- DeFi Dev Corp. (Nasdaq: DFDV)

- Posts

- 2025 Recap: Just The Beginning

2025 Recap: Just The Beginning

From launching the first SOL Digital Asset Treasury to surpassing 2M SOL, 2025 set the foundation. But now, the real compounding begins.

2025 might have marked the birth of DeFi Development Corp. (Nasdaq: DFDV), but it will also go down in history as our defining year. From our public rebrand and strategic shift to Solana, to pioneering the non-bitcoin Digital Asset Treasury (DAT) model, to scaling our SOL per Share (SPS) growth engine, to various corporate onchain innovations, DFDV established itself as the go-to vehicle for Solana exposure.

In just nine months, we:

Raised $378M across private placements, convertible notes, and our Equity Line of Credit (ELOC)

Acquired and launched our Solana validator business.

Became the first DAT to adopt its own liquid staking token (dfdvSOL), tokenize its equity (DFDVx), and push the envelope of corporate onchain yield generation.

Led DAT capital markets innovation through our $5B ELOC, DFDVW Warrants, and preferred stock offering.

Built a following across Twitter, Stocktwits, Reddit, LinkedIn, & more

Partnered with top Solana-native protocols and industry leaders.

Attended dozens of industry events, hosted our very own Solana Investor Day (SOLID) 2025, and made history as the first DAT to ring the Nasdaq bell.

& plenty more…

DAT Stock Performance (2025)

And we did all of this while becoming the top-performing crypto stock of 2025 and the 3rd-best-performing Nasdaq stock. DFDV ended the year up a whopping +853%, cementing DFDV as the only SOL DAT with positive returns post-treasury launch.

In this 2025 company recap, we look back at the key milestones that defined DeFi Development Corp. last year and set the stage for what we believe will be an even more noteworthy 2026.

Year-End Statistics

SOL Holdings: 2,195,926

SOL Holdings Value: $273M

Shares Outstanding: 29,892,800

SOL Per Share (SPS): 0.0743 SOL

dfdvSOL Supply: 429,729.47 SOL

DFDVx (Tokenized DFDV) Trading Volume: $240.3M

Historical SPS and SOL Holdings

🔁 From Janover to DFDV: A New Chapter Begins (April)

In April, a team of former Krakenites and TradFi professionals acquired real estate SaaS company Janover Inc. (Nasdaq: JNVR) before rebranding as DeFi Development Corp. and shifting focus to aggressively growing SOL Per Share (SPS). The shift marked the start of a new era for non-bitcoin DATs, as DeFi Development Corp. became the first public company to operate like a non-bitcoin treasury.

JNVR Acquisition Press Release

Raised $66M via private placements to launch operations, fund initial Solana purchases, and acquire real estate SaaS company Janover (Nasdaq: JNVR) - positioning DFDV as a hybrid holding company with both onchain and traditional revenue potential.

Acquired 317,273 SOL across five significant purchases, establishing our role as an active Solana accumulator from day one.

Recruited a new leadership team from Kraken, Binance, Goldman Sachs, Morgan Stanley, and Jefferies, signaling a blend of TradFi experience and crypto execution.

Launched defidevcorp.com, offering real-time transparency into treasury holdings, SPS metrics, and onchain activity, a first for any public crypto treasury.

Featured in CoinDesk, Decrypt, CoinTelegraph, The Block, Blockworks, and CNBC, driving early awareness across both crypto-native and institutional audiences.

🚀 Going Vertical: SOL, Validators & LSTs (May)

May was, in many ways, a continuation of April - albeit with a greater emphasis on further SOL accumulation. Amongst other things, we doubled our treasury SOL holdings, launched dfdvSOL using Sanctum’s LST technology, expanded into the validator business, and saw record performance. Some of the more notable developments included:

DFDV Featured on Mad Money

Executed a 7-for-1 stock split, increasing share accessibility and supporting future options and warrant issuance.

Began trading DFDV options on Cboe & Nasdaq, making DFDV one of the only public crypto companies with institutional-grade derivatives.

Launched our first validator in partnership with Bonk, creating a new onchain revenue stream directly linked to SPS accretion.

Treasury holdings nearly doubled to 621,313 SOL (+96% MoM), reflecting both internal capital deployment and investor trust.

SPS jumped to 0.0428 SOL (+38%), demonstrating immediate per-share accretion.

Featured across top media and speaking platforms, including Solana Accelerate NYC, SolanaFloor, Blockworks, Bloomberg, and Mad Money, accelerating awareness.

