- DeFi Dev Corp. (Nasdaq: DFDV)

- Posts

- Nov. 2025 Recap: Executing On All Fronts

Nov. 2025 Recap: Executing On All Fronts

Volatility was a catalyst, not a setback, as DFDV expanded its Solana footprint across capital markets and DeFi rails. With new partnerships, yield strategies, and leadership momentum, the flywheel continues to turn.

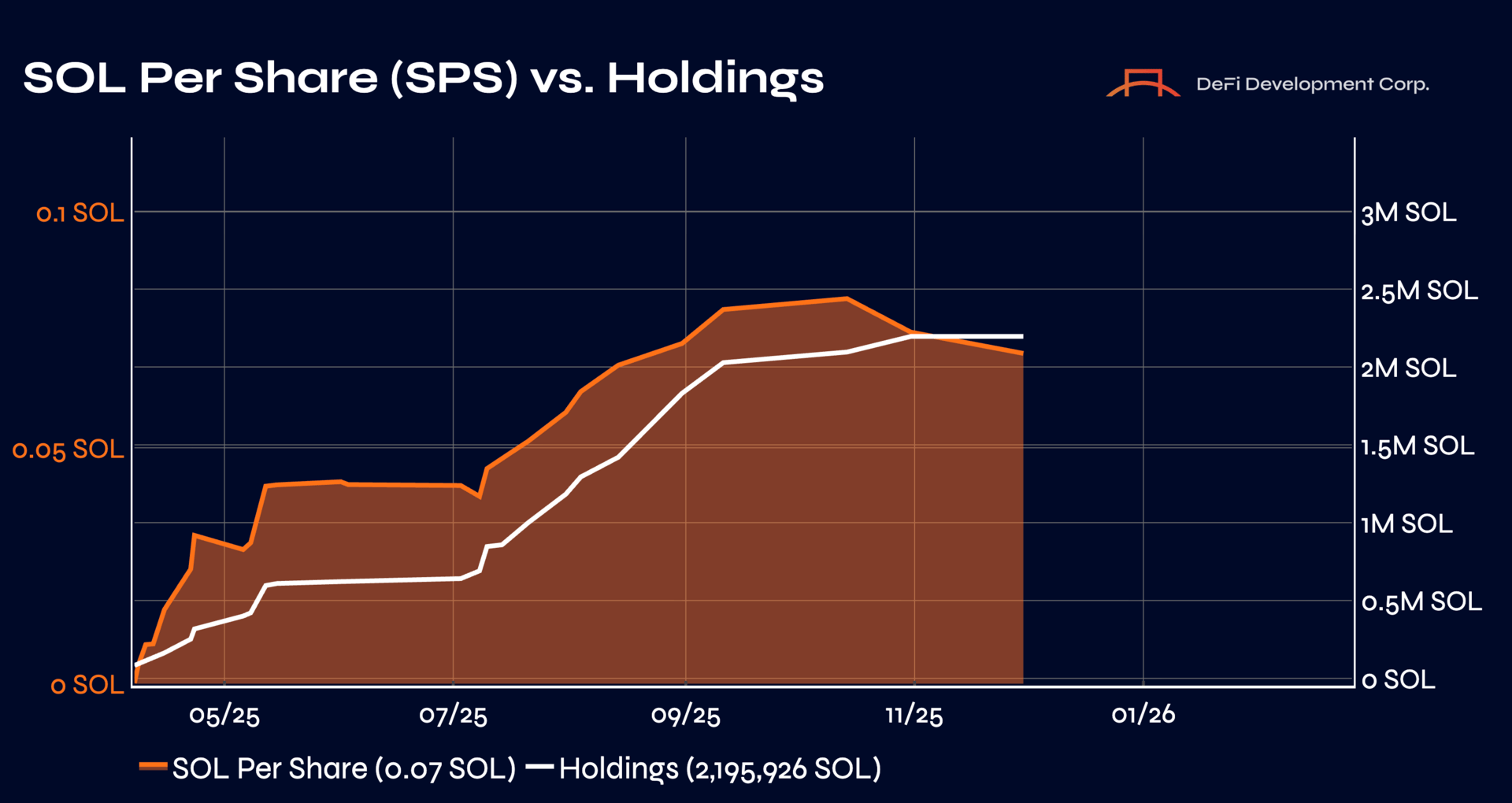

November was a pivotal month for DeFi Development Corp. (DFDV) as we continued executing across capital markets, protocol partnerships, and community transparency. From filing our Q3 results to declaring insider stock purchases, from expanding our Treasury Accelerator to pioneering stablecoin yield optimization, we remained laser-focused on growing Solana per Share (SPS) and reinforcing our role as the leading Solana-native Digital Asset Treasury (DAT).

