- DeFi Dev Corp. (Nasdaq: DFDV)

- Posts

- Oct. 2025 Recap: Pushing Forward, Still

Oct. 2025 Recap: Pushing Forward, Still

October showcased continued execution across capital markets, ecosystem partnerships, and global treasury acceleration, strengthening our leadership in the Solana Digital Asset Treasury (DAT) vertical.

October marked another pivotal month for DeFi Development Corp as we continued to execute on our mission of compounding SOL Per Share (SPS) and strengthening our position as the leading public Solana-native Digital Asset Treasury. We expanded our balance sheet, introduced new shareholder incentives, deepened international reach through the Treasury Accelerator program, and gained meaningful institutional validation from both traditional finance and crypto-native audiences. With growing media coverage, new capital markets tools, and continued performance leadership across key Solana ecosystem metrics, DFDV entered the final quarter of 2025 with strong momentum, improved optionality, and a rapidly expanding global footprint.

Month-End Statistics

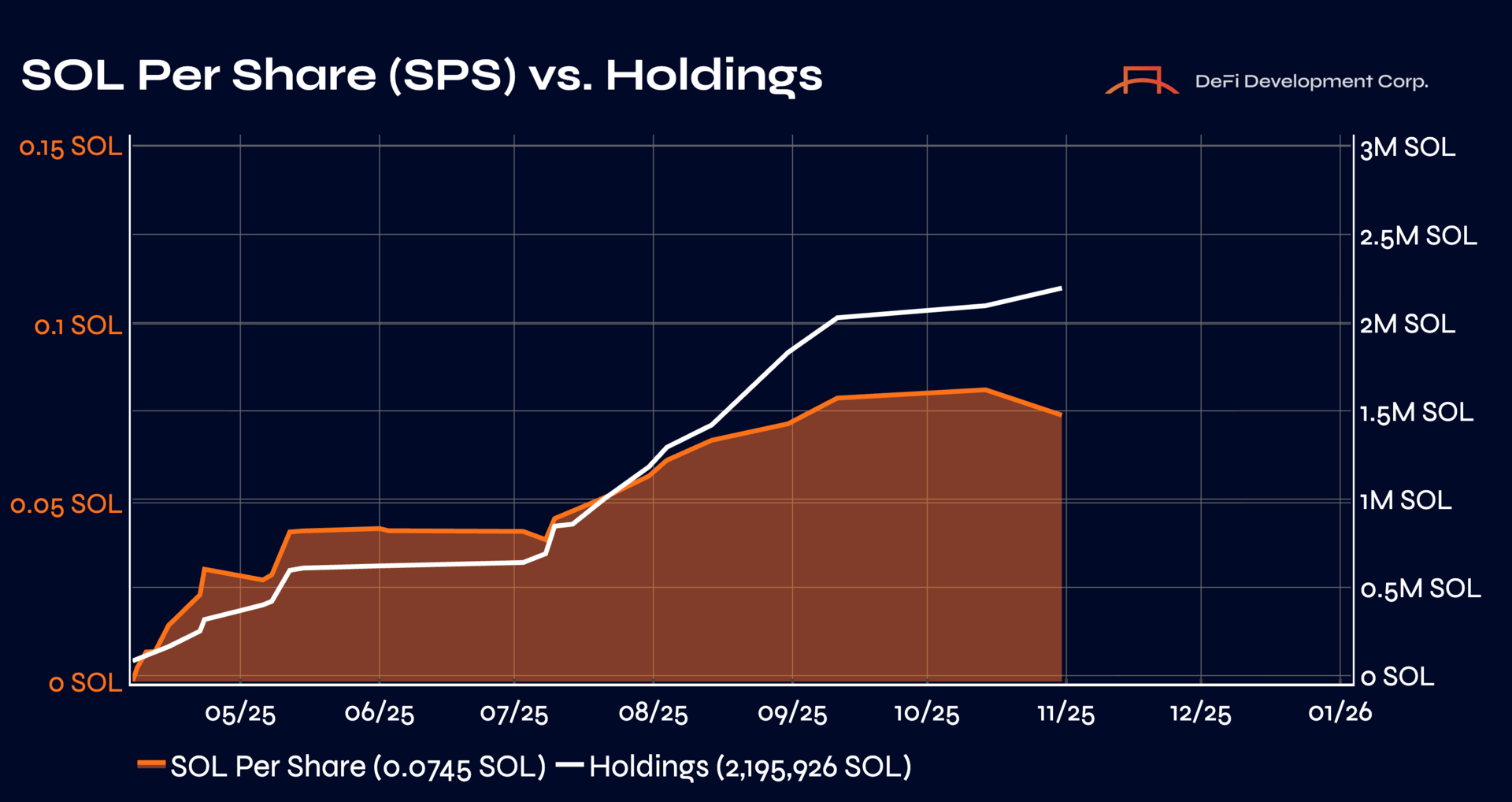

SOL Holdings: 2,195,926

SOL Holdings Value: $411M

Shares Outstanding: 29.46M

SOL Per Share (SPS): 0.0745

dfdvSOL Supply: 615,169 SOL

DFDVx Trading Volume: $22.8M

Note: The exercise of pre-funded warrants can explain the decline in SPS in October.

Key Milestones & Developments

Crossed 2.2M SOL in Treasury Holdings

In October, we added another 86,307 SOL to the balance sheet, bringing total holdings to over 2.19M SOL. This marked another step forward in our mission to deliver compounding SPS growth and further established DFDV as the most aggressive public accumulator of SOL globally.

Additional details

Warrant Dividend to Shareholders

We declared a warrant dividend to all shareholders of record as of October 23. This rewards long-term holders, expands strategic optionality, and reflects confidence in our growth trajectory while maintaining capital efficiency.

Additional details

DFDV Options Begin Trading on CBOE

DFDV options began trading on the Chicago Board Options Exchange (CBOE), giving investors new tools for hedging, directional positioning, and generating yield through options strategies. Weekly expiries also increase flexibility and market participation.

Additional details

