- DeFi Dev Corp. (Nasdaq: DFDV)

- Posts

- The Next Best Crypto Trade? Solana DATs.

The Next Best Crypto Trade? Solana DATs.

Why Solana-focused Digital Asset Treasuries are positioned to dominate, how investors can separate winners from pretenders, and why this vertical may represent the most compelling opportunity in crypto today.

Digital Asset Treasuries (DATs) are more than just the latest crypto narrative; they represent a fundamental shift in how market participants gain exposure to underlying assets. Some DATs will evolve into powerful forces within their ecosystems, amassing enough digital assets to influence network dynamics. But not all will succeed. Many will fail to gain meaningful traction.

As the first SOL-focused DAT, DeFi Development Corp. (Nasdaq: DFDV) has had a front-row seat to the rise of other DATs across the crypto space. The road is difficult, and obstacles are plentiful, but one truth stands out: no DAT segment is better positioned than Solana-focused treasuries. Solana’s unique economics, performance, and ecosystem advantages make its DATs the most compelling vehicles for market participants. We believe Solana DATs will emerge as market leaders, fueling price discovery, driving adoption, and attracting new capital, developers, and users into the network.

In this post, we explain why Solana-focused DATs are set to define the vertical, why they offer the most attractive path to compounding exposure, and how to avoid picking the wrong SOL DAT.

Recap: What Is a DAT?

DATs are publicly traded companies that raise capital through equity, debt, or both to acquire cryptoassets. Structured well, these financings are accretive, increasing the amount of crypto represented per share.

The model is simple: raise capital, buy crypto, and hold it securely. Some DATs add leverage or deploy assets into staking and yield strategies to amplify exposure. For investors, DATs offer access to BTC, ETH, SOL, and other tokens through a traditional brokerage account, without the complexities of wallets, custody, or direct onchain activity. Furthermore, they’re structurally more attractive investment vehicles than ETFs because they charge no management fee, pass through full staking yield, and can exponentially grow underlying exposure (ETFs stay static or shrink exposure given fees). Additionally, because DATs are simply U.S.-listed public companies, they can be held in ETFs, mutual funds, and used as collateral for margin loans at traditional brokers.

DATs mirror the structure of traditional public companies, but instead of funding operations or research, they prioritize building crypto treasuries. As a result, shareholder value is tied to the performance and appreciation of those holdings, along with growth in the asset base itself.

Performance is typically measured by Net Asset Value (NAV), the value of crypto holdings net of liabilities, divided by shares outstanding. Investors also look at mNAV (multiple of NAV), which reflects whether the company trades at a premium or discount to the underlying assets. For example, a DAT holding $100M of crypto but valued at a $150M market cap trades at a 1.5x mNAV, or a 50% premium to its NAV.

Figure 1: The DAT Flywheel

DATs that execute well can create a self-reinforcing flywheel of growth. This model depends on the appreciation of their underlying cryptoassets and works as follows:

Rising crypto prices push the value of a DAT’s holdings higher.

mNAV expands as investors pay a premium for the DAT’s ability to increase its exposure to appreciating assets.

The DAT can then issue new equity or debt at attractive valuations.

New capital is used to purchase crypto, increasing total crypto holdings.

Greater holdings and higher valuations reinforce the cycle, turning the DAT into an increasingly powerful accumulation engine.

Key Risks

DATs are not without challenges. Poorly structured financings can dilute shareholders and stall crypto-per-share growth. Market volatility can compress premiums or flip them into discounts, making capital raises unattractive. Execution risk is also high: running a public company requires transparency and discipline, not just crypto expertise. Ultimately, every DAT remains tied to the performance and resilience of its underlying asset.

Solana’s Core Advantages as a Treasury Asset

The largest and most transformative opportunity in crypto lies in the smart contract vertical. Smart contracts are self-executing agreements on a blockchain, coded with “if-then” logic that automatically triggers outcomes when conditions are met. Immutable and censorship-resistant, they enable trustless automation without intermediaries.

Nearly every exchange of value or information boils down to “if X, then Y.” Pair that with instant settlement, low cost, and verifiable history, and smart contracts represent the first true disruption in how value and data move across systems. Corporations, institutions, and even governments are taking notice, actively testing ways to integrate smart contracts into their operations. In the United States, favorable regulatory shifts under President Trump have only accelerated this momentum.

