially during periods of macro uncertainty.

Coinage Podcast: CIO & COO Parker White spoke with Matt Sigel, Head of Digital Asset Research at VanEck, about the rise of Solana-native corporate treasury strategies, the convergence of public equities and programmable finance, and where the onchain capital stack is heading.

Form & Structure Podcast: Joseph and Parker were featured on this institutional-focused podcast hosted by Surus to discuss how structures like DFDV can unlock capital efficiency, long-term alignment, and composability between traditional and onchain finance.

Permissionless NYC (Main Stage Replay): Dan Kang, our Head of IR, joined Tom Lee (Fundstrat) and David Grider (Finality Partners) for a panel on “Unpacking the Token Acquisition Vehicle Meta” at Blockworks’ annual Permissionless conference. The session addressed how public companies can serve as programmable capital allocators and why DFDV is at the forefront of that trend.

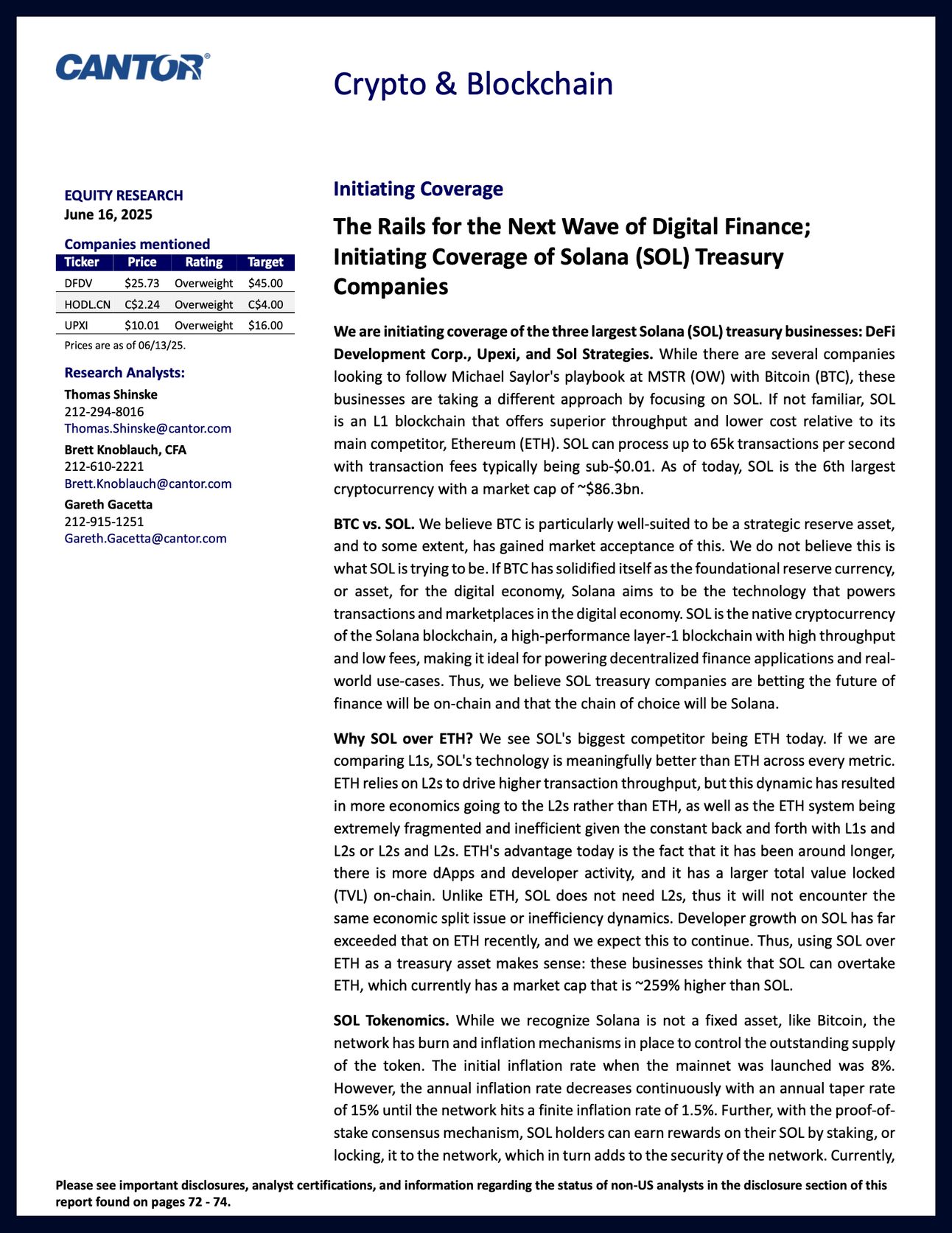

Cantor Fitzgerald Research Coverage: One of Wall Street’s top investment banks initiated coverage on Solana treasury strategies, naming DFDV its top pick with over 70% upside potential. This coverage is a milestone for both our company and the broader adoption of token-centric balance sheet models by public companies. A link to the complete report is available here.