Month-End Statistics

SOL Holdings: 2,195,926

SOL Holdings Value: $293.2M

Shares Outstanding: 31,389,587

SOL Per Share (SPS): 0.0700 SOL

dfdvSOL Supply: 530,286.72 SOL

DFDVx (Tokenized DFDV) Trading Volume: $22.4M

Key Milestones & Developments

Insider Stock Purchases & Equity Transfers

COO & CIO Parker White and CSO Dan Kang purchased common stock on the open market in November 2025, signaling confidence in DFDV’s long‑term value proposition. The company also disclosed internal equity transfers between affiliated entities in recent Form 4 filings, reinforcing its commitment to transparency.

Additional details

Q3 2025 10‑Q Filing

DFDV filed its Q3 2025 Form 10‑Q, reporting over $74 million in unrealized gains and providing deeper insight into treasury performance and onchain yield generation. With 11.4% organic SOL yield reported for the quarter, the filing highlights DFDV’s differentiated positioning as a productive, Solana-native treasury.

Additional details

Loopscale LOI Announcement

DFDV signed a Letter of Intent with Loopscale, a leading stablecoin optimizer, to enhance SOL‑denominated yield and explore programmatic onchain incentives. This partnership aims to scale treasury capital efficiency beyond staking through quantitative stablecoin strategies.

Additional details

Strong Q3 2025 Earnings

DFDV delivered robust quarterly results driven by validator income, DeFi deployments, and yield‑accretive operations, demonstrating the compounding impact of expanding treasury allocation. Revenue growth and improved staking dynamics reinforce continued strength in SPS accumulation.

Additional details

Preferred Stock Offering Announced

DFDV introduced plans for the first Solana‑focused preferred stock offering, designed to attract institutional and yield‑oriented capital while strengthening the Company’s balance sheet and long‑term treasury growth model.

Additional details

Warrant Trading Commences – Ticker: DFDVW

Warrants issued via dividend began trading publicly under ticker DFDVW, giving investors a leveraged way to gain upside tied to DFDV’s execution and SPS expansion. Additional details

Solana Investor Day (SOLID) 2025

On November 5, 2025, we hosted the first Solana Investor Day (SOLID) in New York City, bringing together:

Institutional investors from major asset managers, hedge funds, and banks

Builders from across the Solana ecosystem

The DFDV management team

Every one of the 100 seats was filled, and the conversations were honest, technical, and focused on real-world adoption. As planned, SOLID gave traditional investors a structured, hands-on way to engage with Solana and DFDV’s model, rather than just leaning on reports and raw charts. For those who could not attend, we published a five-part replay series. 👇️

Solana (SOL) to $10,000 – SOLID 2025 (Part 1/5)

DK delivers our macro thesis on Solana as a global value transfer layer and why we believe $10,000 per SOL is a realistic long-term target rather than a meme number.

Fireside Chat with Nick Ducoff, Solana Foundation (Part 2/5)

Joseph Onorati sat down with Nick Ducoff to discuss how institutions are already using Solana, network resilience under stress, Firedancer, Alpenglow, and why Solana is emerging as the preferred settlement layer for stablecoins and tokenized assets.

Talking With Solana Builders (Part 3/5)

A panel moderated by Pete Humiston with teams from Jito, Fragmetric, Sanctum, Marinade, Exchange Art, and more, covering LSTs, MEV, NFTs, and restaking infrastructure on Solana.

The DFDV Strategy (Part 4/5)

DK’s full breakdown of how our SOL treasury structure differs from Bitcoin-based DATs, why organic yield matters, and why we think of DFDV as “SOL on steroids.”

Management Q&A (Part 5/5)

A candid session with Joseph Onorati, John Han, Parker White, and DK, covering capital markets, buybacks, SPS targets, and our global Treasury Accelerator roadmap.

Media, Events, & Thought Leadership

Even with prices down in November, we stayed focused on leading the conversation around Solana, DATs, and SPS growth.

DFDV <> Solflare Livestream #19

Parker joined Solflare, the Solana-dedicated wallet with 1M+ monthly users, on a livestream to discuss DFDV’s Nasdaq “Solana goes public” moment, the dfdvSOL + validator yield stack, and why 1.0 SPS by 2028 remains our North Star.

Replay: Solflare Livestream #19

“Are DATs Dead” Debate w/ Marty Party

On MartyParty’s X Spaces, we broke down mNAV compression, leverage in bear markets, and why DATs remain structurally strong as long as SOL is compounding.

Replay: Are DATs Dead?

Public Support for SIMD-0411

DFDV became the first SOL DAT to publicly back SIMD-0411, advocating for faster disinflation to strengthen SOL’s monetary credibility, reduce emissions, and improve long-term yield dynamics.

Read: Why DFDV Supports SIMD-0411

“DeFi Development: Yes, It’s Even More Of A Buy Now”

On November 18, Seeking Alpha analyst Joseph Parrish reiterated his “BUY” on DeFi Development Corp. with his latest report, “DeFi Development: Yes, It’s Even More Of A Buy Now.”

Key points from the latest report include:

Despite a 54% decline in DFDV’s share price over the prior month, SOL was down closer to 30%. The result is that DFDV shifted from trading near 1.0x mNAV to trading at a discount to its mNAV.