“Smart contracts are poised to revolutionize how we conduct transactions, promising more efficient and secure ways to manage agreements digitally.”

- World Economic Forum

Global value transfer today stands at $1.8 Quadrillion annually, generating roughly $2.4T in revenue. The smart contract opportunity is therefore one of the most attractive investment frontiers in decades. With the industry still so early and nuanced, sharp capital allocators are well-positioned to capture outsized upside.

Ethereum, Cardano, and other Layer-1s have been competing for nearly a decade. Yet the question of which network will ultimately dominate the smart contract landscape remains unresolved. With an opportunity this large, new entrants will continue to emerge while incumbents fight to defend market share.

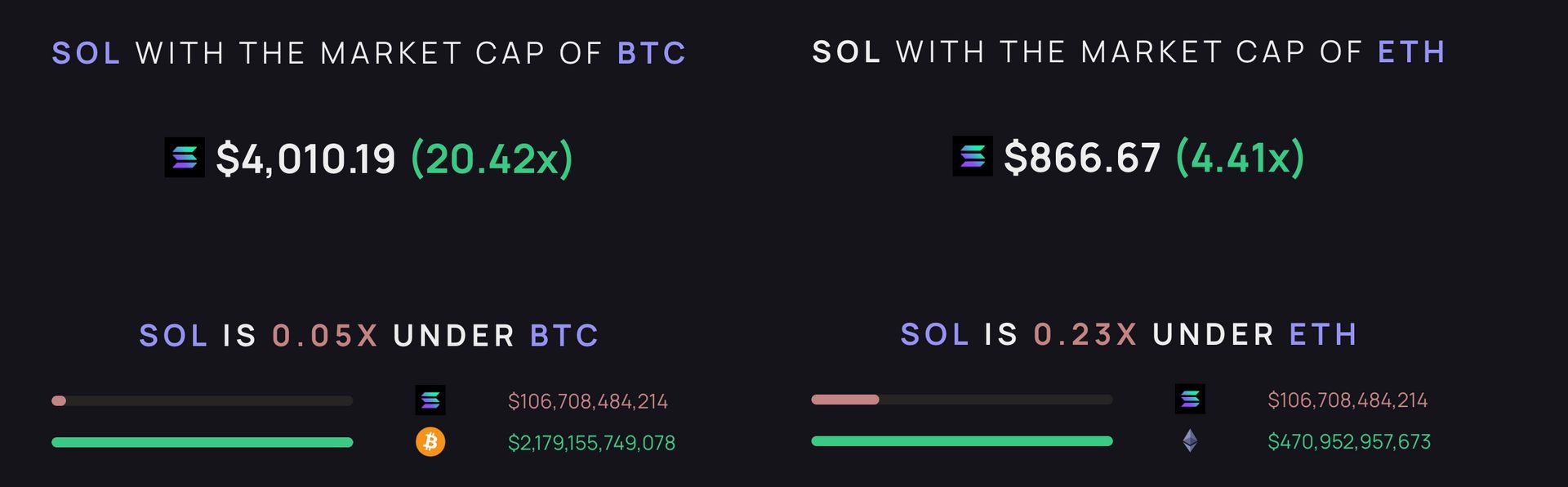

Figure 2: Market Capitalizations

At DeFi Dev Corp., we believe the smart contract war is effectively over. No blockchain is better positioned than Solana to become the default public ledger for the transfer of both value and information.

SOL still trades like an underdog at just 1/5 of ETH’s market capitalization and less than 5% of BTC’s. However, it is the only network demonstrating the speed, scalability, and cost efficiency required for mainstream smart contract adoption. That mismatch makes SOL uniquely attractive.

Figure 3: SOL Market Cap Comparison to BTC & ETH

As smart contracts move from novelty into the core of global finance and commerce, Solana is positioned to not only capture market share from incumbents like Ethereum, but dramatically re-rate as capital allocators shift from viewing crypto as mere digital scarcity (BTC) to the far larger opportunity of programmable value.

Performance

When comparing Solana to competing blockchains on the core performance metrics of throughput, finality, and transaction cost, the gap is clear. Solana is well ahead of the pack. As shown in Figure 4, Solana’s average daily transactions per second (TPS) surpasses that of all other major chains combined. This trend has remained consistent since its inception. Over the past five years, Solana has been the only blockchain to scale in line with its original promise, handling growth without sacrificing performance.