Cantor initiation report.

Our activities throughout June also garnered widespread media coverage in leading financial and crypto publications. Outlets including Decrypt, CoinDesk, Bloomberg, and Barron’s highlighted our onchain equity initiatives, validator expansion, and capital strategy. CoinTelegraph and Sherwood provided additional coverage on our collaboration with Kraken and our partnership with dogwifhat, reinforcing DeFi Dev Corp.’s position as the leading publicly traded Solana treasury company and a first-mover in integrating corporate equity with onchain infrastructure.

Community Engagement & Education

We hosted and participated in multiple high-signal Twitter Spaces this month, including the following:

Kamino x DFDV: Lending, LSTs, and onchain public market bridges.

Capital Strategy AMA: How equity lines, S-1s, and ATM tools empower growth.

Solflare “Hold Strong” Twitter Space: Parker joined Solflare (1M+ wallets) to discuss our roadmap and validator strategy.

On top of that, we published two deep-dive blog posts and released our June 2025 Business Letter & video covering our treasury growth, new tokenized equity milestone, dfdvSOL integrations across Solana DeFi, and our new Days To Flip mNAV (DTF) key performance indicator.

Solana Ecosystem Milestones

Staying true to our commitment to accelerating the adoption of the Solana ecosystem, we highlighted to the world major milestones for the Solana network that further support the notion that Solana is destined to become the de facto Layer-1 blockchain in the years ahead. These highlights include the following:

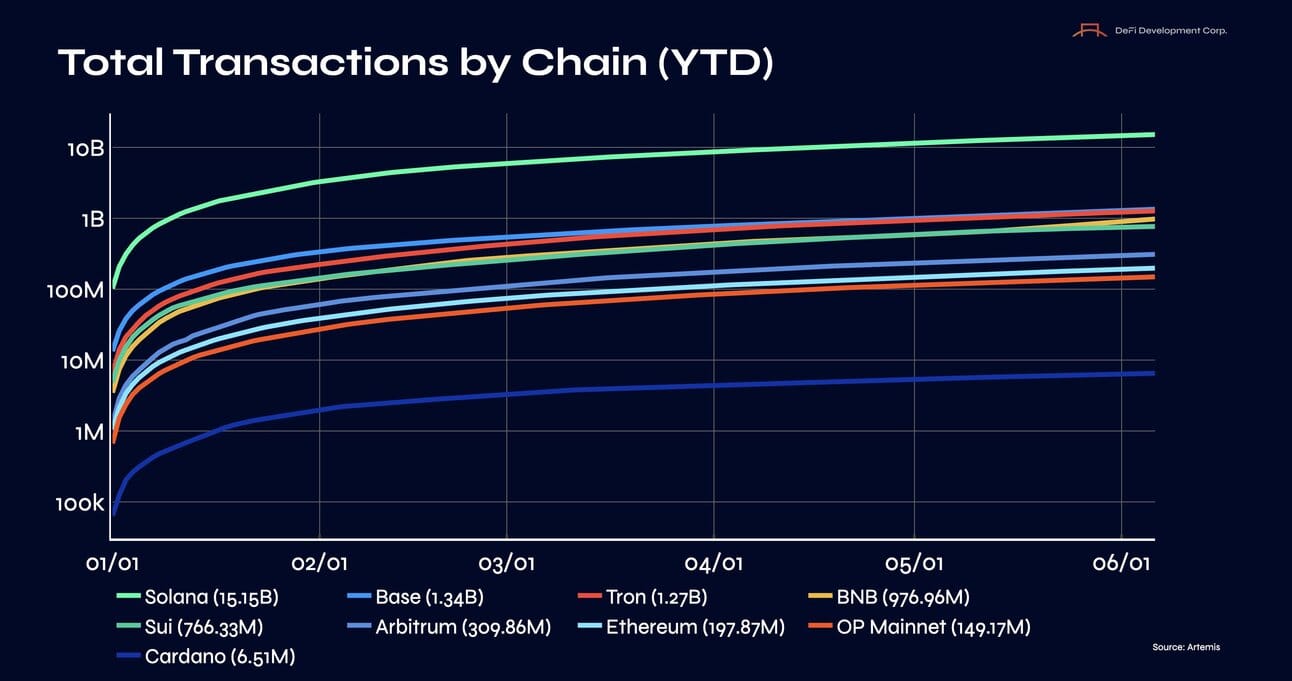

+15 billion transactions processed year-to-date (as of June 9), outpacing the combined throughput of all other major blockchains. This milestone highlights Solana’s unmatched scalability and sustained user activity.

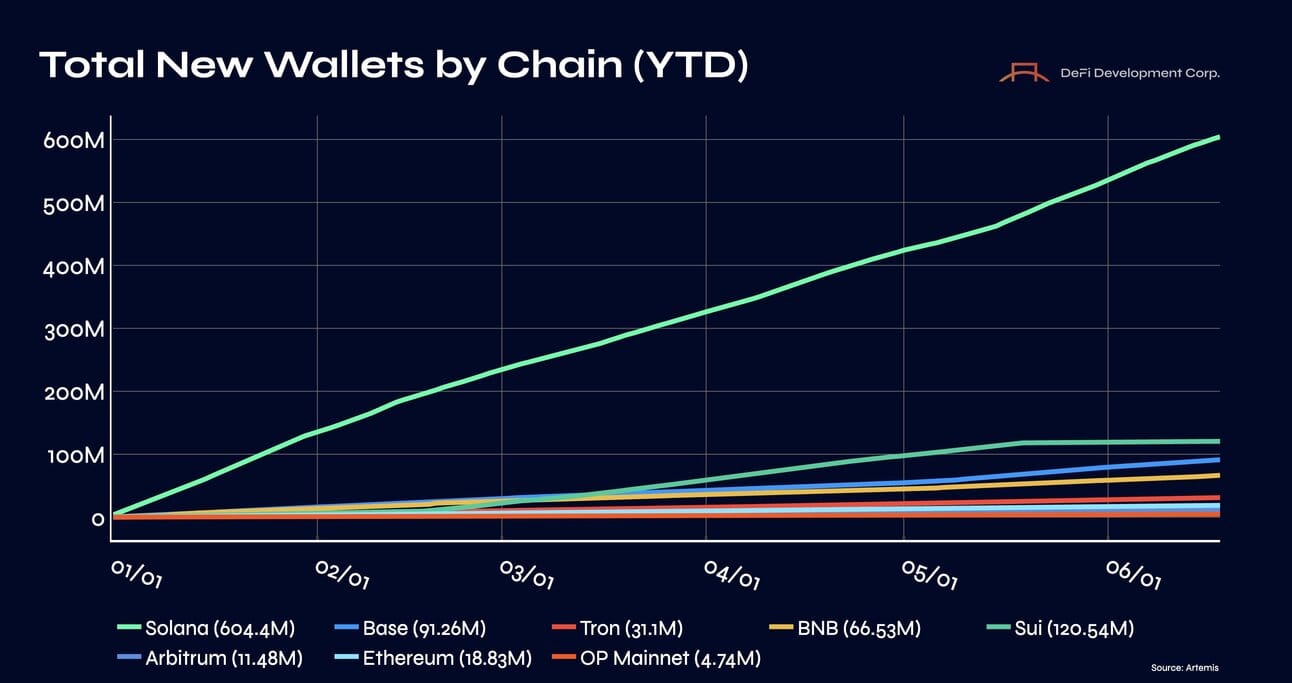

Over 640 million wallets were created YTD, nearly 2x more than the next closest blockchain. This growth underscores Solana’s expanding user base and its ability to onboard new participants at scale.

