- DeFi Dev Corp. (Nasdaq: DFDV)

- Posts

- Crypto’s Winner of 2025: Solana

Crypto’s Winner of 2025: Solana

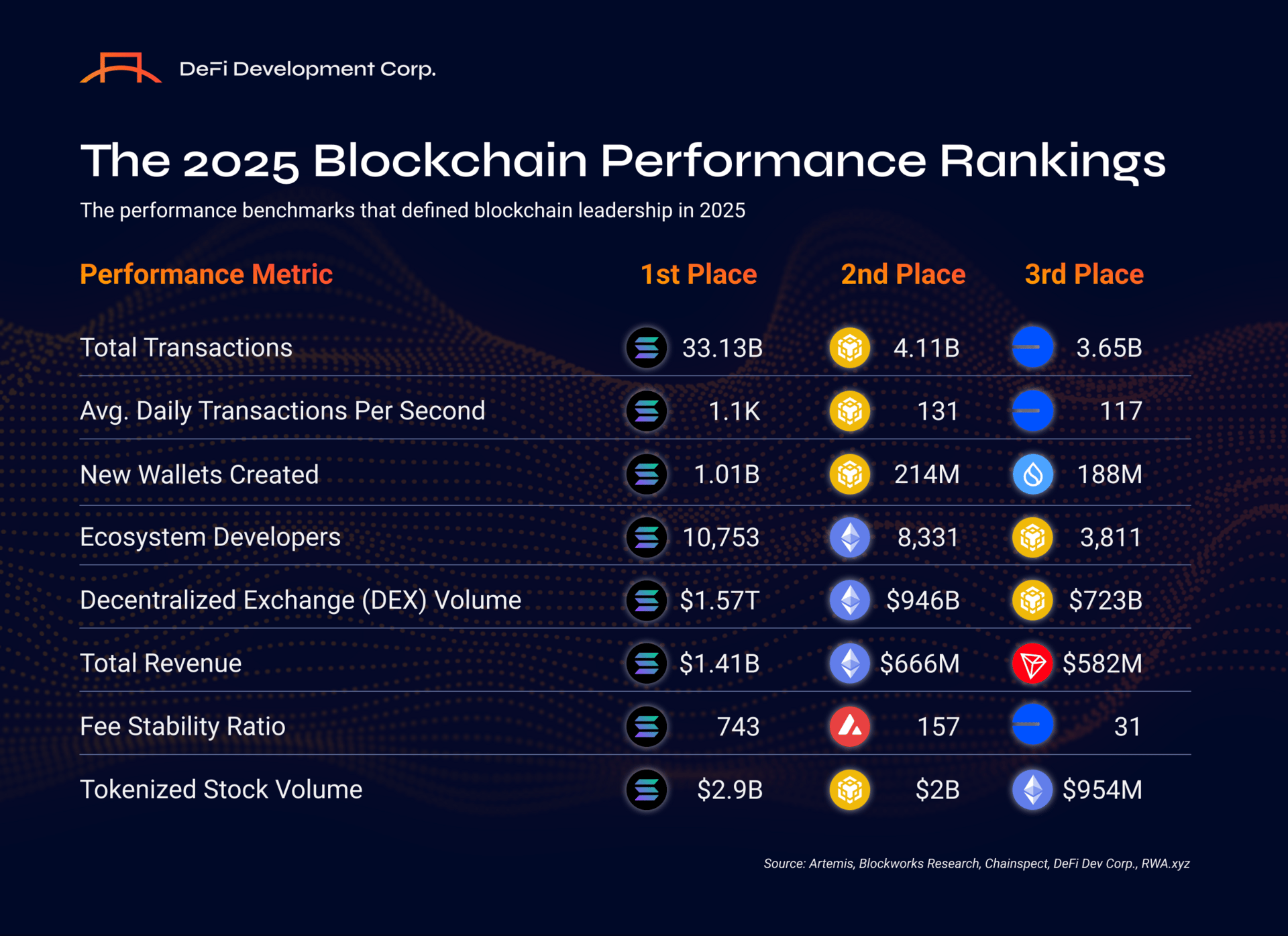

How Solana outperformed every other blockchain across the industry’s core performance metrics in 2025, marking a second consecutive year of absolute dominance.

With 2025 now in the rear-view window, the smart contract war has entered its second decade. For nearly 10 years, market participants have argued over which smart contract platform will come out on top, debating everything from architectural design and measures of decentralization to institutional narratives, ecosystem ethos, and more. But while debates over technological supremacy have existed across all markets for centuries, blockchains have one decisive advantage: their adoption, use, and economic activity are all publicly available.

And in 2025, the data tells an unambiguous story. Across every significant measure of real network demand, including users, transactions, trading volume, fee generation, and developer activity, Solana pulled decisively ahead of the entire industry. Not only did it outperform every competing smart contract platform, but it also extended and compounded the lead it built in 2024. What follows is a data-driven breakdown showing how Solana dominated crypto in 2025 and how its competitors came up short. Simply put, Solana is no longer just competing; it’s winning the smart contract war.

Real Demand, Real Usage

Solana was built to serve transactions of all sizes, from all kinds of users, for all kinds of purposes. No user should ever be priced out of a transaction, regardless of value or urgency. With near-instant settlement and consistently low fees, Solana has become the natural home for real-world use at scale.

