- DeFi Dev Corp. (Nasdaq: DFDV)

- Posts

- Sept. 2025 Recap: Building Steadily, Expanding Globally

Sept. 2025 Recap: Building Steadily, Expanding Globally

September may not have been our flashiest month, but it was one of steady execution and meaningful progress. From surpassing 2M SOL in treasury holdings to expanding our global Treasury Accelerator, we continued laying the foundation for long-term SPS growth and Solana adoption.

September was a steadier month for DeFi Development Corp. (Nasdaq: DFDV), yet it delivered important progress across several fronts. We strengthened our treasury with new SOL purchases, crossed the 2M SOL milestone, and expanded our Treasury Accelerator globally through partnerships in Korea and with ZeroStack. We also announced SOLID: Solana Investor Day, introduced the dfdvSOL Plus Vault, and advanced initiatives on the capital markets front. While not as headline-heavy as prior months, September underscored our ability to keep building strategically and laying the groundwork for long-term Solana Per Share (SPS) growth and global expansion.

Month-End Statistics

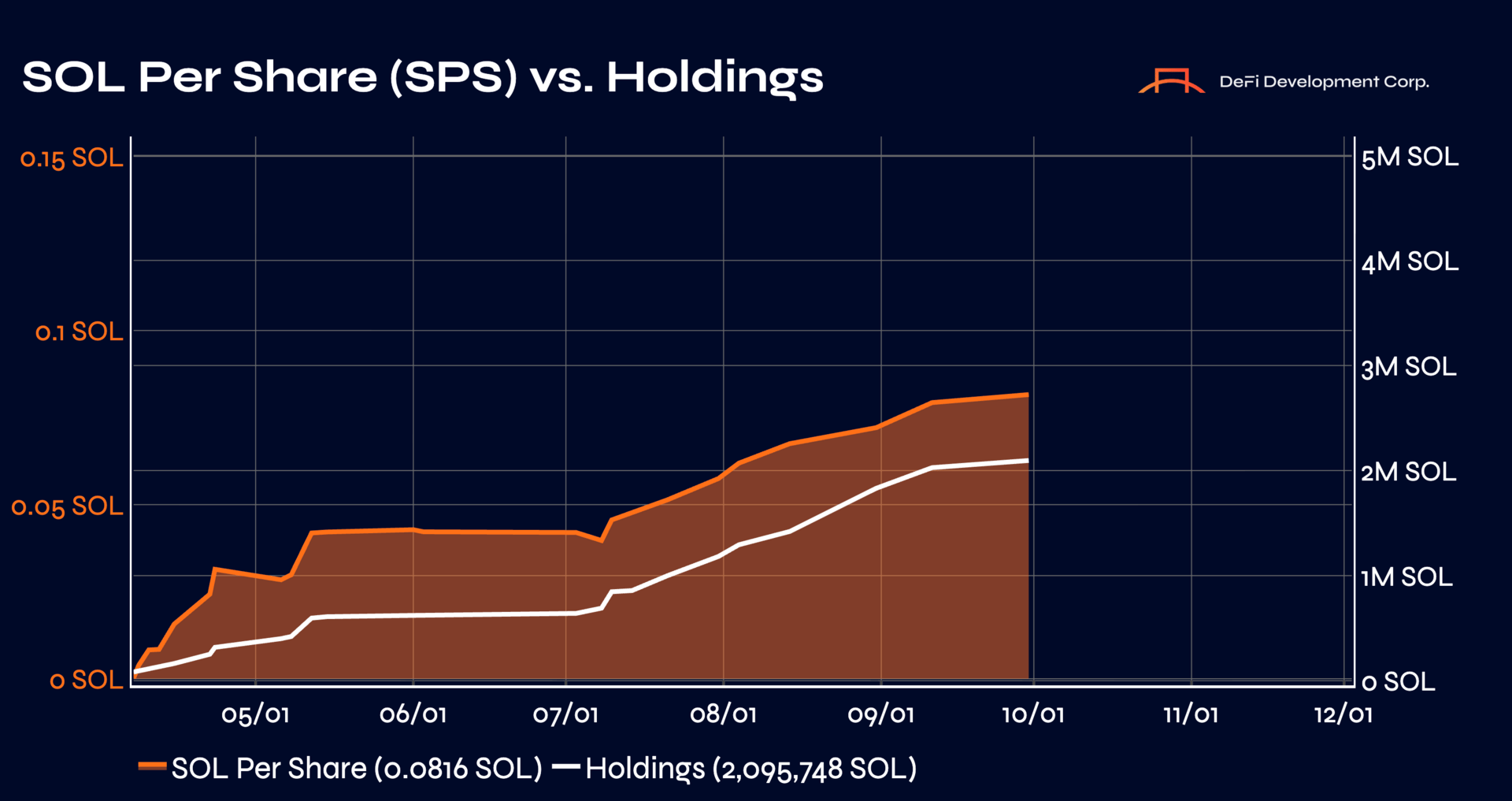

SOL Holdings: 2.09M (+14% MoM)

SOL Holdings Value: $485.4M (+32% MoM)

Shares Outstanding: 25.67M (+1% MoM)

SOL Per Share (SPS): 0.0816 (+13% MoM)

dfdvSOL Supply: 411,638 SOL (+116% MoM)

DFDVx Trading Volume: $48.87M (-16% MoM)

Key Milestones & Developments

SOLID: Solana Investor Day

We unveiled SOLID (Solana Investor Day), the first investor-focused event dedicated entirely to Solana. This initiative positions DFDV as the bridge between institutional capital and Solana’s ecosystem, creating a recurring platform to showcase validator economics, DeFi opportunities, and Solana’s role as the internet’s settlement layer.

Additional details

Surpassing 2M SOL in Treasury Holdings

On September 4, we completed a purchase of 196,141 SOL, pushing our treasury past the 2M SOL mark. This milestone cemented DFDV as the largest Solana-focused public treasury vehicle and validates our aggressive strategy of using capital markets to scale Solana exposure faster than holding spot.