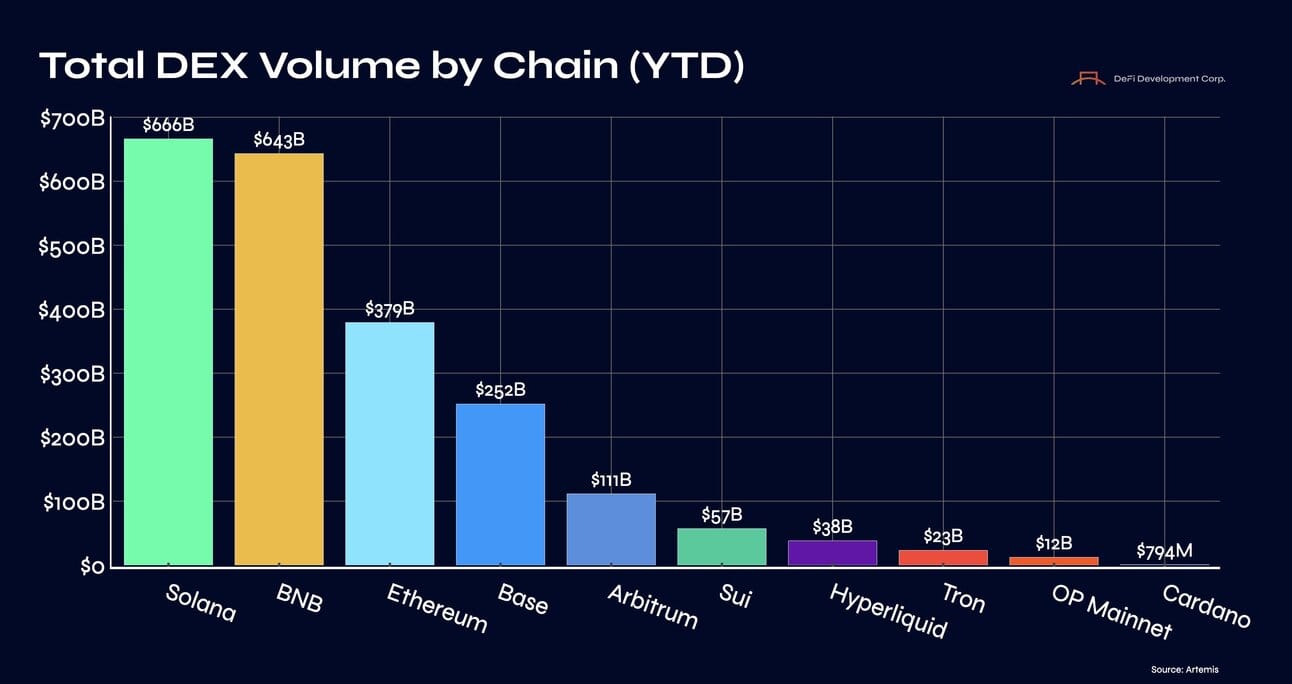

DEX volume exceeded $666 billion year-to-date, maintaining Solana’s position as the leading blockchain for decentralized trading activity.