Announcing DFDV Japan with Superteam JP

We revealed the forthcoming launch of DFDV JP, a new Solana-native DAT in Japan, built in partnership with Superteam Japan. Japan is one of the most active crypto markets globally, marking our first Treasury Accelerator expansion into Asia.

Additional details

Thought Leadership: Foundations Can’t Scale Crypto – But DATs Will

We explored why traditional foundation‑led models are reaching their limits in supporting crypto ecosystems, and why Digital Asset Treasuries (DATs) are emerging as the next evolution. The article delves into how DATs align incentives with investors, drive performance, and scale public chain ecosystems like Solana more efficiently.

Additional details

Q3 2025 Earnings Call Confirmed

We confirmed that Q3 2025 financial results will be released on November 13. Management will provide updates on validator economics, capital deployment, treasury composition, and forward-looking growth initiatives.

Additional details

Thomas Perfumo Appointed to Board of Directors

In October, DFDV welcomed Thomas Perfumo to its Board. A crypto veteran with 8+ years at Kraken, where he currently serves as Senior Principal, Thomas brings deep experience across corporate strategy, product, and capital markets. His background also includes time at Moore Capital as a Long/Short Equity Analyst.

Institutional Coverage & Recognition

Seeking Alpha Initiates Coverage with “Buy” Rating

In October, analyst Joseph Parrish published a bullish initiation report on Seeking Alpha, assigning DeFi Development Corp (Nasdaq: DFDV) a “Buy” rating. The note highlights DFDV’s proximity to Net Asset Value (NAV), sustainable staking yields from Solana, and its unique ability to compound SPS through on-chain strategies and capital markets access. Parrish emphasizes DFDV’s execution-first approach, lean structure, and potential for accretive upside, especially in comparison to less transparent or inactive treasury peers. The report also explores key risks such as SOL volatility and outlines why the current NAV multiple offers a compelling entry point for investors.

📖 Read the full report

Top-Performing U.S. Stock in 2025

As of October 9, DFDV ranked as the highest-performing U.S.-based stock on both Nasdaq and NYSE YTD.

#Solana DAT News: Citidel holds 4.5% of @defidevcorp@solana DAT.