Additional details

$15M SOL Acquisition

We continued to scale our balance sheet with an additional $15M purchase of SOL on September 17. This demonstrates ongoing execution of our mission to compound SOL Per Share (SPS) and reinforces our ability to deploy capital effectively following equity raises.

Additional details

Expanding the Treasury Accelerator

We announced an expansion of our Treasury Accelerator, allowing DFDV’s balance sheet to seed and scale new Solana Digital Asset Treasuries globally. The program takes our U.S. playbook abroad, offering franchise-style deals that combine validator services, capital-markets expertise, and operational support.

Additional details

1/ We're thrilled to announce our strategic collaboration with @stack0G (ZeroStack), a DAT focused on $0G accumulation.

This partnership is our next step in combining strategic capital, operational expertise, & aligned incentives to fuel $SOL Per Share (SPS) growth.

🧵

— DeFi Dev Corp. (DFDV) (@defidevcorp)

1:27 PM • Sep 22, 2025

ZeroStack Strategic Partnership

We partnered with ZeroStack, a decentralized AI-focused project, through a SOL-denominated convertible note. As part of the Treasury Accelerator, this collaboration showcases how our franchise model supports new verticals like AI while ensuring SPS accretion.

Additional details

1/ We’re excited to announce the forthcoming launch of DFDV Korea, the 1st $SOL Digital Asset Treasury (DAT) in Korea. 🇰🇷

This new initiative, in partnership w/ @fragmetric, expands the $DFDV Treasury Accelerator program into one of the world’s most dynamic trading markets. 🧵👇

— DeFi Dev Corp. (DFDV) (@defidevcorp)

2:27 PM • Sep 22, 2025

DFDV Korea with Fragmetric Labs

We announced DFDV Korea, the first Solana DAT in South Korea, in partnership with Fragmetric Labs. Korea is one of the most active crypto markets in the world, and this launch expands our franchise into Asia while reinforcing Solana’s global adoption curve.