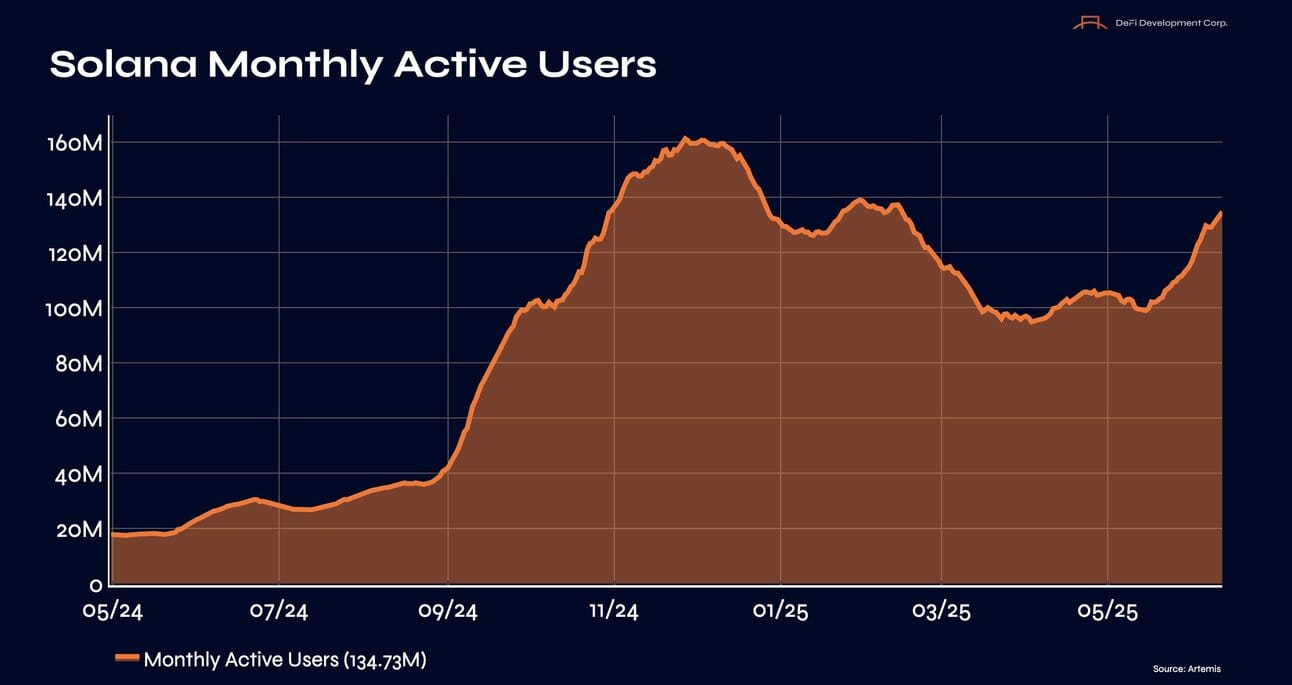

Monthly active users reached 127 million in June, marking a three-month high and reflecting continued user re-engagement across key Solana-based applications.

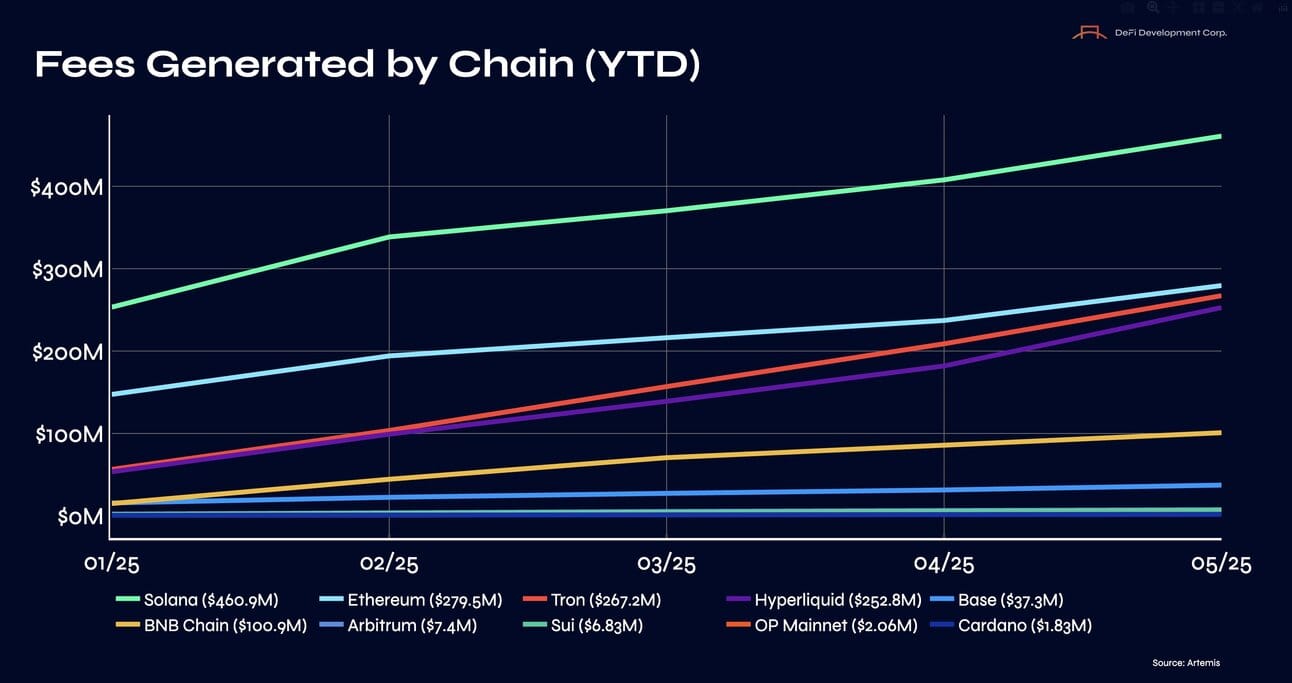

Network fees increased from $460M to $490M during the month, demonstrating strong onchain economic activity despite market headwinds and coming well ahead of Ethereum, Tron, and Hyperliquid at $280M, $267M, and $253M, respectively.

Solana processed more than 111 million transactions in a single day, making June 26 the highest daily volume in over 20 weeks and signaling renewed momentum in network usage.