13G Filing shows Ken Griffin - CEO of @Citadel holds 4.5% stake in NASDAQ: DFDV

bamsec.com/filing/1104659…

— MartyParty (@martypartymusic)

3:24 PM • Oct 22, 2025

Ken Griffin Discloses Stake in DFDV

Billionaire investor and Citadel CEO Ken Griffin filed a 13G showing a 4.5% stake in DFDV - a powerful validation of the DAT model and our positioning.

Media, Events, & Thought Leadership

Arrington Capital’s PiratePod

Joseph Onorati, CEO of DFDV, discussed a wide-ranging conversation about the rise of Digital Asset Treasuries (DATs), Solana’s growing institutional appeal, and how DFDV is bridging TradFi and DeFi through innovative structures like preferred stock and warrant dividends.

Jun’s Economy Lab (Korea)

Parker White, COO and CIO, joined one of Korea’s leading economics channels with over 1M subscribers to talk Solana DATs and the future of onchain finance.

📺 Watch here

Sol Brothers Podcast

In this in-depth interview, DFDV’s Dan Kang walks through the emerging Digital Asset Treasury (DAT) model and how Solana unlocks real yield, global expansion, and institutional-grade growth strategies. He explains why DFDV sees volatility as an asset, how cash flow is generated on-chain, and why Solana fundamentals position it to outperform in the next market cycle.

📺 Watch here

Stocktwits’ Shocktoberfest 2025

DFDV CFO John Han sat down for a wide-ranging interview on how DFDV is using capital markets tools like PIPEs, convertibles, and ATMs to accumulate SOL and redeploy it across the Solana ecosystem. He explained why Solana’s speed and scalability give it an edge, how the team is compounding onchain yield, and why DFDV offers a more aligned and efficient way to gain SOL exposure than simply buying the asset outright. With SPS at the heart of DFDV’s strategy, John also outlined how management incentives are tied directly to long-term shareholder value.

Seed Club & Roll Up Podcasts

Joseph and DK appeared on Seed Club and Roll Up to explore warrant dividends, preferred stock, and validator restaking strategies.

🎙️ Seed Club Replay

DFDV JP Spaces Replay

We hosted a dedicated Twitter Spaces to spotlight the upcoming launch of DFDV JP, our strategic partnership with Superteam Japan and the first Solana-native Digital Asset Treasury in the country. The discussion featured DFDV’s Head of Research Pete Humiston, Parker White, and Superteam Japan’s Hisashi Oki. Together, they unpacked why Japan is a prime launchpad for Solana treasuries, how the Treasury Accelerator model supports international expansion, and what this means for long-term SPS growth.

Superteam Content Bounty

We hosted our first content bounty via Superteam, allowing Solana ecosystem participants to be rewarded for creating content explaining the rise of Solana DATs, how DFDV separates itself from peers, and more. The bounty attracted nearly 200 entries, generating almost 500K impressions on Twitter.

Reddit AMA Recap: Transparency, Strategy & Community

We hosted our first-ever Ask Me Anything (AMA) under the official r/DFDVDegens subreddit.

As the Solana ecosystem grows and the number of Digital Asset Treasuries (DATs) multiplies, we remain committed to setting the standard for transparency, open dialogue, and community alignment. This AMA marked a major milestone in our effort to expand investor communication, tackle tough questions head-on, and maintain our position as the leading Solana-native DAT in the market.

Below is a summary of key themes and takeaways from the Reddit discussion:

🔒 Shorts, Borrow Rates & PIPE Overhang

Q: Why is the borrow rate 134%?

A: Primarily due to the August PIPE; those shares remain unregistered due to the SEC shutdown. Once registered, borrow pressure should ease.

🌍 Treasury Accelerator & International Expansion

Q: Update on DFDV UK, Korea, and Japan?

A: Korea & Japan are progressing toward public launches, DFDV UK (CYK.L) is working through FCA approval (expect ~3 months), and our Treasury Accelerator remains early but high-potential—designed to compound SPS globally.

🛡️ Solana Custody & Security

Q: How secure is our SOL treasury?

A: Managed by a team with decades of crypto experience, including past roles at Binance, Kraken, and Huobi. Custody is handled with institutional-grade practices.

📈 Revenue & Yield Strategy

Q: How does DFDV earn yield vs other DATs?