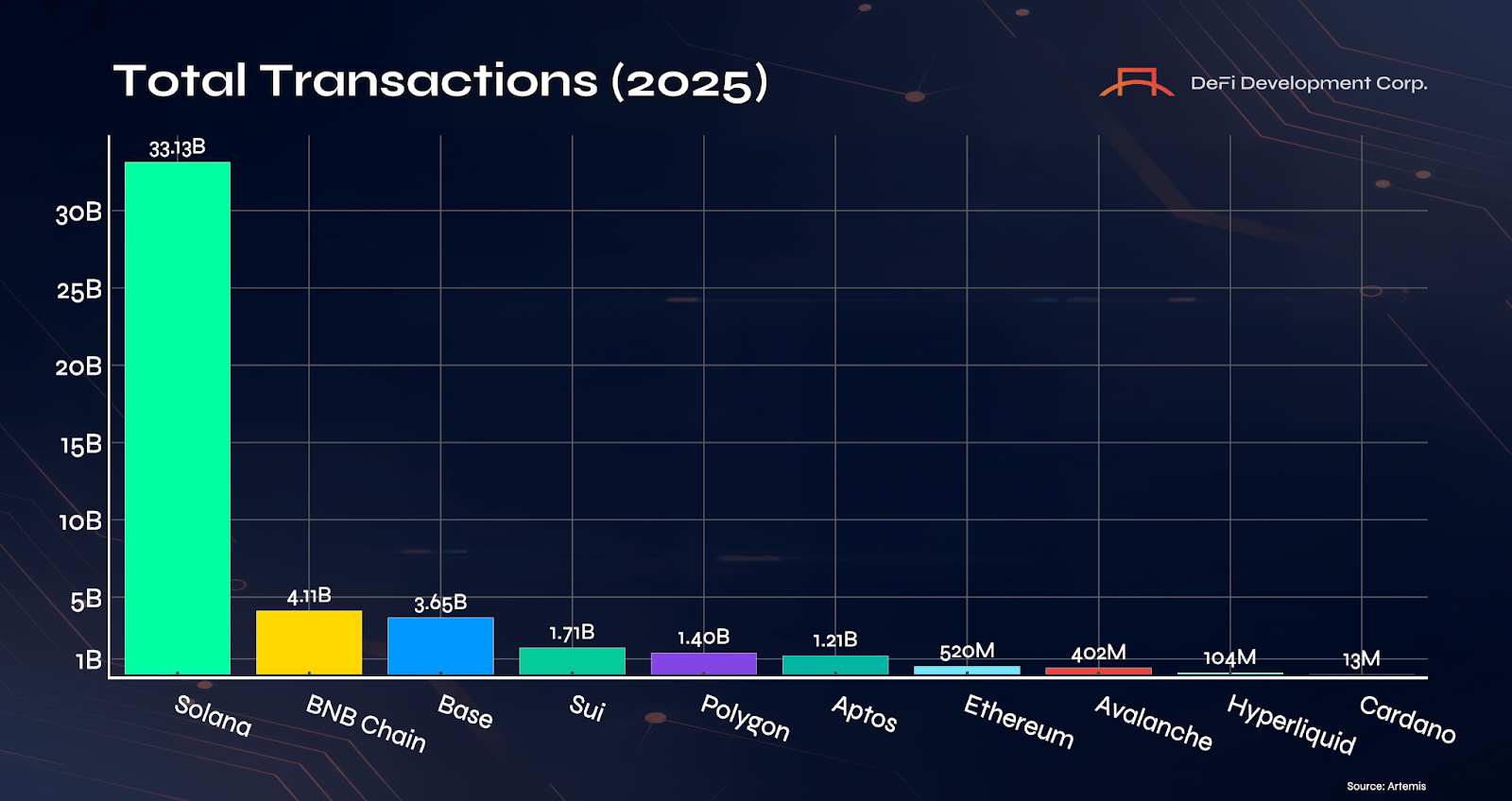

In 2025, Solana processed approximately 33.1B transactions, up from 25.8B in 2024, representing +28% Year-over-Year (YoY) growth on top of an already massive base. Solana alone handled more transactions than every other major blockchain combined, exceeding the rest of the industry by more than 2.5x. Ethereum, its largest competitor, processed just 520M, less than 2% of Solana’s total.