Additional details

Leadership Update: Dan Kang

Dan Kang was promoted to Chief Strategy Officer,He will continue to oversee investor relations while also leading DFDV’s global strategy, corporate development, and capital markets initiatives. reflecting his leadership in scaling our Treasury Accelerator, driving institutional outreach, and elevating DFDV’s visibility.

Additional details

$100M Share Repurchase Authorization

Our Board approved a $100M buyback program, one of the largest by a public crypto treasury company. All shares repurchased will be retired and returned to the status of authorized but unissued shares or held as treasury stock.

Additional details

Ecosystem Partnerships & Product Innovation

The dfdvSOL Plus Strategy in Partnership with Gauntlet & Drift

dfdvSOL Plus Strategy: Gauntlet & Drift Partnership

We partnered with Gauntlet to launch the dfdvSOL Plus Vault on Drift, applying advanced risk models to maximize SPS growth.

Read more

dfdvSOL Integration with Project0

The dfdvSOL liquid staking token (LST) was added to Project0, a DeFi-native prime broker, enabling holders to borrow against their dfdvSOL at a collateral weight of up to 95.5% while continuing to earn staking yield.

Read more

1/ It's true, you can now claim your .dfdv Solana wallet domain! 🚀

Align your digital identity with the $DFDV community while helping fuel $SOL Per Share (SPS) growth - net proceeds go directly to the treasury.

GetYoursToday.dfdv 👇

alldomains.id/domains/dfdv— DeFi Dev Corp. (DFDV) (@defidevcorp)

2:15 PM • Sep 5, 2025

.dfdv Wallet Domains Went Live

We partnered with AllDomains to launch .dfdv wallet domains, a new way for shareholders, validators, and community members to align their digital identity with DFDV. This expands Solana’s naming ecosystem and provides holders with a direct way to show affiliation with our Solana-first treasury strategy.

Events & Thought Leadership

Token 2049

Dan Kang (Chief Strategy Officer) delivered his presentation “SOL to $10,000” and DFDV co-hosted the official Crypto Treasury Summit side event with partners and speakers including DigitalX (ASX: DCC), Canaan Inc. (Nasdaq: CAN), DDC Enterprise (Nasdaq: DDC), 01 Quantum (TSXV: ONE), Animoca Brands, the Antanas “Tony G” Guoga Family Foundation, Matrixport, and Nansen.

Dan Kang Presenting at DATCON during Korea Blockchain Week

Solana Oriental 2025 & Korea Blockchain Week (KBW)

DFDV sponsored the Solana Oriental 2025 event hosted by Fragmetric. Dan Kang was among the panel speaker lineup for the Accelerate Solana DeFi panel discussion. Dan also gave his “mNAVs for DATs” presentation at DATCON during Korea Blockchain Week.

Replay

The Defiant Podcast

CEO Joseph Onorati shared how DFDV transformed into a Solana-focused treasury powerhouse, discussed innovative yield and staking strategies, and explained why Solana’s volatility and native yield make it the most compelling foundation for crypto treasuries.

Replay

Research Publications

We published two long-form blog posts in September: DATs: The Next Frontier of Crypto Exposure, which explained how Digital Asset Treasuries (DATs) create value, the risks in their business model, and why Solana DATs could lead the next major wave of adoption; and The Next Best Crypto Trade? Solana DATs, which outlined why Solana-focused DATs are positioned to dominate and how investors can separate winners from pretenders.

Treasury Accelerator Update

In September, we provided a deeper look into our Treasury Accelerator program through a dedicated X Spaces event, “DFDV Dealmaking: An Update on Treasury Accelerator Initiatives.” The conversation highlighted the deals we’ve recently announced and provided shareholders with an opportunity to understand how these partnerships are structured to maximize long-term Solana Per Share (SPS) growth.