A: SOL staking, validator rewards, and onchain opportunities enable ~10% ROA. Unlike BTC-focused DATs (e.g. MSTR), we generate revenue organically—no constant equity raises needed.

💰 Fundraising Without Dilution

Q: How do you plan to grow without stock dilution?

A: Through preferred stock offerings, validator economics, and Treasury Accelerator deals that convert SOL into compounding SPS.

📉 Volatility & IV

Q: IV is low—can DFDV do anything about it?

A: Macro trend across all crypto, DFDV still trades above SOL in IV terms, and our Treasury Accelerator + new catalysts may drive future upside volatility.

🆚 DFDV vs. SOL ETFs

Q: Won’t a SOL ETF make DFDV obsolete?

A: Not at all. ETFs are passive; DFDV is an active yield generator with real onchain revenue and upside leverage to Solana’s ecosystem.

🤝 Citadel’s Stake

Q: Did Citadel buy through PIPE or the open market?

A: Likely a mix, but significant open market activity has been observed. They’re now among the top traders of our stock.

⚔️ Beating the DAT Competition

Q: How does DFDV stack up to newer DATs?

A: We have the highest SPS growth rate in the industry; most competitors are early-stage or yieldless BTC treasuries, and DFDV’s management incentives are SPS-aligned.

💸 Buybacks & mNAV

Q: When trading below mNAV, why not aggressively buy back?

A: Buybacks are on the table; priority is compounding SPS through accretive capital deployment.

🔁 Dividend Policy

Q: Can you pay a dividend from staking yield?

A: Not planned for common stock due to tax complexity. Preferred shares are being structured to include ~10% yield.

🧠 Coordination Between Global Entities

Q: Can DFDV Japan/Korea/UK buy DFDV shares to reduce float?

A: Not planned, but entities will collaborate across marketing, LST products, and potentially stablecoin initiatives.

We plan to continue hosting monthly AMAs on Reddit to promote transparency and surface deeper community feedback. If you haven’t already, join the conversation at r/DFDVDegens.

Solana Performance Metrics

Despite temporary shifts in monthly revenue rankings, October showcased the continued strength of Solana’s onchain economy. The network once again led all blockchains in DEX volume, processed far more transactions than the next several competitors combined, and retained the largest community of monthly active users worldwide. The consistency of this performance at scale highlights Solana’s growing role as the primary venue for real user activity, liquidity, and transactional demand across the global blockchain landscape.