Figure 4: Avg. Daily Transactions Per Second by Chain

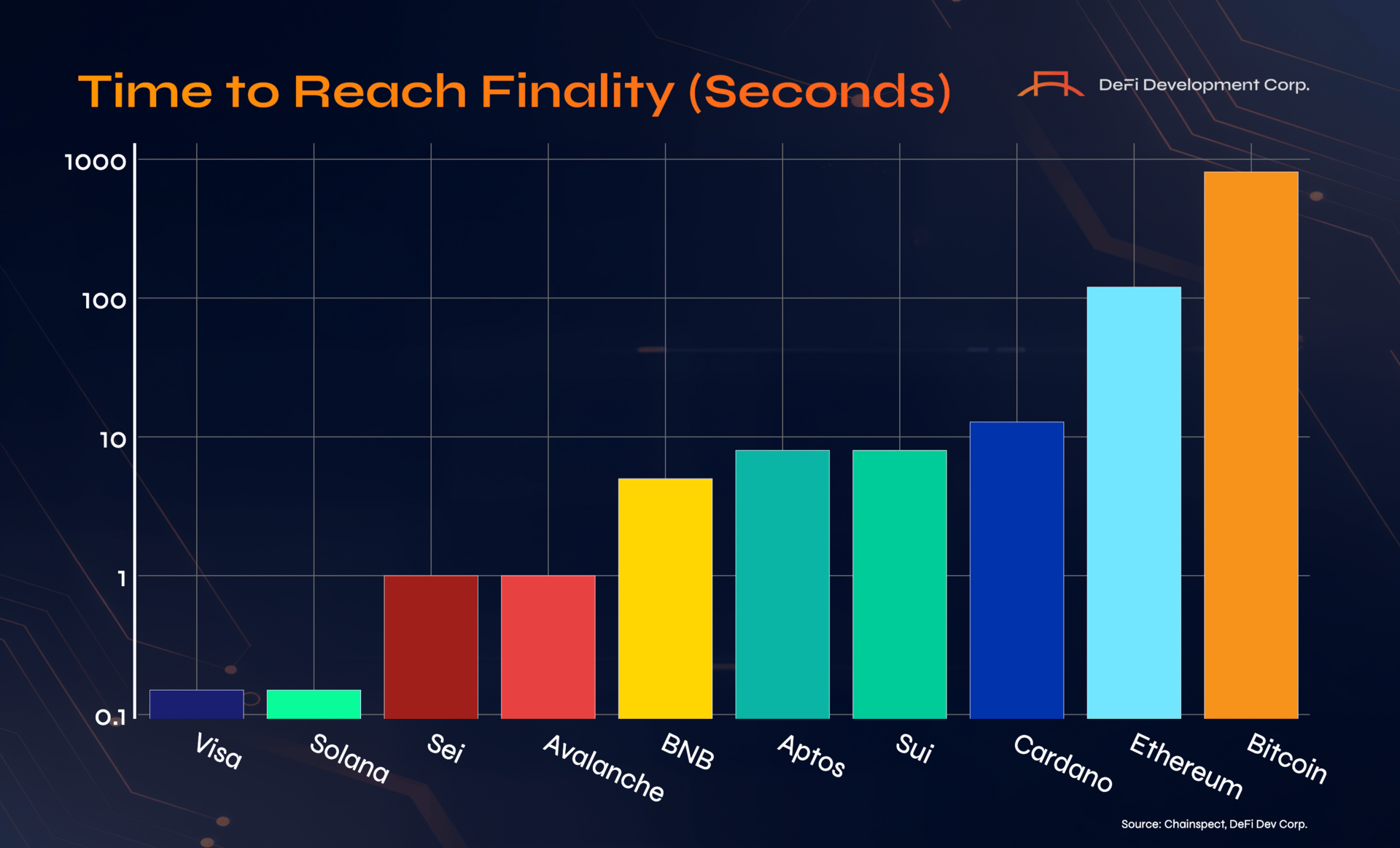

Another key differentiator is transaction finality: the time required for a transaction to be permanently added to the blockchain and become irreversible. As shown in Figure 5, Solana’s finality is roughly 0.15 seconds, putting it on par with centralized Web2 payment systems like Visa.