Key Initiatives Discussed:

DFDV UK: Building the first Solana DAT vehicle in the United Kingdom through a 45% acquisition of a listed entity. This represents a foundational step in scaling our strategy globally and unlocking institutional channels in Europe.

ZeroStack: Partnering with the Zero Gravity team on a decentralized AI-focused vehicle. This deal was structured using a SOL-denominated convertible note, ensuring DFDV never sells SOL from its balance sheet while gaining exposure to equity upside and franchise-style fee arrangements.

DFDV Korea: In collaboration with Fragmetric, we are pursuing a Korea-based Solana treasury vehicle. Korea remains one of the most active crypto markets worldwide, and our local partnership positions DFDV to establish the flagship SOL DAT in the region.

The Bigger Picture:

Management emphasized that the Accelerator model is not just about investing capital into new vehicles. Each deal is designed as a franchise arrangement, where DFDV contributes operational expertise, validator infrastructure, accounting and asset-management support, and brand recognition. In return, we secure long-term economics that drive direct and indirect SPS accretion.

The discussion also underscored the “flywheel effect” of this strategy: every successful Accelerator partnership strengthens DFDV’s brand as the premier DAT operator, attracts more inbound opportunities, and enhances our ability to demand better economics in future deals.

For those who want to hear the full breakdown of how these deals were structured and what comes next, you can watch the full replay.