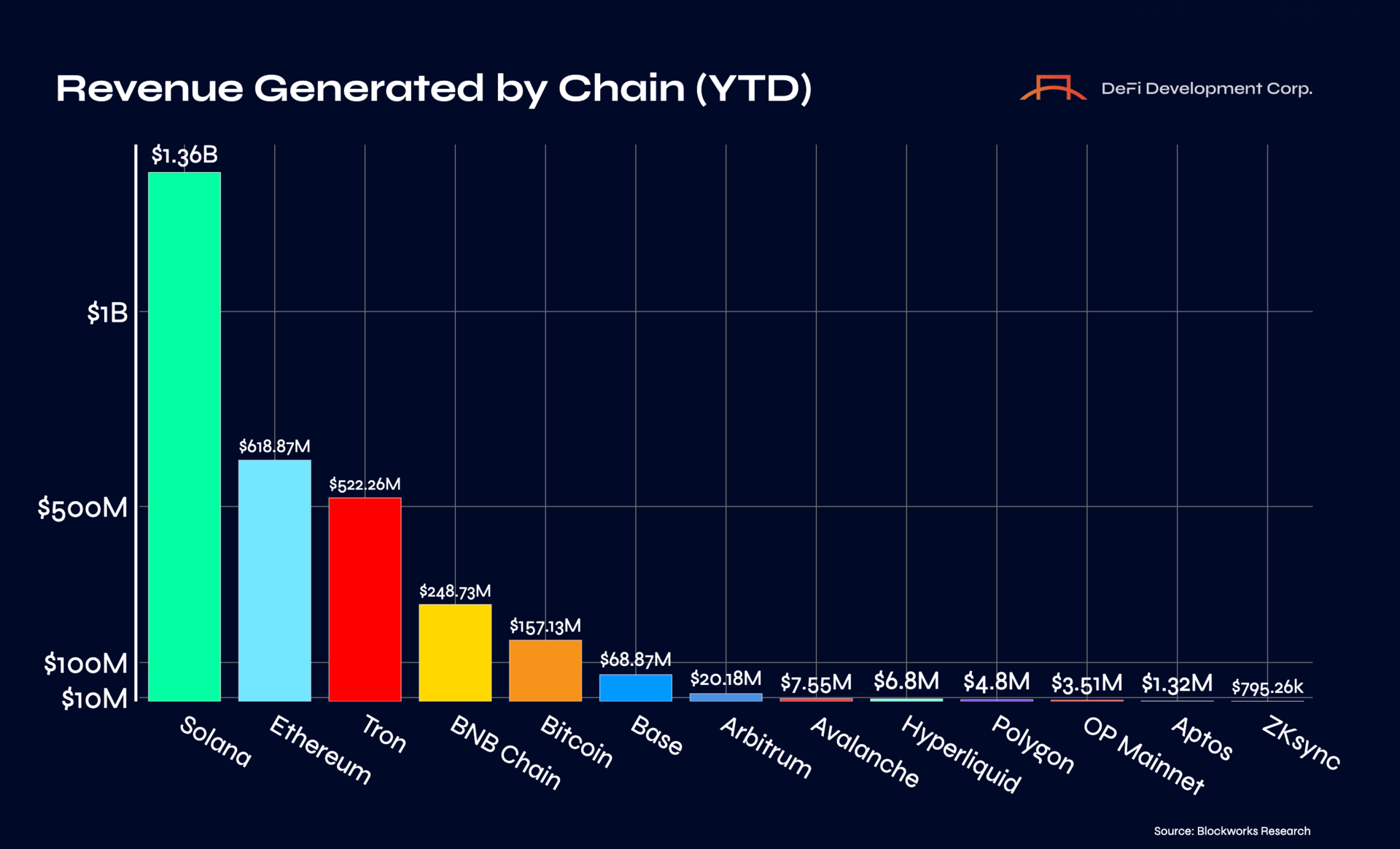

Protocol Revenue: After leading all other chains in monthly revenue for 12 straight months, Solana ($40M) ranked third this month, behind BNB ($77M) and Ethereum ($65M). Even so, Solana continues to hold first place on a year-to-date basis with more than $1.36B in revenue, well ahead of second-place Ethereum at $618M.