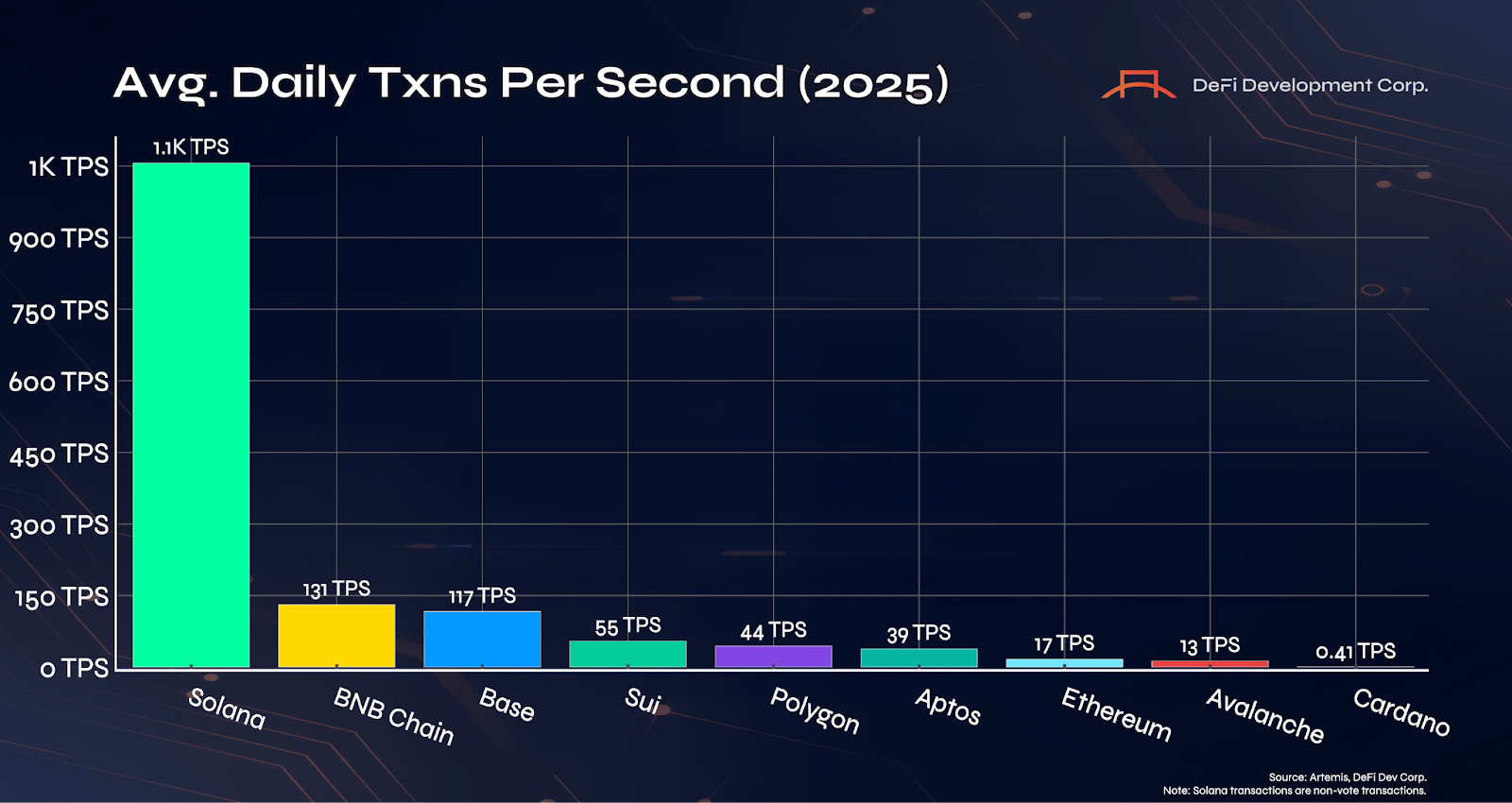

This gap becomes even more meaningful when looking at the average daily transactions per second for each chain in 2025. Solana averaged each day more than 1,100 transactions per second across 2025, up from about 819 TPS in 2024, a +34% YoY increase. No other chain came even close. Solana’s outperformance and YoY growth prove it remains the only chain capable of serving the decentralized apps of tomorrow. Not only that, but persistent performance improvements position Solana as the only chain to have delivered on its promise of scaling.

It should be noted that skeptics often claim these figures are misleading because a disproportionate share of Solana’s activity is programmatic. They miss the point. The future of finance is automated. Payments, trading, transfers, and settlement already run on software. Solana is the only blockchain built to handle that reality at scale.

Unprecedented User Demand

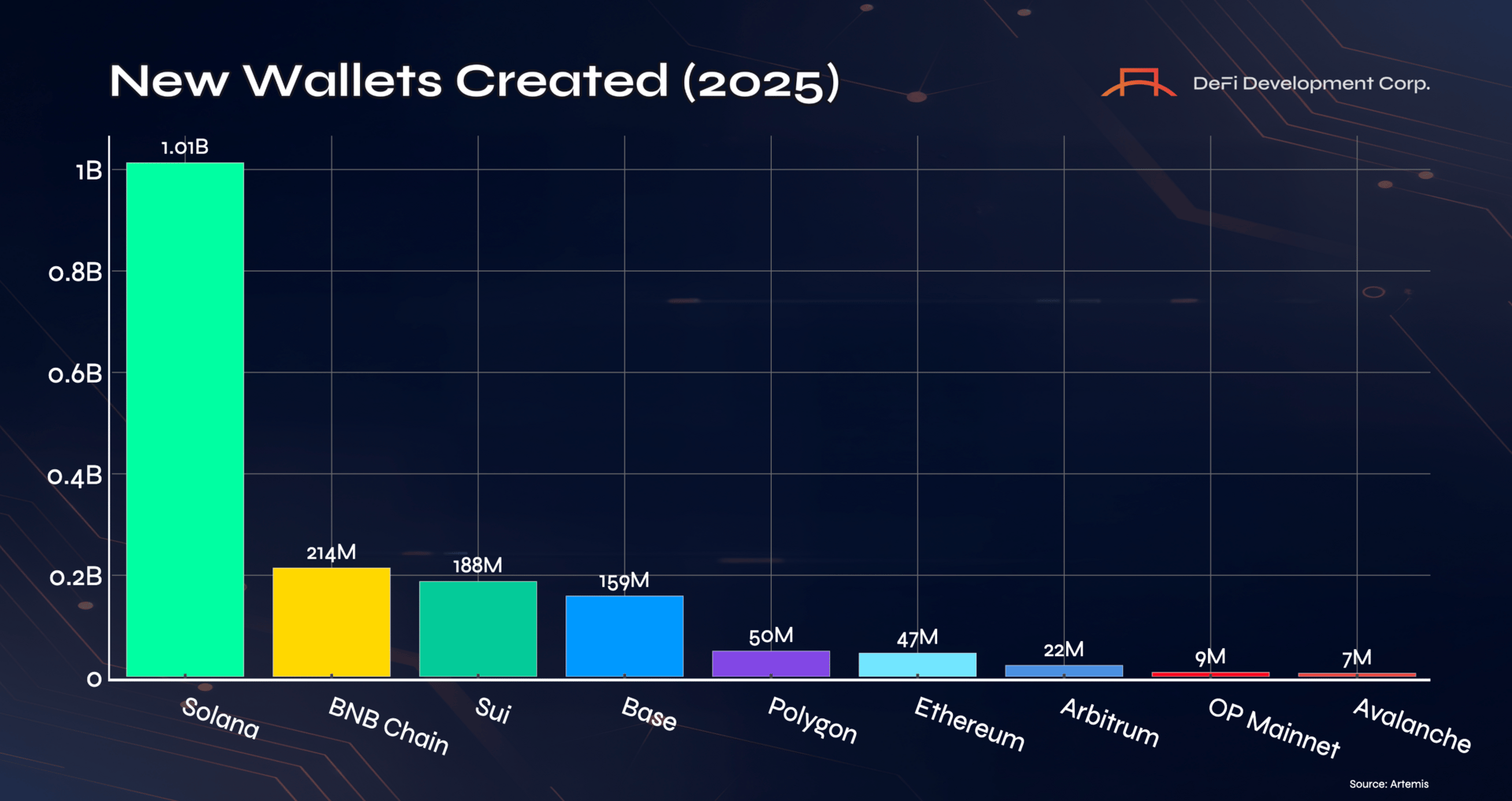

Transaction counts show what is happening, but user growth shows where the future is going. And while no metric is perfect, new wallets remain the best proxy for how many people and applications are choosing to engage with a network. In 2025, Solana added approximately 1B new wallets, up from 668M in 2024, representing roughly +50% YoY growth on an already dominant base. Solana onboarded more new users than all other major blockchains combined for the second year in a row.