He emphasizes that DFDV’s SOL-focused treasury model is structurally different from BTC-based treasuries because staking yield and validator operations generate recurring cash flow, which can help cover the cost of capital and grow SPS.

He highlights our warrant dividend, preferred stock plans, and Treasury Accelerator as creative levers for long-term growth beyond simple price appreciation of SOL.

While acknowledging that volatility cuts both ways, he concludes that the current discount already reflects many of the risks and that DFDV’s model is still value-creative over long horizons.

His bottom line: DFDV remains a Buy below $12.18 per share, in his view, for investors who size positions appropriately and understand the leverage to SOL.

Reddit AMA Recap: Transparency, Strategy & Community

We hosted our second monthly Reddit AMA on r/DFDVDegens, where Parker answered a long list of thoughtful questions from shareholders and prospective investors.

The following were a few recurring themes from the Q&A, as summarized:

Q: How do you grow SPS in a bear market?

A: Two main levers: opportunistic buybacks when the stock trades at a large discount to mNAV, and organic SPS growth via staking, validators, DeFi strategies, and new revenue lines.

A: Financing can come from preferred offerings, ATM issuance in better markets, and cash flow from the balance sheet. Selling “principal” SOL is a last resort, but not off the table if needed to protect long-term SPS.

Q: Timeline and confidence around the 1.0 SPS target by 2028

A: Management believes the goal is realistic, though not guaranteed.

A: Multiple “irons in the fire” exist that could each move SPS significantly, alongside the more traditional toolkit of preferreds, ATMs, and buybacks.

A: The work does not stop at 1.0 SPS. The mission is to keep growing SPS and use that compounding engine to help DeFi absorb global finance.

Q: What are the balance sheet risk, SOL dependence, and downside scenarios?

A: Most of our leverage is unsecured or SOL-denominated, which avoids forced liquidations from mark-to-market margin loans.

A: The biggest risk is not a short-term drawdown, but SOL going down and staying depressed for multiple years. Against that, we are building non-price-dependent revenue streams and onchain services that can generate cash even in harsh markets.

A: If SOL truly failed, that would reflect far broader issues in crypto, not just at DFDV.

Q: Why talk publicly about $10,000 SOL? Does that overshadow DFDV?

A: Our North Star is SPS growth.

A: However, SPS only matters in the context of the underlying asset, so we care deeply about the long-term health of SOL.

A: The full thesis behind the $10,000 target, including the math, is outlined in our investor deck and public materials, not as a short-term price call, but as a long-run vision of Solana’s share of global value transfer.

Q: Buybacks, PIPEs, and managing discounts to mNAV

A: We do not plan to repeat the August PIPE structure unless we are in truly dire conditions.

A: Buying stock at a discount and issuing at a premium is powerful for SPS, but publicly announcing exact buyback levels can just hand that edge to fast-moving funds.

A: Our focus is squarely on long-term holders who benefit from SPS growth over cycles, not on smoothing every bump in the chart.

Overall, the AMA reinforced a simple message: we will be candid about tradeoffs, we will keep the community in the loop, and we will continue to optimize SPS across very different market regimes.

As a reminder, we plan to continue hosting monthly AMAs on Reddit to promote transparency and surface deeper community feedback. If you haven’t already, join the conversation at r/DFDVDegens.

Looking Ahead

November 2025 may not go down as anyone’s favorite month when considering the broader market’s performance, but for DeFi Development Corp, it was yet another month of continued execution. We continued to professionalize our capital stack through preferred equity, warrant dividends, and insider purchasing. We expanded our onchain footprint, doubled down on validator operations, pushed forward on new stablecoin yield strategies, and jumped at other opportunities designed to fuel SPS growth. We also added our voice to critical ecosystem governance, publicly supporting SIMD-0411 to accelerate Solana’s path toward institutional-grade monetary stability.

And despite the market backdrop, we spent the month showing our work. From SOLID in New York to Solflare’s livestream, to long-form conversations with Gauntlet, Odyssey, Derive, and a strong turnout in our monthly Reddit AMA, we opened up the hood on our strategy for institutions, builders, and retail investors alike.

Be that as it may, our goals remain unchanged: aggressively grow SOL Per Share, help Solana become the global value transfer layer, and bring the full weight of public capital markets onchain.

In service of SPS growth,

The DFDV Team

Disclaimer: This is for informational purposes only and reflects publicly announced developments, milestones, and media coverage related to DeFi Development Corp. (“the Company”). The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities, nor should it be relied upon as investment advice or a recommendation regarding any securities. Certain statements in this post may constitute “forward-looking statements” within the meaning of applicable securities laws. These statements are based on current expectations and assumptions and involve risks and uncertainties that could cause actual results or events to differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of publication. DeFi Development Corp. undertakes no obligation to update any forward-looking statements, except as required by law. All information is accurate as of the date posted and is subject to change without notice.