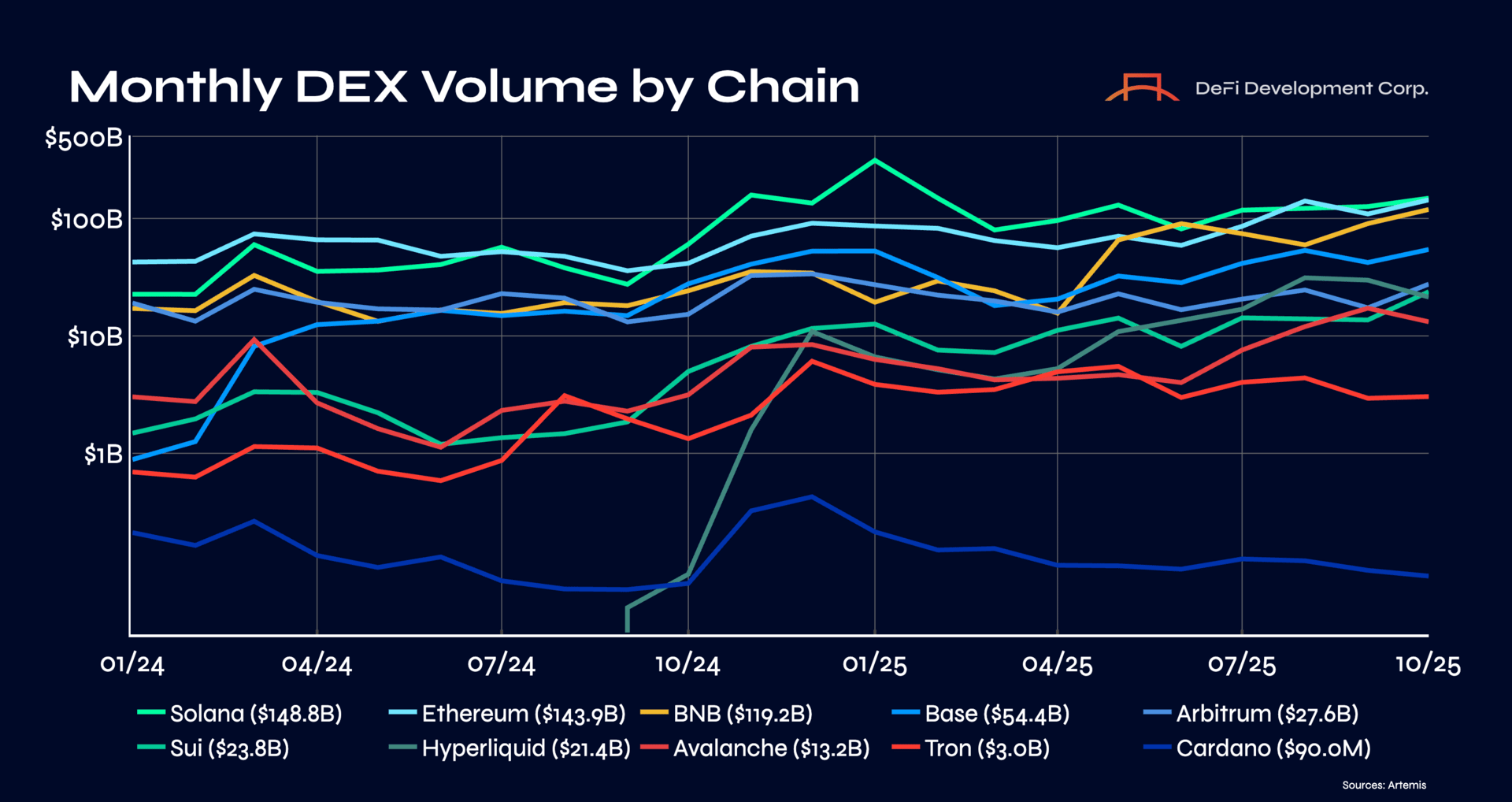

DEX Volume: Trading activity continued to climb in October, with Solana once again leading all blockchains in monthly DEX volume at $148.8B. Ethereum followed closely at $143.9B, while BNB ranked third at $119.2B. The sustained strength in onchain trading solidifies Solana’s position as the most active venue for decentralized market activity. On a year-to-date basis as of October 31, 2025, Solana remains in 1st place with nearly $1.37T in DEX volume, well ahead of 2nd place Ethereum at $900B.