Ethereum added just 47M new wallets, or less than 5% of Solana. Even chains with modest network usage, like Base, BNB Chain, and Sui, remained far smaller in absolute terms. This sustained inflow explains why Solana continues to lead in transactions, trading volume, and revenue. It has become the default onramp to the global crypto economy.

Developers Follow the Demand

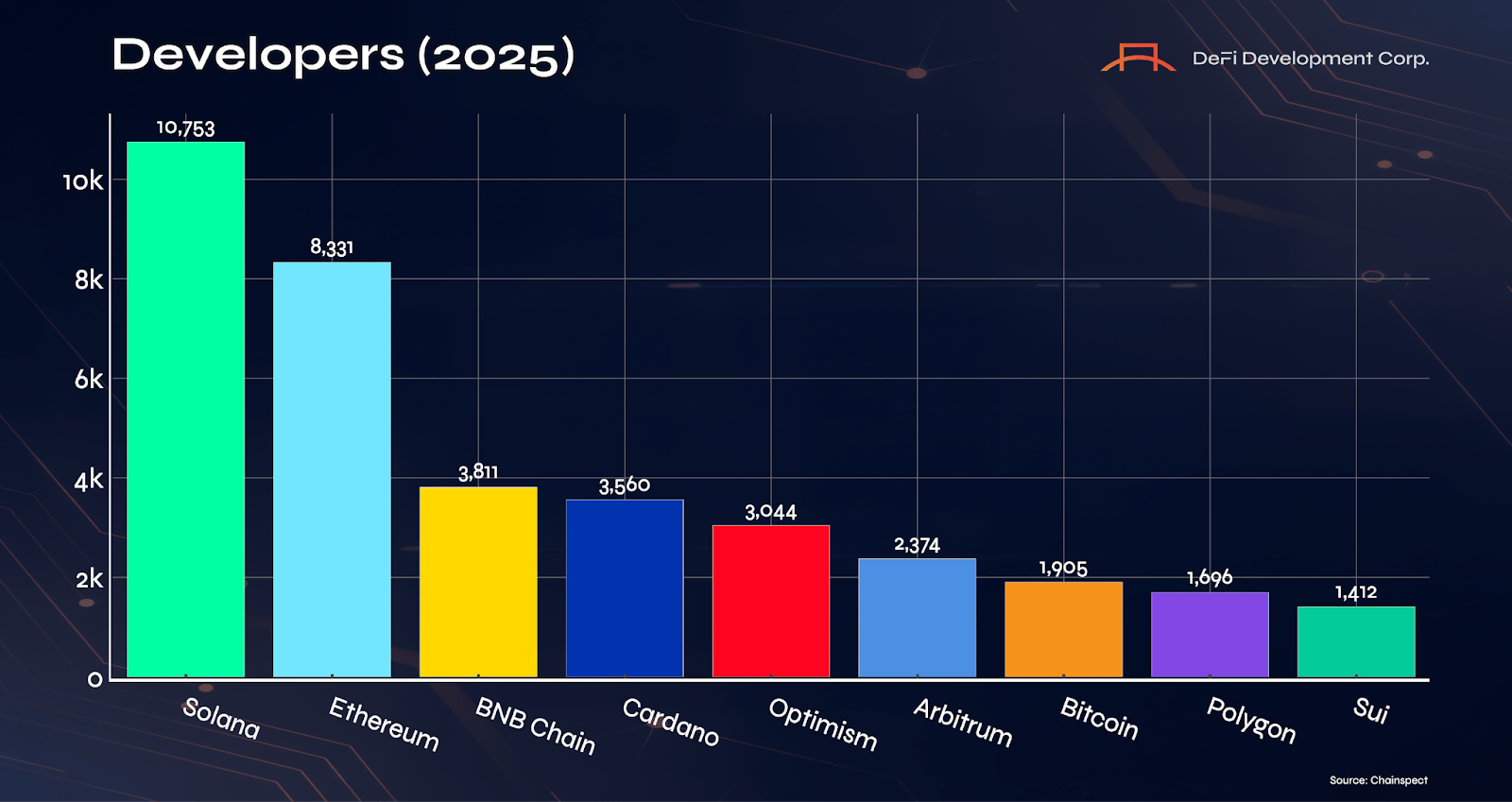

It’s not just user demand that is an essential barometer for the current and future success of a blockchain, but also developers. It’s the developers creating the applications of tomorrow who bring users onchain and drive network usage. Networks that fail to attract, maintain, and grow a developer base are destined for doom. As such, it’s essential to be cognizant of developer growth. Fortunately for Solana, the number of developers on the network also surged in 2025.

In the prior 12 months, Solana became the largest developer ecosystem in crypto, with approximately 10,753 active developers, up +41% YoY from 2024 and well ahead of Ethereum’s 8,331. This shift reflects where real economic gravity now exists. Developers go where users are, where liquidity is deepest, and where infrastructure is reliable.

Solana’s dominance in transactions, users, trading, and fee stability has made it the most attractive platform for building consumer and financial applications. The largest pool of developers is now concentrated on the same chain that has the most users and activity. That is how network effects become self-reinforcing.