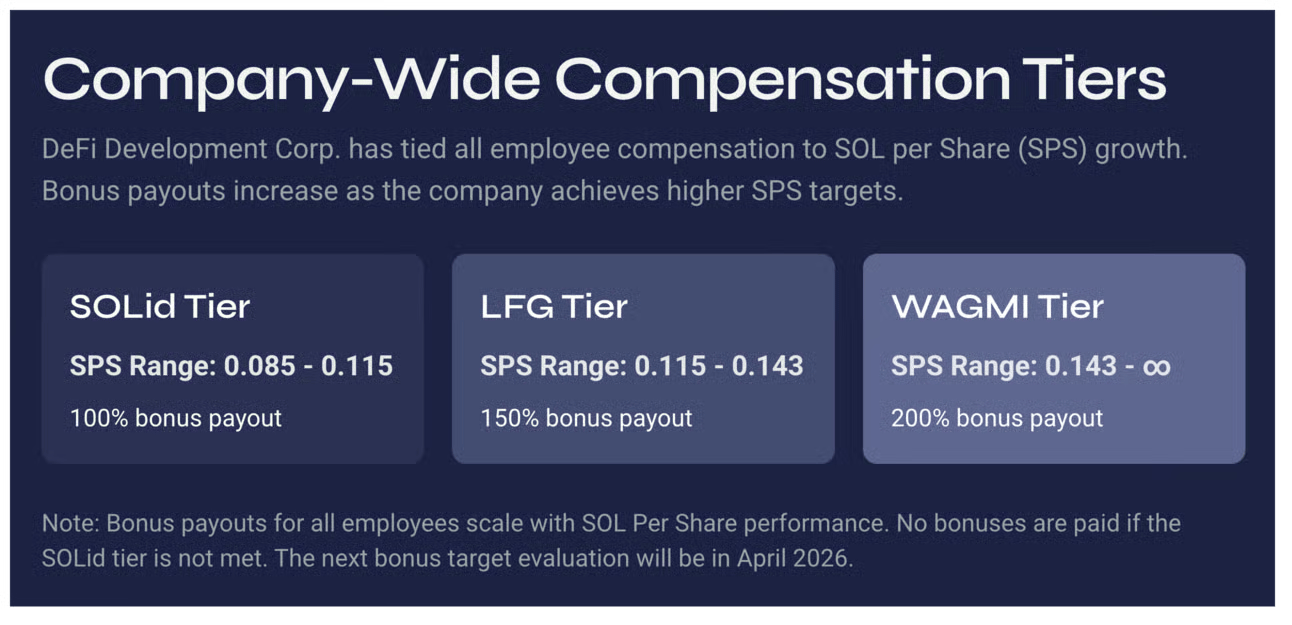

Introduced an executive compensation structure tied to SPS, aligning internal incentives with token-per-share performance.

DeFi Dev Corp. Compensation Plan

🌎 Global Growth & Validator Scale (June–August)

The broader cryptoasset industry showed signs of sluggishness over the summer amid broader financial market seasonality, but the team at DFDV kept pushing forward. Over the summer, DFDV expanded its footprint, led the charge on various “industry-first” initiatives, continued to accumulate SOL, and even pushed the limits of our validator business. Key highlights include:

DFDV became the first Digital Asset Treasury (DAT) to become tokenized onchain after partnering with Kraken and Backed. Our tokenized stock, DFDVx, was listed on MEXC and Gate.io, enabling global access via spot and perps for both retail and institutional investors.

Secured a $5B ELOC to dynamically scale capital formation as needed — an unmatched capital stack in the DAT space.

Partnered with leading protocols, Kamino, Drift, Orca, RateX, and Exponent, thus further embedding DFDV deeper into Solana DeFi.

Partnered with WIF and Dogwifhat DAO to launch the DogWifHat community validator.

Went live on the Frankfurt Stock Exchange (FWB), marking DFDV’s formal European debut.

Cited by CNBC as the top-performing digital asset treasury of 2025, validating both our execution and the broader Solana thesis.

Issued forward SPS guidance for the first time ever: targeting 1.0 SPS by December 2028, yet another industry-first.

Initiated and upsized a $122.5M convertible note, showcasing strong institutional demand for DFDV exposure.

Grew our treasury to 1.83M SOL and reached an ATH SPS of 0.0721 SOL, proving capital efficiency via validator and LST integrations.

Published our SIMD-0326 explainer, outlining why DFDV voted “yes” on Alpenglow, and educating shareholders on protocol upgrades.

Rang the Nasdaq Closing Bell on August 29 with Solana Foundation, BONK, WIF, Drift, and more — cementing DFDV’s place as the Wall Street-native Solana voice.

Cantor Fitzgerald, one of Wall Street’s top investment banks, initiated coverage on Solana treasury strategies, naming DFDV its top pick with over 70% upside potential. Later in the summer, investment bank Craig-Hallum initiated research coverage with a Buy rating and $25 target, citing validator economics, treasury growth, and our Solana-first strategy.

Cantor Fitzgerald Initiation Report

✅ Surpassing 2M SOL & Strategic Treasury Evolution (September)

Although being one of our steadier months, in September, the team delivered on a number of fronts that ultimately positioned DFDV to finish the year strong. We hit a number of milestones that not only expanded our Solana footprint but also deepened our institutional positioning across capital markets and DeFi-native infrastructure.

Crossed the 2 million SOL milestone after a 196,141 SOL purchase, further cementing DFDV as a dominant SOL DAT.