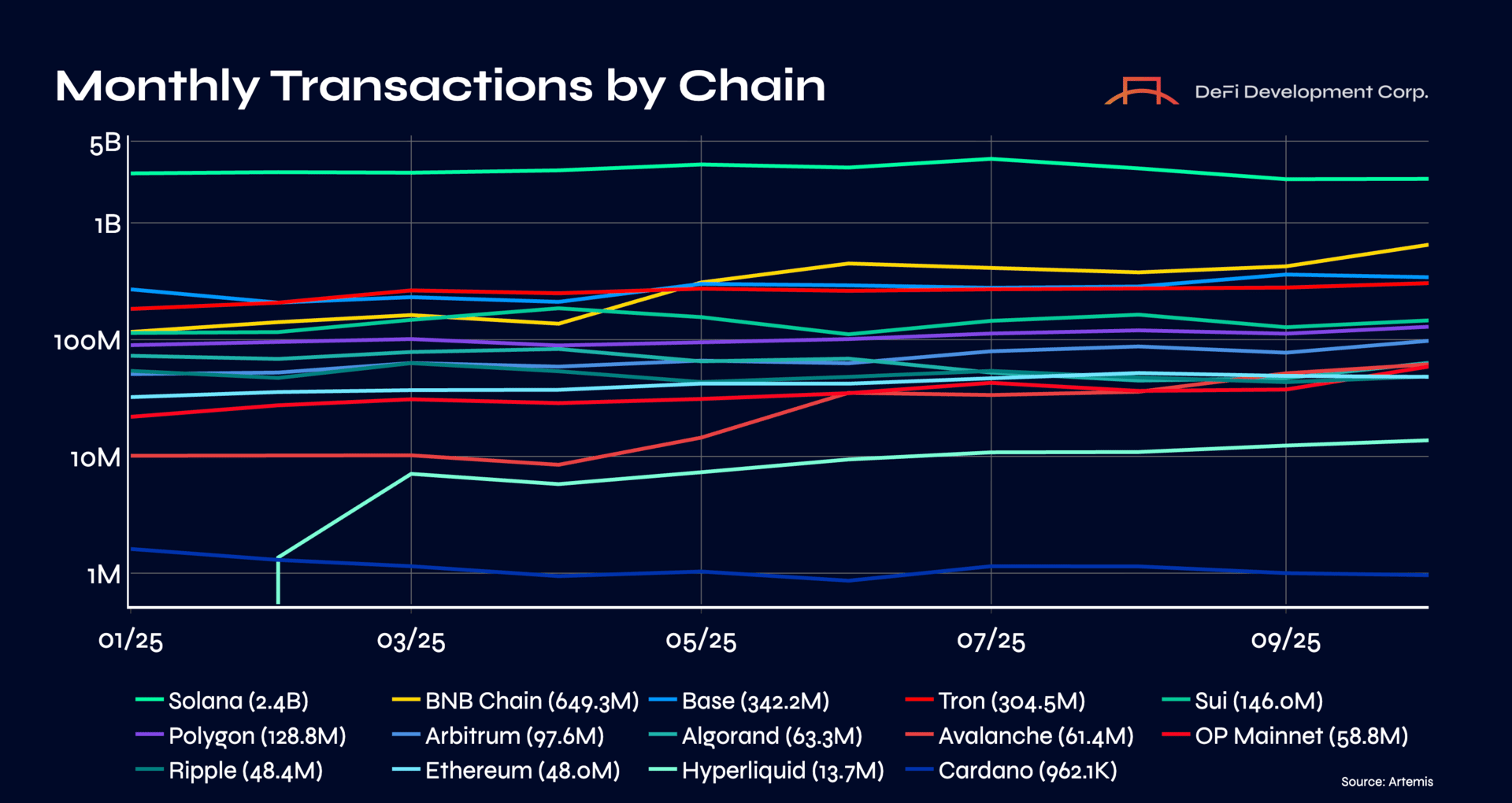

Transactions: Solana processed 2.3B transactions in October, continuing to outpace every other blockchain by a wide margin. That is more than 45x Ethereum, and still more than 4x the combined throughput of Polygon, Base, Sui, and Arbitrum. No other network comes close to matching Solana’s dominance in raw transaction performance.