Economic Activity Onchain

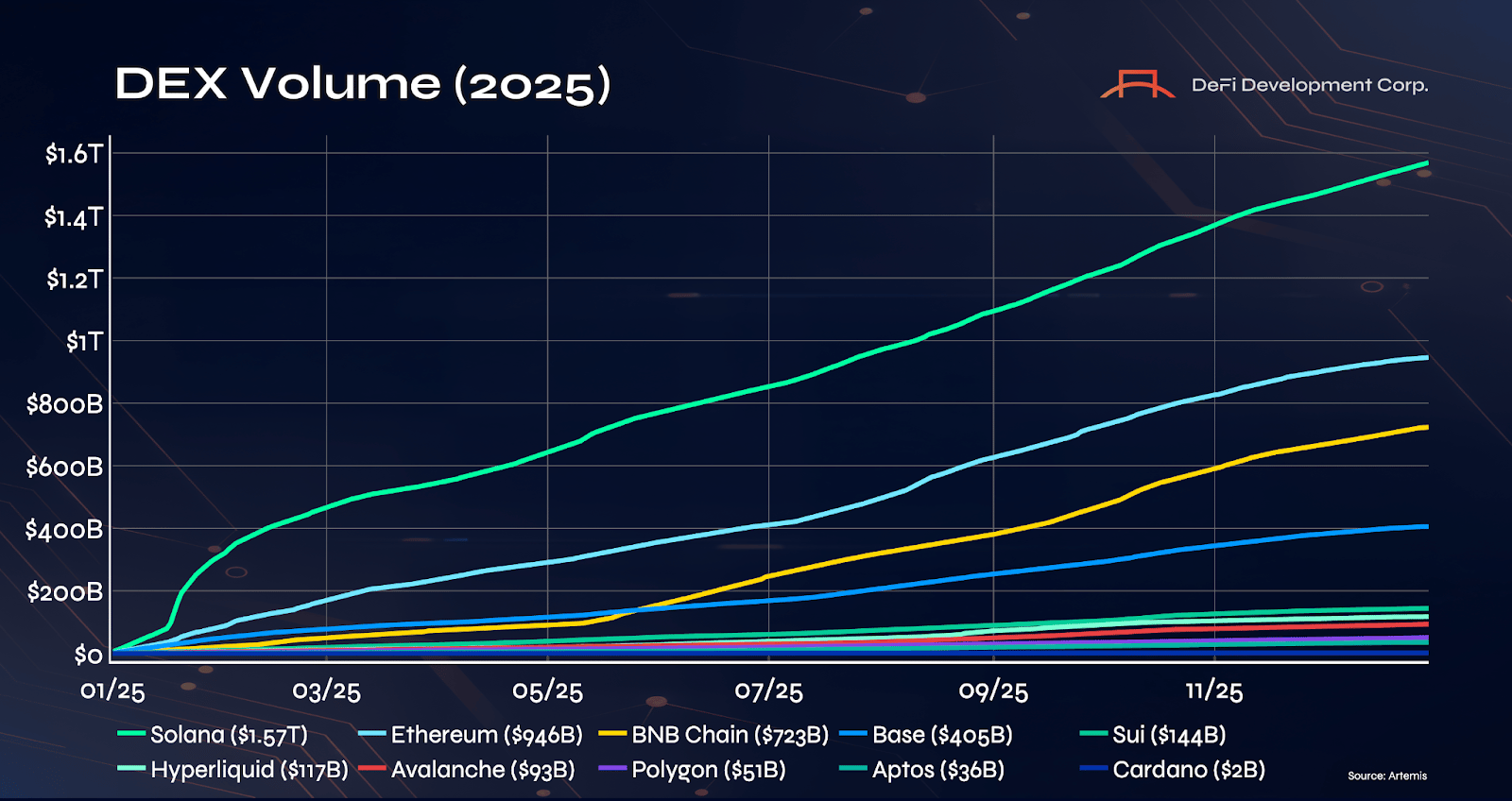

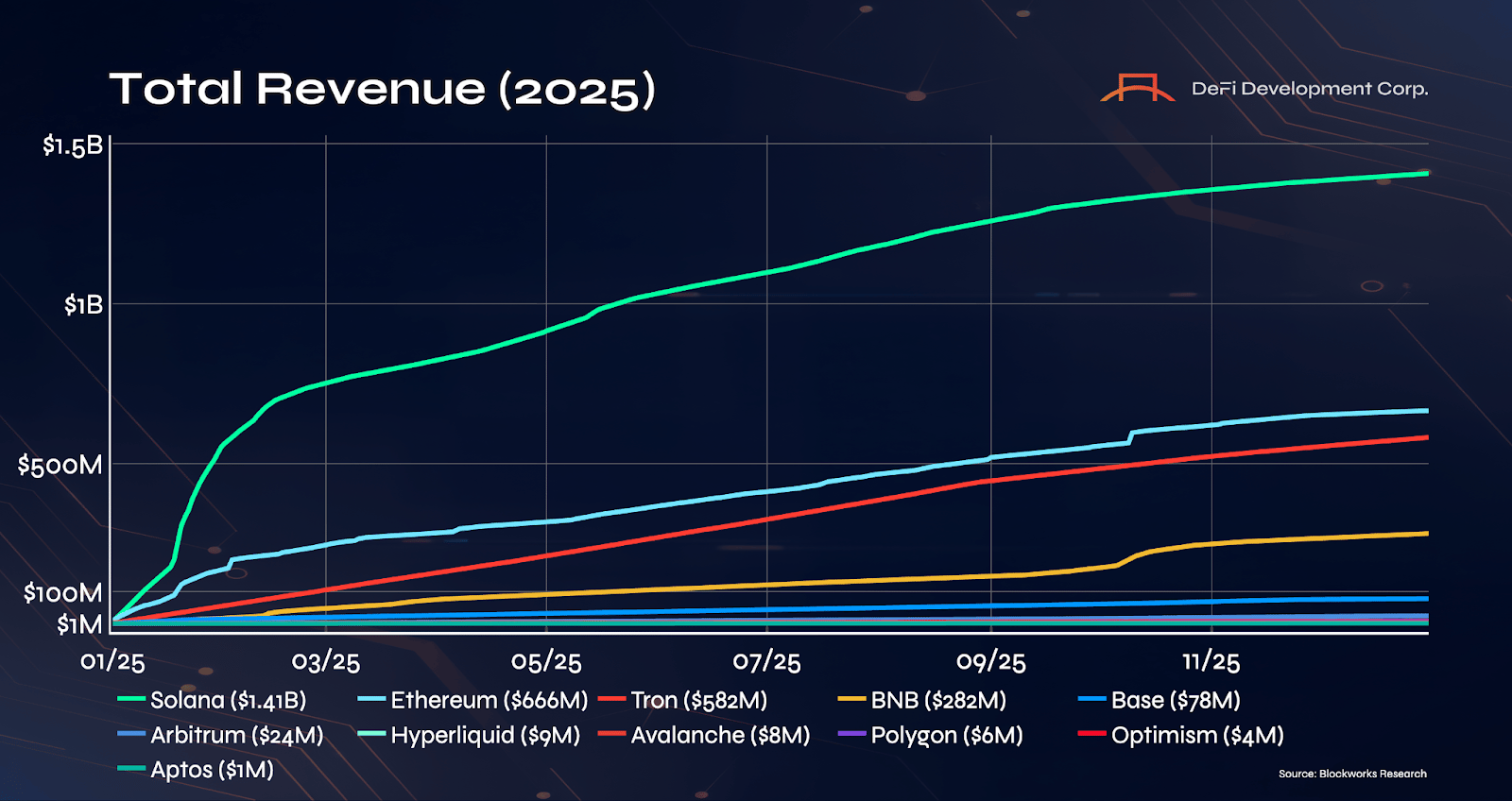

High transaction counts and rapid user growth only matter if they translate into real economic activity. To understand how much value was actually moving through Solana in 2025, we can look to two of the most important financial metrics onchain: decentralized exchange volume and network revenue.