Structured a SOL-denominated convertible note with ZeroStack, expanding the Treasury Accelerator into the AI sector while ensuring SPS accretion

The DFDV Board approved a $100 million share repurchase program, marking one of the largest ever by a public crypto treasury company. Repurchased shares will be retired or held as treasury stock, improving capital efficiency and reducing outstanding supply during periods of deep NAV discount.

Launched the dfdvSOL Plus Vault on Drift in partnership with Gauntlet, applying institutional-grade risk models to unlock additional validator yield and grow SOL per share (SPS).

Integrated dfdvSOL with Project0, enabling DeFi-native borrowing at 95.5% collateral weight, compounding both yield and capital efficiency

We published two of our most popular blog posts: the first, DATs: The Next Frontier of Crypto Exposure, which explained how Digital Asset Treasuries (DATs) create value, the risks in their business model, and why Solana DATs could lead the next major wave of adoption. Later in the month, we published The Next Best Crypto Trade? Solana DATs, which outlined why Solana-focused DATs are positioned to dominate and how investors can separate winners from pretenders.

Following a steady September, the broader cryptoasset market and the DAT vertical entered a downturn. As industry veterans, the team remained unfazed and continued to concentrate on accumulating SOL, leveraging capital markets, and notching additional industry firsts. Top highlights include the following:

Added 86,307 SOL to the treasury, pushing total holdings beyond 2.19M SOL

COO & CIO Parker White and CSO Dan Kang purchased common stock on the open market, signaling confidence in DFDV’s long‑term value proposition.

Announced the first Solana-native preferred stock offering, expanding our capital stack for non-dilutive growth

DFDV’s Warrants (DFDVW) began trading publicly, which were issued to reward long-term holders, expand strategic optionality, and reflect confidence in our growth trajectory.

Partnered with Loopscale to earn points-based stablecoin yield, layering on additional DeFi-native cash flows

Filed our Q3 10-Q, disclosing $74M in unrealized gains and an organic SOL yield of 11.4% - well ahead of the standard 6-7% stake rate.

Held first Reddit AMA on r/DFDVDegens, engaging directly with retail and onchain community members. The success of our first Reddit AMA prompted us to run it back in November and make it a routine community offering.

DFDV became the first SOL DAT to take a public stance in favor of SIMD-0411, advocating for accelerated disinflation to improve SOL’s monetary credibility, reduce emissions, and support healthier long-term yield dynamics.

Hosted the first Solana Investor Day (SOLID) in New York City, bringing together: Institutional investors from major asset managers, hedge funds, & banks, builders from across the Solana ecosystem, and the DFDV management team. A five-part replay series is available.

🌟 Finishing Strong: December Highlights

Notwithstanding a lackluster finish to the year amid a failed Santa Claus rally across crypto markets, DFDV finished 2025 with momentum, innovation, and recognition before gearing up to enter the new year fully recharged. Here are a few developments that round up how we closed out the year:

Named the top-performing crypto stock of 2025 with a +853% return, thereby outperforming every listed peer DAT across all chains

Partnered with Perena to incorporate stablecoin yield directly into the SPS compounding strategy

Partnered with Harmonic to fully automate validator reward optimization, improving stake delegation and uptime performance

Announced Solana Breakout, a virtual summit (Feb 10–12, 2026) featuring teams like Helius, Solflare, Bonk, Kamino, Marinade, Orca & more

Attended Breakpoint 2025 in Abu Dhabi, hosted side events with Solflare, MonkeDAO, Marinade, and hosted the DFDV event booth at the Etihad Arena alongside other ecosystem builders.

The DFDV Booth at Solana Breakpoint 2025

Looking Ahead to 2026

It goes without saying that DeFi Development Corp. made tremendous strides in 2025 and led the charge on a number of fronts, both as a public company and the first non-bitcoin DAT. But while we feel as though the year went on, the whole, we’re kicking off 2026 hungry for more. Irrespective of what the new year has in store for both crypto and traditional markets, we intend to remain focused on:

Scaling dfdvSOL and validator integrations

Taking advantage and innovating within capital markets

Launch a number of initiatives that will notch us additional industry firsts

Aggressively grow SOL per Share (SPS)

Explore new ways to maximize yield and generate additional value for shareholders

In short, we’re proud to be an industry leader and to continue providing the most transparent, liquid, and performance-driven way to gain exposure to the Solana ecosystem. Thanks to each and every one of you for being part of our journey. We hope you stick with us through 2026 and beyond!

In service of SOL Per Share Growth,

DeFi Development Corp.

Disclaimer: This is for informational purposes only and reflects publicly announced developments, milestones, and media coverage related to DeFi Development Corp. (“the Company”). The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities, nor should it be relied upon as investment advice or a recommendation regarding any securities. Certain statements in this post may constitute “forward-looking statements” within the meaning of applicable securities laws. These statements are based on current expectations and assumptions and involve risks and uncertainties that could cause actual results or events to differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of publication. DeFi Development Corp. undertakes no obligation to update any forward-looking statements, except as required by law. All information is accurate as of the date posted and is subject to change without notice.