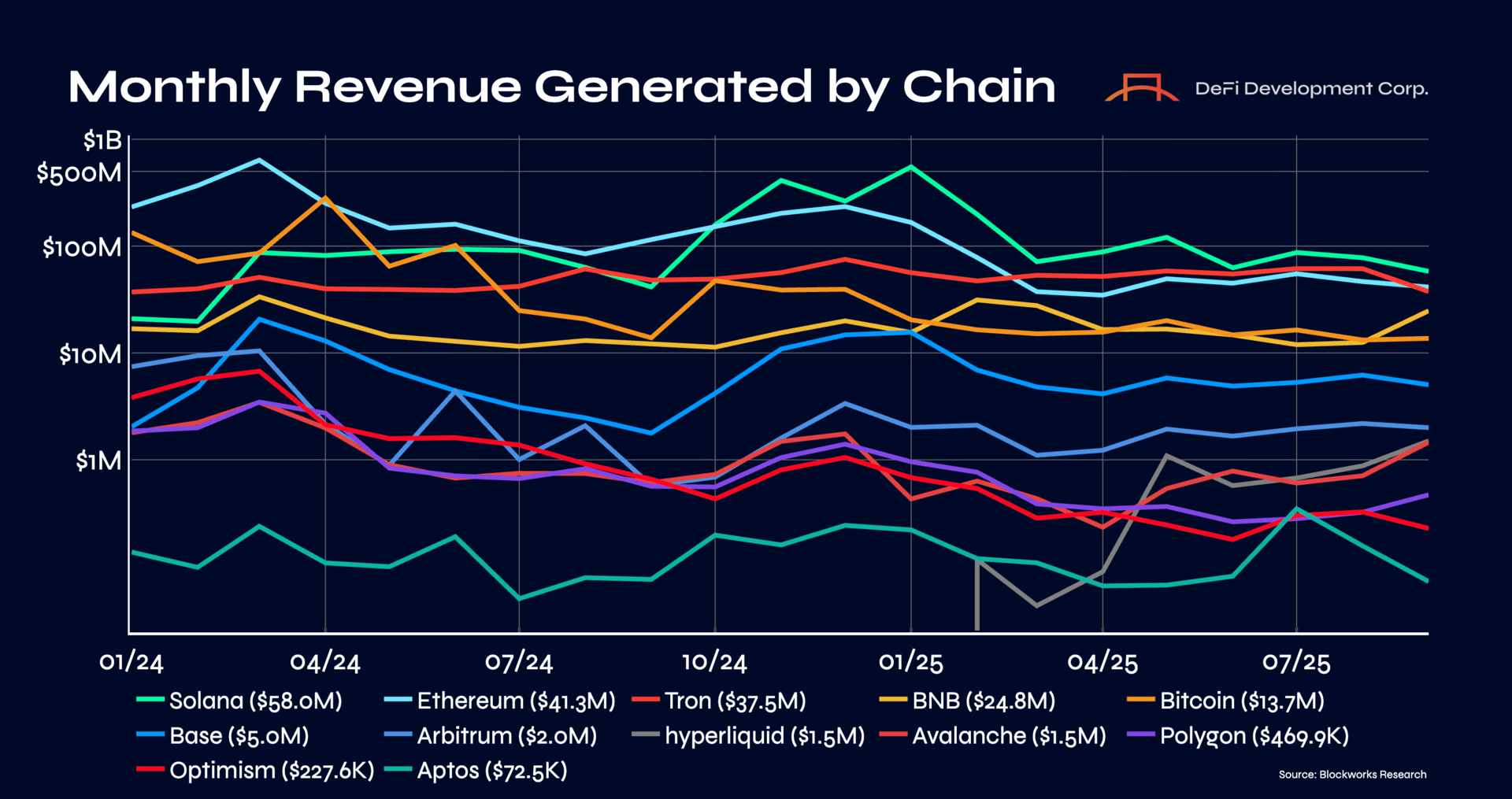

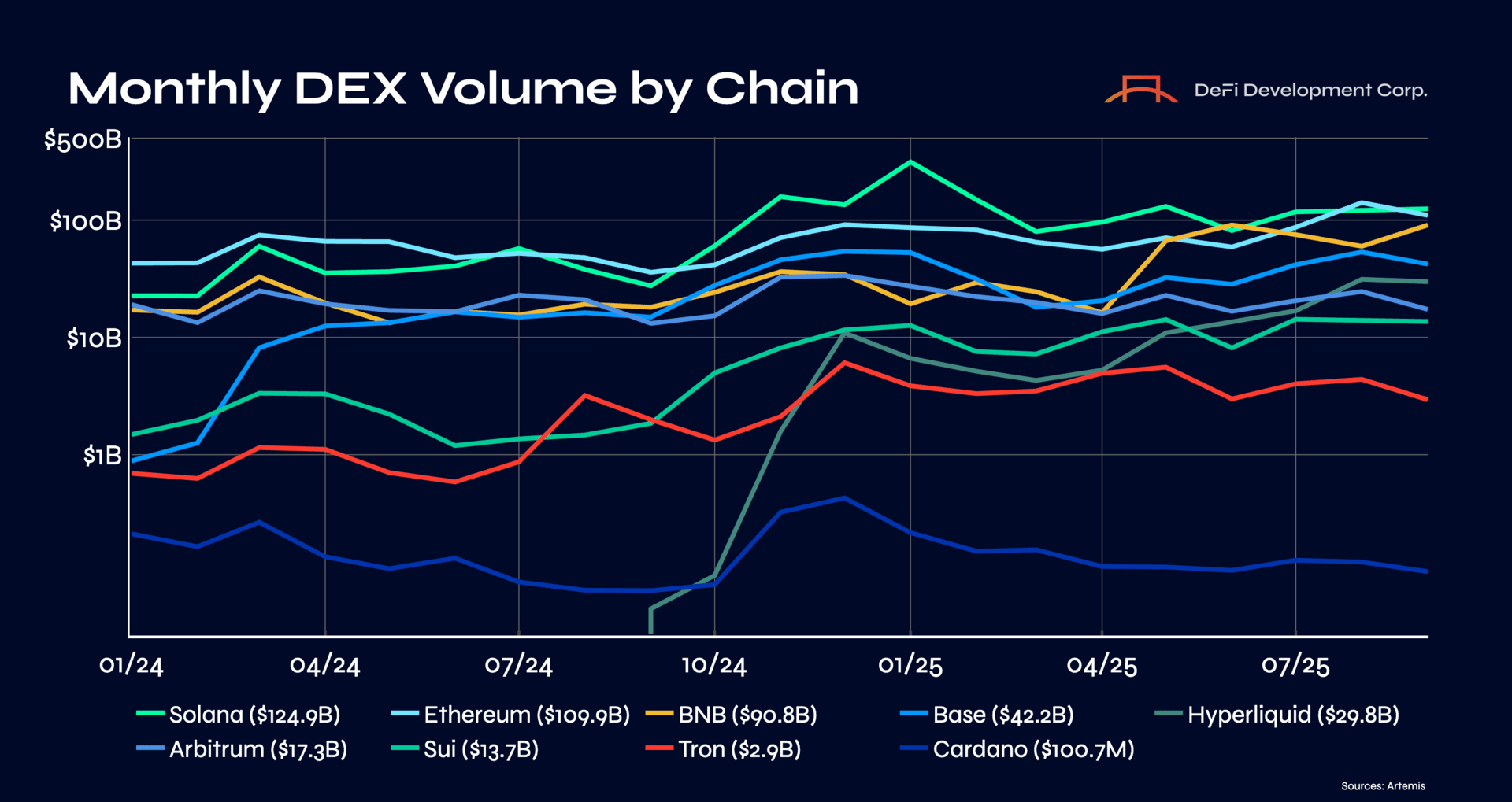

Solana Performance Metrics

September once again highlighted Solana’s dominance across every key metric. From revenue generation and trading activity to transactions and active users, Solana not only outpaced Ethereum and Tron but also widened its lead over the broader field. Whether measured by protocol fees, DEX volume, throughput, or adoption, Solana consistently sets the standard for blockchain performance.

Protocol Revenue: Solana generated $58M in protocol fees — outpacing Ethereum ($41M) and Tron ($37M) to lead all chains once again. This marks the 12th consecutive month Solana has ranked #1 in fee revenue, underscoring unmatched demand for its DeFi, trading, and onchain activity.

DEX Volume: After falling short of Ethereum in August, DEX volume on Solana roared back higher in September ($125B) and surpassed Ethereum ($110B), thereby reclaiming the throne as top blockchain by trading activity.

Transactions: Solana processed 2.4B transactions — more than 50x Ethereum, and still 5x greater than Polygon, Base, Sui, and Arbitrum combined. No other chain comes close to matching Solana’s dominance in raw transaction throughput.