Solana became the largest onchain trading venue in crypto in 2025, with DEX volume surging from roughly $694B in 2024 to $1.57 trillion, representing +126% YoY growth. While Ethereum’s DEX volume increased to about $946B from $669B, Solana added more than three times as much new trading volume in absolute terms, allowing it to pull decisively ahead and capture the leading share of global onchain trading. Solana now processes more DEX volume than any other blockchain, including Ethereum, BNB Chain, and every Layer 2 network, confirming that it has become the primary venue for high-frequency trading, liquidity provision, and capital formation across crypto markets.

That trading activity translated directly into network revenue. Solana delivered one of the strongest financial performances in crypto in 2025, generating approximately $1.41B in onchain fees, essentially matching its $1.42B from 2024 while much of the industry contracted. Ethereum, by contrast, saw its revenue collapse from about $2.7B to $665M, or an unprecedented -75% YoY decline. As a result, Solana overtook Ethereum to become the highest-revenue blockchain in the world, despite charging far lower transaction fees. Compared with the rest of the field, Solana earned more than 2x the revenue of Tron, 5x that of BNB Chain, and more than every Ethereum Layer 2 network combined. Together, these figures show that Solana was not only the most economically active network in 2025, but also the most resilient, sustaining a high and stable revenue base even as much of the crypto economy slowed.

Lowest Fees, Always

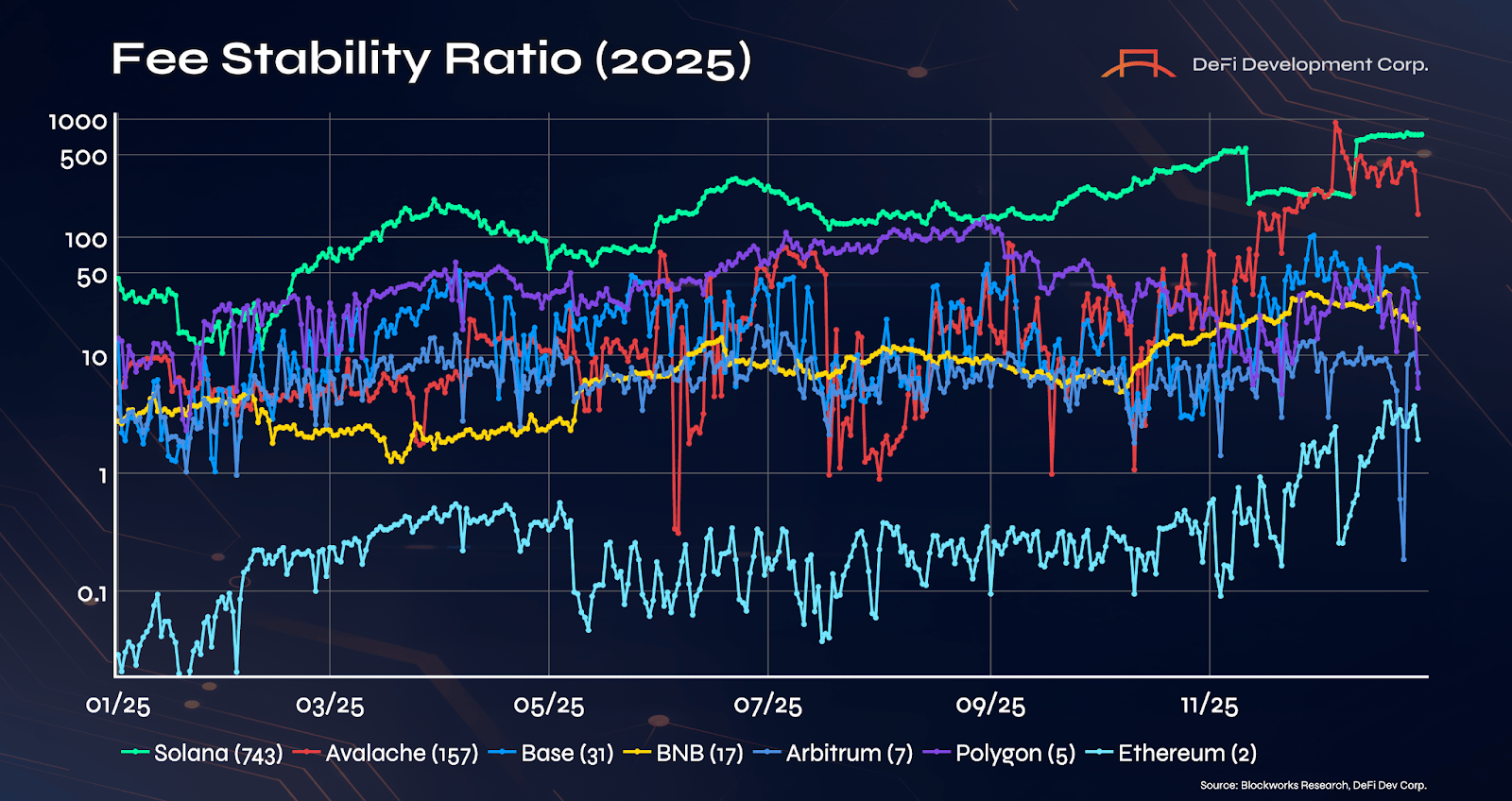

Solana’s dominance in transactions, users, developers, and economic activity did not happen by accident. A major driver behind it all is transaction cost. While many chains claim to offer cheap transactions, those claims are often based on cherry-picked moments or short time windows. What matters in practice is not whether a chain is sometimes cheap, but whether it stays cheap when demand rises. Looking across all of 2025 provides a much more accurate picture of fee reliability.