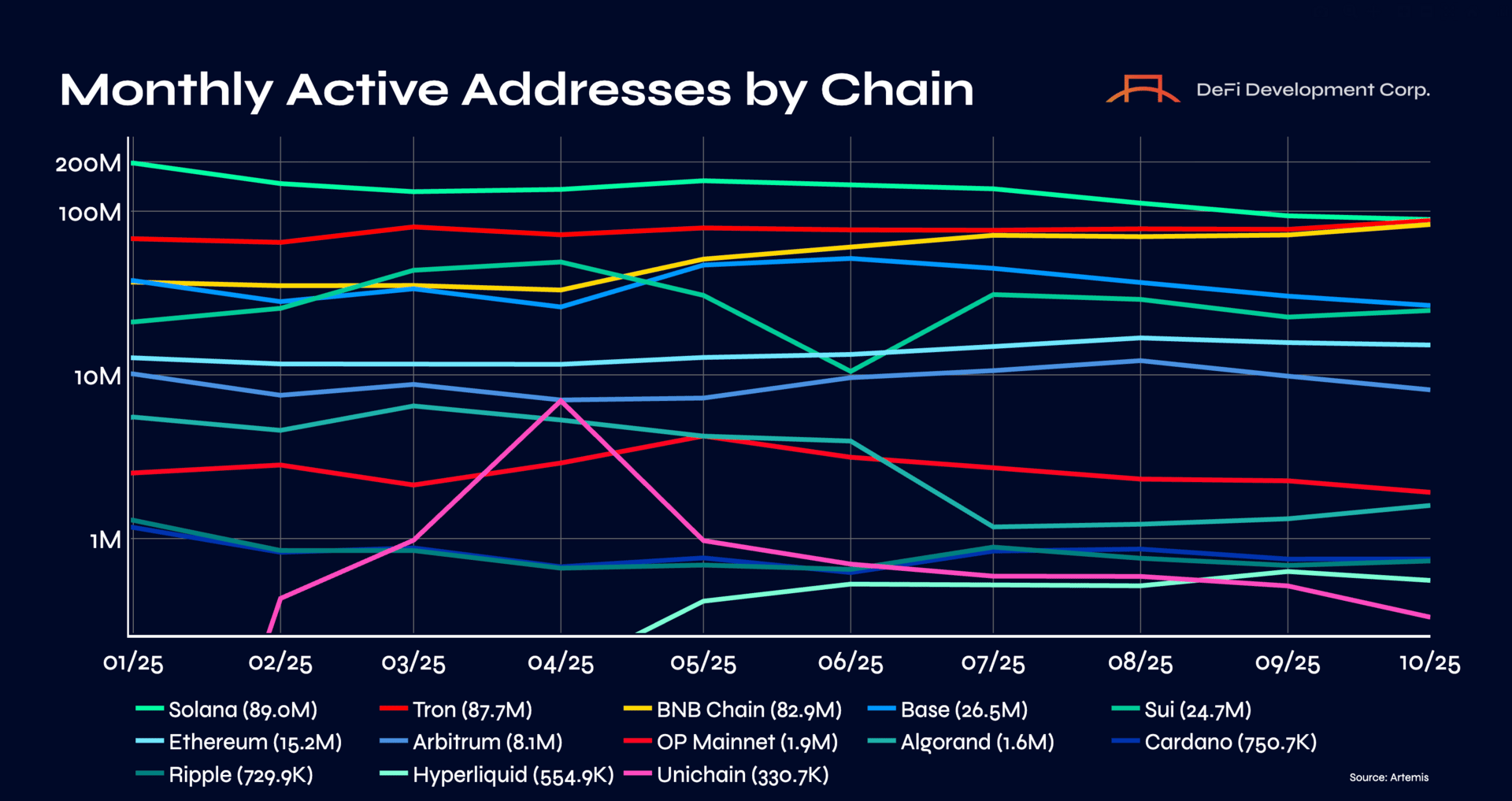

Active Addresses: Solana recorded 89.0M monthly active addresses in October, extending its lead as the most used blockchain worldwide since August 2024. That is more than 3x Base, over 11x Arbitrum, and nearly 6x Ethereum. The consistency at scale highlights Solana’s position as the dominant environment for real onchain user activity.

Looking Ahead

October solidified DFDV’s position as the leading public Solana-native Digital Asset Treasury - not just in terms of SOL holdings, but also in innovation, reach, and recognition. From major ecosystem partnerships and institutional coverage to international expansion and community engagement, we continue to execute on our vision to grow SPS through intelligent accumulation, onchain yield, and non-dilutive capital structuring.

Looking ahead, we’ll be doubling down: acquiring more SOL, deepening our validator and restaking integrations, expanding the DFDV franchise via our Treasury Accelerator program, and pursuing strategic deals that compound long-term shareholder value.

The era of DATs has arrived. DFDV is just getting started.

In service of SPS growth,

The DFDV Team

Disclaimer: This is for informational purposes only and reflects publicly announced developments, milestones, and media coverage related to DeFi Development Corp. (“the Company”). The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities, nor should it be relied upon as investment advice or a recommendation regarding any securities. Certain statements in this post may constitute “forward-looking statements” within the meaning of applicable securities laws. These statements are based on current expectations and assumptions and involve risks and uncertainties that could cause actual results or events to differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of publication. DeFi Development Corp. undertakes no obligation to update any forward-looking statements, except as required by law. All information is accurate as of the date posted and is subject to change without notice.