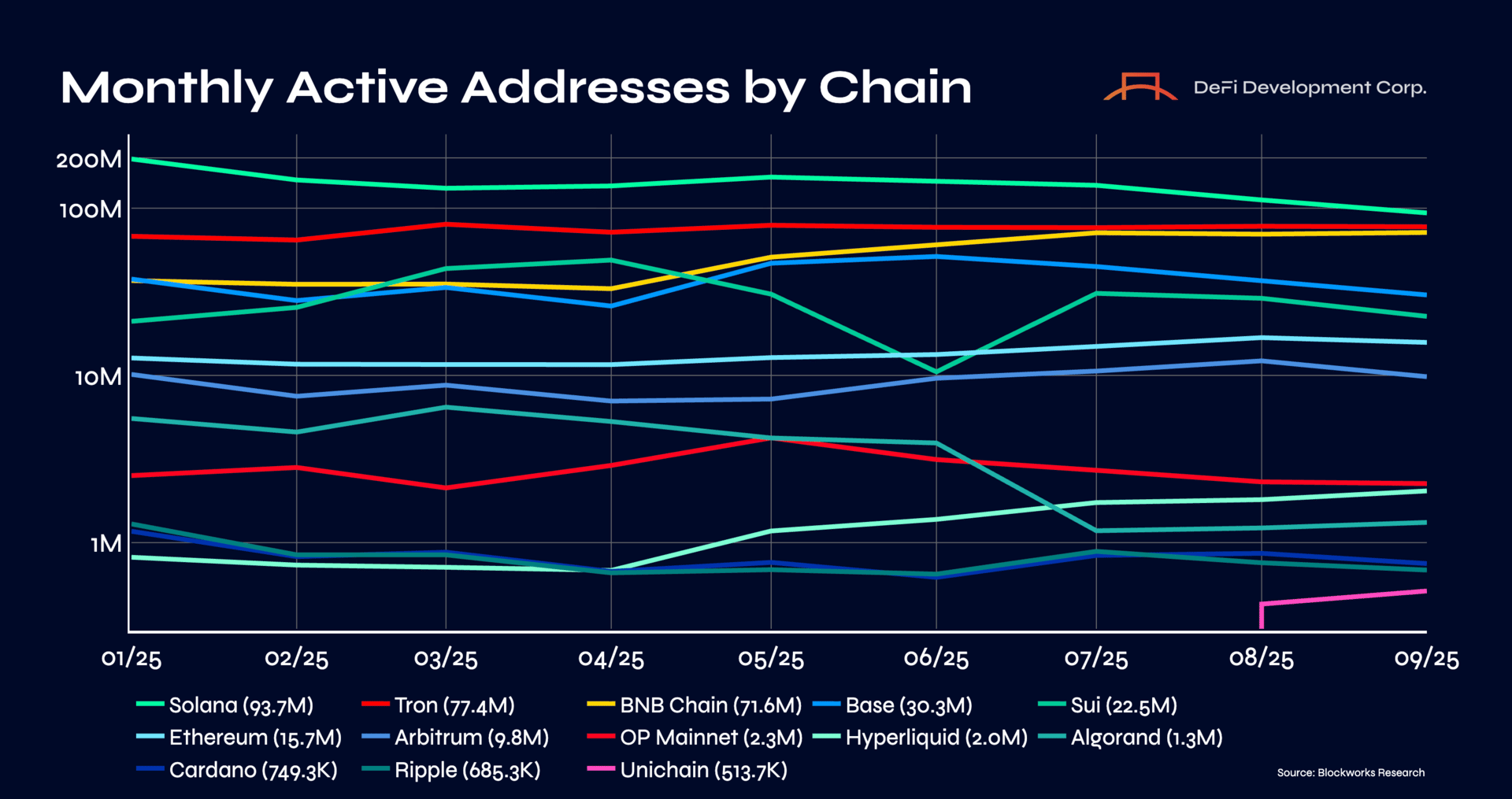

Active Addresses: With 93.7M monthly active addresses in September, Solana continues to dominate user activity across all blockchains. That’s more than 3x Base, 9.5x Arbitrum, and nearly 6x Ethereum — cementing Solana’s position as the undisputed leader in onchain adoption.

Looking Ahead

As we enter the final quarter of 2025, our focus remains clear: aggressively compounding Solana Per Share (SPS) while expanding our role as the premier Solana Digital Asset Treasury (DAT). September provided us with the opportunity to advance ongoing initiatives and strengthen our market positioning while expanding our global reach through new partnerships and capital markets initiatives. With catalysts on the horizon, we are confident that the groundwork laid this past month positions DFDV to accelerate through the end of 2025.

In service of SPS growth,

The DFDV Team

Disclaimer: This is for informational purposes only and reflects publicly announced developments, milestones, and media coverage related to DeFi Development Corp. (“the Company”). The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities, nor should it be relied upon as investment advice or a recommendation regarding any securities. Certain statements in this post may constitute “forward-looking statements” within the meaning of applicable securities laws. These statements are based on current expectations and assumptions and involve risks and uncertainties that could cause actual results or events to differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of publication. DeFi Development Corp. undertakes no obligation to update any forward-looking statements, except as required by law. All information is accurate as of the date posted and is subject to change without notice.