Figure 5: Time to Reach Finality (Seconds)

Ultimately, Solana stands out in terms of cost efficiency and predictability. As shown in Figure 6, Solana leads in what we call the Fee Stability Ratio (FSR), a proprietary metric created by DeFi Dev Corp. Unlike median-fee snapshots, FSR measures both the level and consistency of fees over time. This distinction matters: a blockchain must deliver fees that are not only low but also reliably stable across all demand environments. On this measure, Solana decisively outperforms its peers.

Figure 6: Fee Stability Ratio (FSR)

Ecosystem Growth

A core indicator of Solana’s long-term dominance is its robust developer base. Independent research from Electric Capital shows that Solana has consistently been the fastest-growing major blockchain among developers. From 2020 to 2023, the number of active Solana developers grew more than 10x.

In 2024, Solana crossed a historic milestone: for the first time since 2016, a blockchain other than Ethereum attracted more new developers. According to Electric Capital, Solana onboarded 7,625 new developers in 2024, roughly 1,200 more than Ethereum, representing an 83% year-over-year increase. This surge firmly established Solana as the leading ecosystem for new builders.

Figure 7: Solana Ranked the Top Ecosystem for Developers in 2024

This momentum is also confirmed by Chainspect, which shows that Solana now hosts the largest number of developers overall (Figure 8). The takeaway is clear: Solana is attracting and retaining talent at a faster pace than any other major blockchain. For investors, developer growth is not a vanity metric. It signals long-term network health, compounding innovation, and a durable moat. Put simply, the builders have already chosen Solana, positioning it as the blockchain best equipped to capture the next wave of adoption.

Figure 8: Active Developers by Chain

Ecosystem vibrancy is also visible in the onchain economy itself. One clear indicator is token issuance from launchpads like PumpFun. Since January 2024, Solana has absolutely dominated the launchpad landscape. With more than 30M tokens created since 2024, Solana has seen nearly 3x more tokens launched than all competing chains combined. This reflects both developer preference and end-user demand, as founders consistently choose Solana’s combination of high throughput, ultra-low fees, and predictable finality as the foundation for new projects.

Figure 9: Total Launchpad Tokens by Chain

For investors, this metric matters. Every new token represents a community, an experiment, and potential economic activity that accrues to the underlying chain. Solana’s outsized lead confirms its status as the platform of choice for builders and, by extension, the network best positioned to capture market share as adoption accelerates.

Figure 10: New Wallets Created by Chain (YTD)

Another powerful sign of Solana’s ecosystem strength is the number of new wallets created. In 2025 alone, Solana has generated more than 851M new wallets, several orders of magnitude higher than any other chain. For perspective, Sui stands at 168M, BNB Chain at 145M, Base at 142M, and Ethereum trails at 32M, while Polygon, despite its maturity and brand recognition, shows only 175,000.

Critics argue that many of Solana’s newly created wallets (and transactions) are bots, but this misses the larger point. The future of blockchain adoption is inextricably linked to autonomous agents and programmatic activity. Most global value transfer already comes from automated systems, not human clicks. The real question is whether a blockchain can support this new reality. Solana is the only chain that has proven it can deliver the scalability, cost efficiency, and throughput required to handle autonomous-agent transactions at a global scale.

Innovation

For years, Solana has been the chain where innovation takes root. Time and again, when new categories of applications gain traction, Solana emerges as the proving ground. The NFT boom and memecoin mania of 2021 through 2024 unfolded primarily on Solana, which was the only chain capable of absorbing industry-wide demand from retail users, developers, and artists.

Figure 11: Total Tokenized Stock Volume by Chain (YTD)

That same dynamic is playing out again today. In tokenized stocks, a category that only launched in June of this year, Solana has already seen nearly $800M in trading volume - more than all other chains combined. In prediction markets, another rapidly emerging vertical, Solana also leads with more active platforms than any of its competitors.

Figure 12: Prediction Market Platforms by Chain

The pattern is consistent: whenever a new frontier in crypto opens, Solana is where the innovation happens first. Its combination of scale, low cost, and reliability makes it the only blockchain capable of supporting global experimentation without bottlenecks. For investors, this signals more than today’s adoption. It represents tomorrow’s optionality. Whatever sector drives the next wave of growth, the odds are overwhelming that it will take root on Solana first.