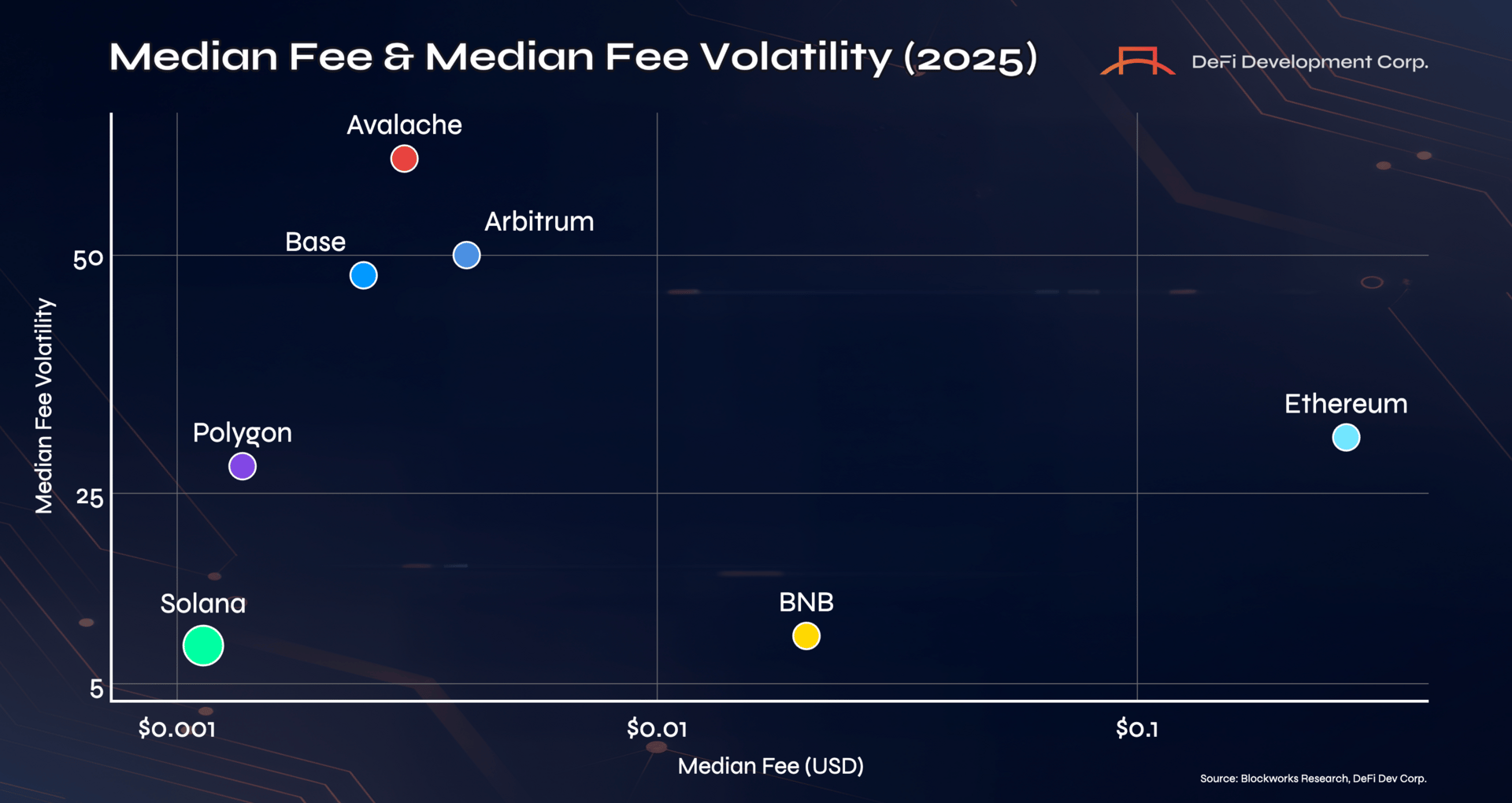

Transaction fees are often discussed in crypto as if the only thing that matters is which chain is cheapest at a given moment, but what actually matters for users and applications is how reliably low those fees remain over time. A network that is sometimes cheap and sometimes prohibitively expensive is fundamentally less usable than one that delivers consistently low and predictable costs across all market conditions. That is why DeFi Development Corp. developed the Fee Stability Ratio (FSR), which measures both median transaction fees and their volatility. FSR is defined as one divided by the median fee, multiplied by median fee volatility. Hence, a higher score reflects a blockchain that is not only inexpensive on average but also stable and predictable in its pricing, which is critical for all applications and users.

Last year, Solana was the clear leader on this dimension, posting an FSR of roughly 743, far ahead of every other major blockchain. Avalanche followed at around 157, while Base, BNB Chain, Arbitrum, Polygon, and Ethereum all trailed far behind, with Ethereum itself scoring just 2. This means Solana delivered orders of magnitude greater fee reliability than any competing network, maintaining low, predictable transaction costs even as it handled record levels of user growth, trading volume, and throughput.

The median fee versus fee volatility chart makes this even more apparent. Solana sits in the bottom left corner, combining some of the lowest median transaction fees in crypto with some of the lowest volatility. Other networks cluster far to the right, higher up, or both, indicating either much higher typical fees, much greater volatility, or both. Ethereum, for example, shows high median fees and significant volatility, which explains its low FSR score and why its network becomes difficult to use at scale during periods of demand. Even chains that occasionally advertise lower fees than Solana, such as Base or Arbitrum, exhibit far greater fee volatility, meaning users and applications cannot rely on those costs remaining low when activity spikes. Taken together, the data shows that Solana is not just cheap, but consistently cheap, which is one of the core reasons it became the dominant execution layer in 2025.