Month-End Statistics

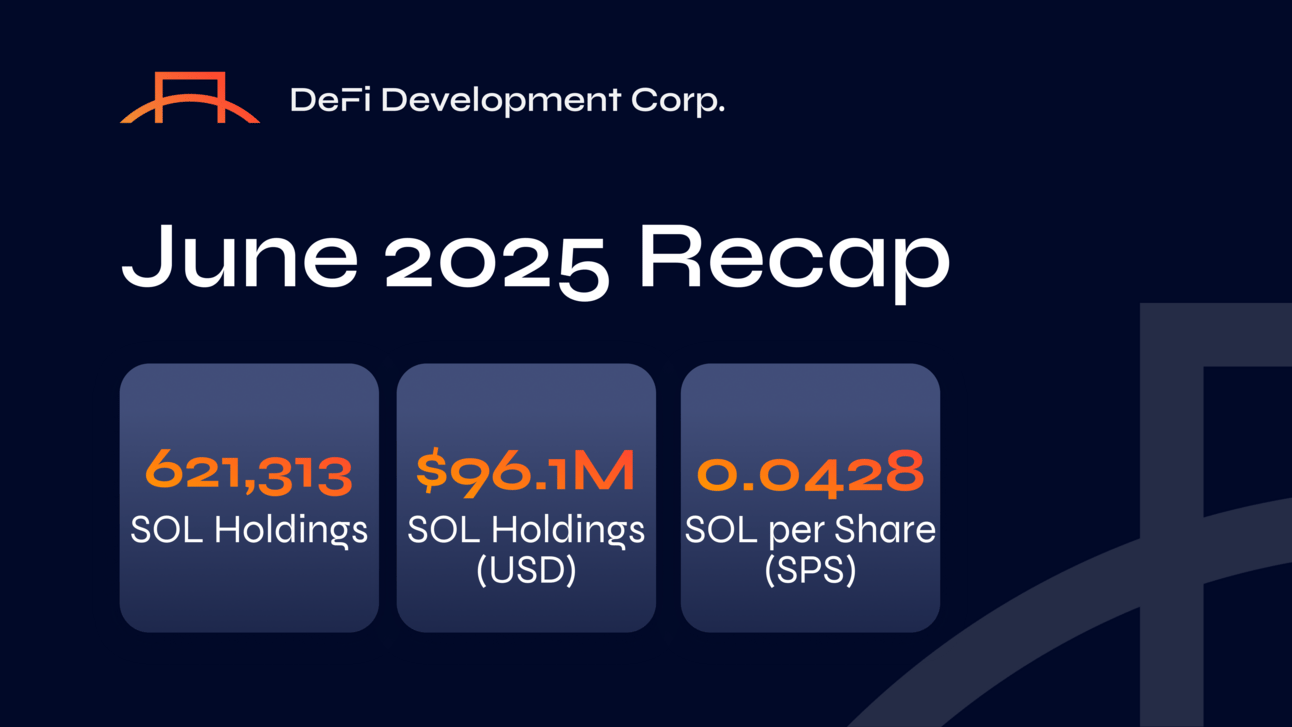

SOL Holdings: 621,313 SOL

SOL Holdings Value: $96.1M

Shares Outstanding: 14,740,779

SOL Per Share (SPS): 0.0428 SOL

Looking Ahead

As we head into 3Q25, DeFi Development Corp. remains committed to:

Driving SOL per share growth through strategic staking and LST integrations.

Unlocking capital-efficient access to Solana through public market structures.

Expanding the reach and impact of our various initiatives, including our validator business, the dfdvSOL LST, our DFDVx tokenized equity, and more.

Cementing our position as the most transparent and impactful corporate treasury strategy in crypto.

Stay tuned for our July shareholder letter, validator updates, and additional institutional & ecosystem integrations as we continue to cement DeFi Dev Corp. as the best way to accumulate SOL.

In service of SPS growth,

The DFDV Team

Disclaimer: This is for informational purposes only and reflects publicly announced developments, milestones, and media coverage related to DeFi Development Corp. (“the Company”). The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities, nor should it be relied upon as investment advice or a recommendation regarding any securities. Certain statements in this post may constitute “forward-looking statements” within the meaning of applicable securities laws. These statements are based on current expectations and assumptions and involve risks and uncertainties that could cause actual results or events to differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of publication. DeFi Development Corp. undertakes no obligation to update any forward-looking statements, except as required by law. All information is accurate as of the date posted and is subject to change without notice.