Institutional Adoption

One of the strongest proofs of Solana’s usefulness, value, and long-term potential comes from the caliber of institutions choosing to build on it. Beyond retail adoption and developer growth, the true validation of a blockchain arrives when global financial firms, payment providers, and infrastructure companies commit capital and resources to deploying products onchain. Institutions and even governments are increasingly turning to Solana to capture the benefits of instant settlement, cost efficiency, transparency, and programmability - benefits that are difficult to replicate in legacy financial rails.

Here are just a few recent examples of institutions adopting Solana:

May 29, 2024: PayPal, one of the world’s largest payments companies with +400M active users, expanded its PYUSD stablecoin to Solana to leverage instant settlement, extremely low fees, and high throughput. This positioned PYUSD as a practical digital dollar for everyday payments and financial applications. Today, nearly $400M of PYUSD has been issued on Solana.

February 12, 2025: U.S.-based asset manager overseeing $1.5T in assets, Franklin Templeton, expanded its OnChain U.S. Government Money Market Fund (FOBXX) to Solana, bringing a fund with roughly $594M in assets onchain.

March 25, 2025: BlackRock, the world’s largest asset manager with over $10T in AUM, and Securitize, a leader in tokenization infrastructure, together expanded the BUIDL tokenized money market fund to Solana - making it the largest tokenized fund in existence.

June 23, 2025: Fiserv, a Fortune 500 fintech company that provides payments and banking technology to thousands of financial institutions, launched a regulated stablecoin platform on Solana in partnership with Circle, Paxos, and PayPal. The initiative connects tokenized dollars directly to banks and merchants, creating a major bridge between traditional finance and blockchain-based money.

July 9, 2025: Bullish, a regulated global exchange and liquidity provider backed by Founders Fund and Block.one, partnered with the Solana Foundation to expand onchain financial infrastructure. The collaboration placed Solana-native stablecoins at the center of new trading, custody, clearing, and settlement systems for institutional markets.

September 4, 2025: R3, an enterprise blockchain software company whose Corda platform is used by more than 400 financial institutions, announced it would bring $17B of tokenized real world assets (RWAs) to Solana and launched R3 Labs to accelerate the integration of traditional finance with decentralized infrastructure.

Together, these examples show that Solana is no longer just a proving ground for experimentation. It is rapidly becoming the preferred settlement layer for some of the world’s largest and most influential institutions.

SOL DATs benefit not only from SOL’s appreciation as the network continues to lead in growth, innovation, and adoption, but also from Solana’s unique ecosystem. This gives them multiple channels to deliver greater value to shareholders:

Native Yield

SOL offers one of the highest native staking yields in crypto, currently around 6.5% APY. For DATs, this creates an organic way to grow holdings and compound returns over time, even through bear markets. Unlike most SOL ETFs, where yield cannot be fully earned due to liquidity requirements, DATs capture these rewards directly for shareholders. The ability to compound staking rewards directly on behalf of shareholders gives SOL DATs a structural economic advantage.

Validator Operations

Beyond staking, SOL DATs can enhance returns by operating their own validators. This allows them to capture 100% of staking rewards rather than paying fees to outside operators, while also creating opportunities to attract additional stake from retail or institutional participants seeking competitive yields. More stake translates into higher rewards and greater SOL accumulation on the balance sheet, directly fueling SPS growth.

1/ Let's BONK ❗️❗️❗️

Today, we're announcing a historic partnership with @bonk_inu, Solana’s premier community memecoin with +920K holders and +400 integrations!

Together, we’re launching the first-ever public company x memecoin validator on Solana. 🧵

— DeFi Dev Corp. (DFDV) (@defidevcorp)

12:07 PM • May 16, 2025

DFDV has capitalized on this advantage by acquiring its own validator business in April 2025 and later announcing joint operations with BONK, WIF, and AllDomains - three of the largest communities in crypto. These efforts enable DFDV to compound rewards, expand its validator footprint, and accelerate SOL accumulation for shareholders.