Spearheading Crypto’s Newest Use Case

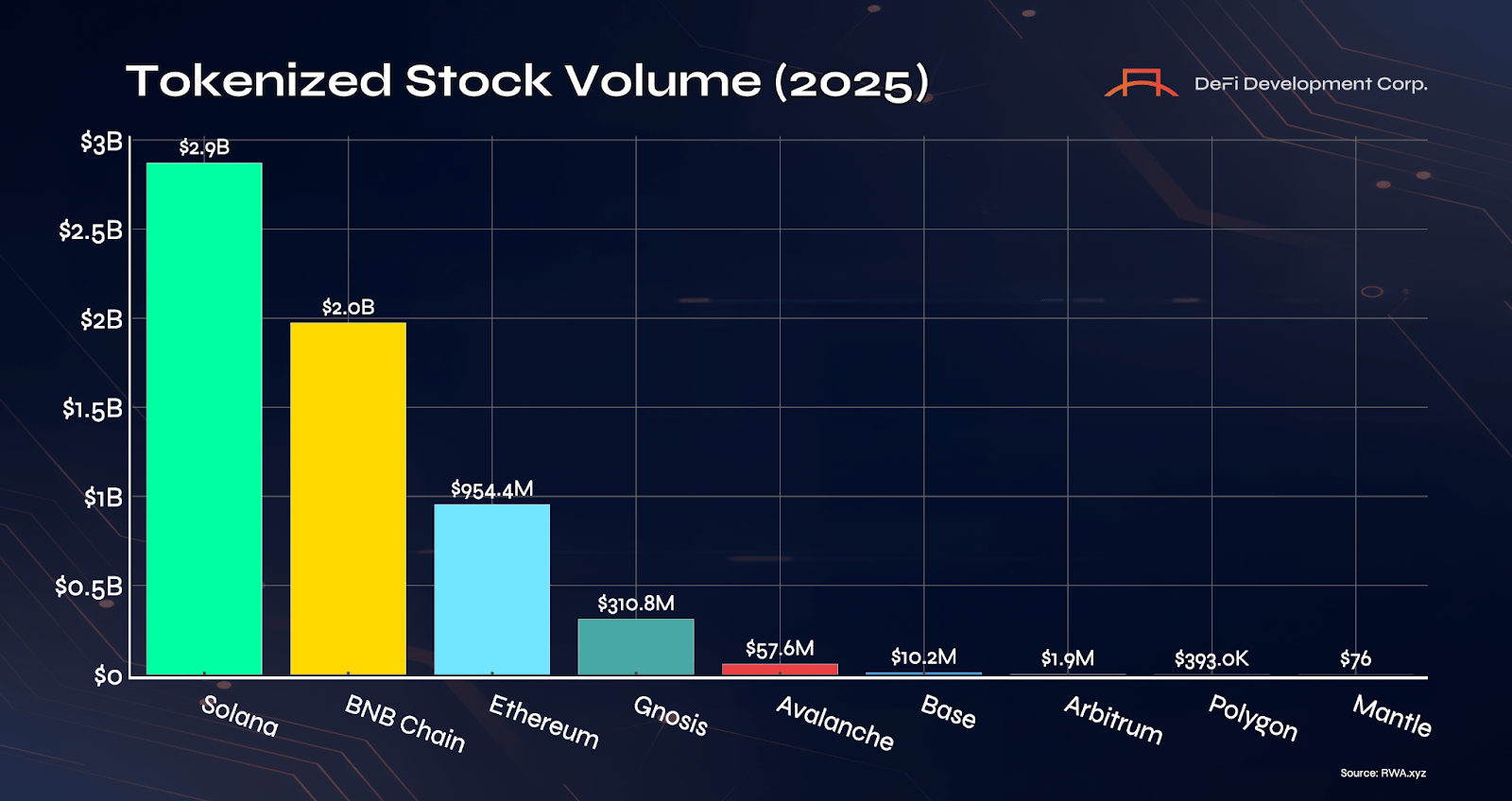

As crypto matures, the frontier of innovation is shifting from purely digital assets toward the tokenization of real-world financial instruments. Tokenized stocks, in particular, represent one of the most important new categories to emerge, because they bring traditional capital markets onchain and require the same speed, liquidity, and reliability as modern electronic exchanges. Historically, when new high-demand use cases appear, they gravitate toward the one network that can actually support them at scale. NFTs, consumer apps, and high velocity trading all converged on Solana for precisely that reason, and in 2025, the same pattern repeated with tokenized equities.

Solana emerged as the dominant blockchain for tokenized stock trading in 2025, processing approximately $2.9B in volume despite tokenized equities only going live on Solana in July 2025 following the launch of xStocks. In just six months, Solana surpassed every other chain, thus confirming that tokenized equities naturally migrate toward networks that offer high throughput, low latency, and consistently low fees. Because tokenized stocks require real-time execution, tight spreads, and high-frequency market making, they cannot function reliably on congested or expensive blockchains. Solana’s rapid capture of this market shows that it has become the natural home for onchain capital markets, extending its dominance beyond crypto-native trading into the next iteration of global markets.

Another Year of Dominance

Across every meaningful onchain metric in 2025, Solana led the broader cryptoasset industry. It processed the most transactions, onboarded the most users, supported the highest trading volume, generated the most revenue, maintained the most reliable fees, attracted the largest developer base, and became the primary venue for tokenized equity trading. These results were not driven by a single trend or temporary market cycle. They reflect a network that has reached true product-market fit at a global scale, where users, capital, and builders all converge on the same chain.

The broader takeaway is that whitepapers or narratives are no longer deciding the smart contract war. It is being decided by usage, liquidity, and economic gravity, all of which are now concentrated on Solana. As the industry continues to develop new and innovative decentralized applications, the same attributes that drove Solana’s dominance in 2025 are set to persist into and throughout 2026.

Disclaimer: This is for informational purposes only and reflects publicly announced developments, milestones, and media coverage related to DeFi Development Corp. (“the Company”). The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities, nor should it be relied upon as investment advice or a recommendation regarding any securities. Certain statements in this post may constitute “forward-looking statements” within the meaning of applicable securities laws. These statements are based on current expectations and assumptions and involve risks and uncertainties that could cause actual results or events to differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of publication. DeFi Development Corp. undertakes no obligation to update any forward-looking statements, except as required by law. All information is accurate as of the date posted and is subject to change without notice.