Figure 13: The Validator Flywheel

Onchain Innovation

Solana’s unmatched speed, scalability, and near-zero costs make it the epicenter of onchain innovation. This opens new yield opportunities for DATs. A prime example is the rise of Liquid Staking Tokens (LSTs). By issuing or adopting an LST, DATs can attract liquidity-sensitive stakers, deepen participation in DeFi, and unlock incremental rewards on top of native yields. Integration across Solana’s DeFi ecosystem further amplifies these benefits, as LSTs can be deployed across lending, trading, and structured products to drive compounding returns.

Figure 14: dfdvSOL Growth Loop

DFDV has led the way with the launch of dfdvSOL in May 2025. Since then, dfdvSOL has been integrated with top protocols, including RateX, Exponent, Fragmetric, and Kamino, as well as the dfdvSOL Plus vault on Drift in partnership with Gauntlet. These initiatives have created a growth loop while also attracting 410,000 additional SOL (over $86M) staked with DFDV, thereby boosting our SOL accumulation and SPS. DFDV has also pioneered tokenized equity with the launch of DFDVx, the first DAT stock to trade onchain. This innovation introduced 24/7 access, deeper liquidity, and more efficient price discovery, while expanding reach to new categories of shareholders.

Locked SOL

Because Solana launched after the ICO wave of 2017–2018, regulatory constraints forced it to raise capital through private rounds with strict lock-up agreements. As a result, a large portion of SOL remains in the hands of early investors, institutions, and high-net-worth individuals, much of it still restricted from open trading.

This dynamic creates a unique advantage for SOL DATs. As regulated corporate entities, they can purchase locked SOL directly from these holders, often at discounts of 10–15% to market price. For shareholders, this represents a channel of discounted accumulation that is unavailable to retail participants. By accessing locked supply at scale, SOL DATs can enhance returns and accelerate SPS growth, offering a distinct edge over BTC and ETH DATs that lack a similar mechanism.

Underexposed: Demand Is Catching Up

While institutions are beginning to build on Solana thanks to its unmatched throughput, low fees, and decentralized architecture, the adoption of SOL remains in its early stages. In other words, institutions are still underexposed, and that gap represents one of the biggest opportunities ahead.

As shown in Figure 15, the percentage of total SOL supply held by public companies remains far smaller than the institutional footprint for BTC and ETH. Yet the trajectory is clear: institutional adoption of SOL is accelerating. If this pace continues, it is reasonable to expect that the share of circulating SOL held by public companies will eventually surpass BTC and ETH. That shift would not only validate SOL as a core treasury asset but also drive sustained price appreciation and relative outperformance, setting off a recursive feedback loop of growing awareness, further accumulation, and even greater demand.

Figure 15: Supply Held by Public Companies by Cryptoasset

The same pattern is visible in digital asset investment products. As Figure 16 highlights, assets under management (AUM) in SOL-based products currently stand at just $4.3B, compared to $40.3B for ETH and $183B for BTC. Said differently: SOL has only one-tenth the AUM of ETH despite having one-fifth its market capitalization, and just 2.3% of BTC’s AUM despite representing 5% of BTC’s market cap. The imbalance is glaring.

Crucially, SOL investment products are now showing the same early ramp that ETH and BTC products experienced in past cycles. As that trend accelerates, the flow of institutional and retail capital into SOL will expand dramatically.

Figure 16: AUM of Digital Asset Investment Products by Asset

For investors, this asymmetry is key: SOL DATs are uniquely positioned to capture the catch-up trade. As market participants become aware of Solana’s superior technological capabilities and unmatched performance, demand for SOL will increase, and the vehicles most leveraged to meet that demand are SOL DATs.

What To Watch Out For

As can be seen, SOL DATs are uniquely positioned to become the standout performers in the ongoing DAT wave. However, not every SOL DAT will succeed. The reality is that poorly managed, predatorily structured, and underperforming DATs will ultimately struggle to trade at net asset value (NAV), much less at a premium. Over time, we believe a natural flight to quality will occur, where capital flows toward disciplined operators and away from weaker entrants. Investors should be cautious of the following red flags when evaluating SOL DATs:

Toxic Financing Terms: Since the core strategy of a DAT is leveraging public markets to issue debt or equity for the purchase of SOL, financing terms matter greatly. Convertible notes, warrants, equity lines of credit, and similar structures can either support or erode shareholder value. Investors should scrutinize public filings to avoid DATs that adopt toxic financing arrangements designed to extract value rather than create it.

Onerous Asset Management Arrangements: Some DATs outsource day-to-day treasury operations or engage third-party managers under costly arrangements. Excessive management fees, performance fees, or “double-layered” expense structures can quietly erode shareholder value over time.

Misaligned Executive Compensation: As Warren Buffett once said, “Show me the incentives and I’ll show you the outcome.” Market participants should not underestimate how executive pay structures shape behavior. At DeFi Dev Corp., compensation is tied to SPS growth, ensuring that management's interests are aligned with those of shareholders. Unfortunately, some DATs link compensation to market capitalization, stock price momentum, or even the number of new shares issued. These structures create perverse incentives to dilute existing holders or chase short-term valuation pops rather than focus on disciplined accumulation of SOL. Investors must carefully evaluate proxy filings to ensure compensation policies reinforce, not undermine, the long-term mission of the DAT.

Transparency & Ethics: Public companies must disclose key information, but disclosure quality varies widely. DATs that obscure critical details, such as compensation structures, financing arrangements, or accounting practices, put investors at a higher risk. Trustworthy DATs should not only meet baseline requirements but also go above and beyond in transparency and ethics. Those who cut corners will eventually lose credibility, face litigation, and/or destroy shareholder value.

Figure 17: SEC & FINRA Investigating DAT Insider-Trading

Public-Market Inexperience: While barriers to launching a DAT are relatively low, success in the public markets requires expertise. DATs that lack seasoned experience in capital markets risk making missteps that can permanently erode shareholder trust.

Crypto-Market Inexperience: Launching a public vehicle is only half the challenge. The other half is navigating crypto markets themselves. DATs led by teams with purely traditional finance backgrounds often underestimate the speed, volatility, and complexity of crypto. Without a deep familiarity with the Solana ecosystem and the cryptoasset industry, DAT operators risk leaving yield on the table, struggling to generate shareholder value, and/or mismanaging their treasury. A lack of crypto-native expertise is a red flag that should not be overlooked.

Incorrect Performance Metrics: Investors should avoid DATs that fail to measure performance in a way that prioritizes shareholder outcomes. At DeFi Dev Corp., we pioneered the SOL Per Share (SPS) metric, ensuring that investors steadily increase their exposure to SOL over time, rather than simply buying spot. This is the fundamental value proposition of DATs, and those who ignore it risk misleading their shareholders.

Leverage Risks: Leverage can amplify returns when used prudently, but excessive leverage creates the risk of catastrophic failure. DATs that chase short-term gains with unsustainable debt levels should be approached with extreme caution.

Failure to Innovate: The DAT landscape is still new and evolving, and what worked yesterday will not guarantee success tomorrow. Oversaturation and low entry barriers mean that ongoing innovation is key. The winners will be those who adapt, experiment, and expand their toolkits. That is why DeFi Dev Corp. launched, amongst other things, its Treasury Accelerator program, tokenized its stock onchain, and built out the dfdvSOL liquid staking token (LST). Innovation is not optional in this space. It is survival.

Conclusion

DATs are the next frontier of crypto investing, but Solana DATs are the crown jewel. With Solana’s unmatched performance, ecosystem strength, and growing institutional adoption, SOL DATs are uniquely positioned to capture the largest share of this emerging opportunity.

Still, not every DAT will succeed. Execution, disciplined use of capital markets, innovation, and transparency will separate the winners from the rest. Investors who identify and back the right SOL DATs stand to capture the most upside as the space matures.

As this wave accelerates, the call to action is clear: perform real due diligence, be hypercritical, and ask tough questions. Focus on those SOL DATs that consistently deliver value to shareholders even during unfavorable market conditions. These will be the companies that lead the DAT era forward and reward investors who recognize their potential early.

Sources

Disclaimer: This is for informational purposes only and reflects publicly announced developments, milestones, and media coverage related to DeFi Development Corp. (“the Company”). The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities, nor should it be relied upon as investment advice or a recommendation regarding any securities. Certain statements in this post may constitute “forward-looking statements” within the meaning of applicable securities laws. These statements are based on current expectations and assumptions and involve risks and uncertainties that could cause actual results or events to differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of publication. DeFi Development Corp. undertakes no obligation to update any forward-looking statements, except as required by law. All information is accurate as of the date posted and is subject to change without notice.